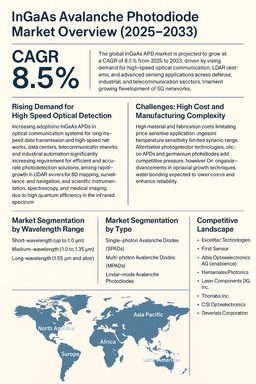

The global InGaAs avalanche photodiode (APD) market is projected to grow at a CAGR of 8.5% from 2026 to 2034, driven by rising demand for high-speed optical communication, LiDAR systems, and advanced sensing applications across defense, industrial, and telecommunication sectors. InGaAs APDs are highly sensitive semiconductor devices capable of detecting low-level optical signals in the near-infrared (NIR) and short-wave infrared (SWIR) regions. Their superior gain, low noise, and fast response make them essential in optical receivers, range-finding systems, and spectroscopy instruments. Growing deployment of 5G networks, increasing use of LiDAR in autonomous vehicles, and the expanding fiber-optic communication infrastructure globally are expected to boost market growth during the forecast period.

Rising Demand for High-Speed Optical Detection

The market expansion is primarily fueled by the increasing adoption of InGaAs APDs in optical communication systems, where they enhance signal detection in long-distance data transmission and high-speed networks. The development of data centers, telecommunication networks, and industrial automation is significantly increasing the requirement for efficient and accurate photodetection solutions. Moreover, their application in LiDAR systems, used for 3D mapping, surveillance, and navigation, is witnessing rapid growth, particularly in automotive and aerospace sectors. InGaAs-based photodiodes are also preferred in scientific instrumentation, spectroscopy, and medical imaging due to their high quantum efficiency in the infrared spectrum.

Challenges: High Cost and Manufacturing Complexity

Despite strong potential, the InGaAs APD market faces challenges such as high material and fabrication costs, which limit adoption in price-sensitive applications. The manufacturing process involves precise control over epitaxial layer growth and device integration, increasing production complexity. Additionally, temperature sensitivity and limited dynamic range in certain wavelength conditions affect performance stability. The availability of alternative photodetector technologies, including silicon APDs and germanium photodiodes, in specific wavelength ranges also adds competitive pressure. However, ongoing advancements in epitaxial growth techniques, wafer bonding, and monolithic integration are expected to lower production costs and enhance reliability, supporting long-term growth.

Market Segmentation by Wavelength Range

By wavelength range, the market is categorized into short-wavelength (up to 1.0 µm), medium-wavelength (1.0 to 1.55 µm), and long-wavelength (1.55 µm and above).

In 2025, the medium-wavelength (1.0–1.55 µm) segment accounted for the largest share due to its widespread use in fiber-optic communication and telecom infrastructure. This range provides optimal sensitivity for long-distance data transmission while minimizing optical loss. The long-wavelength (1.55 µm and above) segment is projected to grow fastest, supported by increasing applications in LiDAR and defense imaging systems where longer wavelength detection offers superior penetration and resolution. The short-wavelength segment remains relevant for spectroscopy and scientific measurement systems requiring high-speed detection at lower optical power levels.

Market Segmentation by Type

By type, the InGaAs avalanche photodiode market is segmented into Single-photon Avalanche Diodes (SPADs), Multi-photon Avalanche Diodes (MPADs), and Linear-mode Avalanche Photodiodes.

In 2025, linear-mode APDs dominated the market owing to their extensive use in optical receivers and fiber networks for high-speed data transfer. Their low noise and stable gain performance make them a preferred choice in telecommunication systems. SPADs are witnessing increasing demand in quantum communication, biophotonics, and low-light imaging applications due to their ability to detect single photons with high timing precision. MPADs, though at a nascent stage, are expected to gain traction in specialized research and industrial imaging where multi-photon counting capability enhances detection efficiency and spatial resolution.

Regional Insights

In 2025, North America led the InGaAs APD market, driven by strong investments in telecommunication infrastructure, defense modernization programs, and aerospace sensing technologies. The U.S. remains the largest market, supported by advanced R&D in photonics and LiDAR integration for autonomous systems. Europe followed, led by Germany, France, and the UK, where increasing adoption in industrial automation and scientific research facilities supports steady growth. The Asia Pacific region is projected to register the fastest CAGR, led by China, Japan, and South Korea, owing to rapid expansion in 5G deployment, semiconductor manufacturing, and optical sensor development. Latin America and Middle East & Africa (MEA) are emerging markets where gradual adoption in surveillance and defense sectors is opening new growth avenues.

Competitive Landscape

The 2025 InGaAs avalanche photodiode market was moderately consolidated, with leading players emphasizing technological innovation, material efficiency, and wavelength range expansion. Excelitas Technologies and First Sensor (a TE Connectivity company) lead through strong product portfolios and integration in fiber-optic and defense applications. Albis Optoelectronics AG (Enablence) focuses on high-speed APD production for telecom and LiDAR systems. Hamamatsu Photonics remains a key player with extensive R&D in optoelectronic components and custom photodiode solutions. Laser Components DG, Inc. and Thorlabs Inc. cater to specialized scientific and industrial applications with precision photonics products. OSI Optoelectronics and Dexerials Corporation are strengthening their market positions through miniaturized and high-reliability devices tailored for harsh environments. Competitive differentiation is being shaped by advancements in epitaxial design, gain uniformity, low-noise operation, and cost-effective wafer-scale fabrication, which will continue to define market leadership through 2034.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of InGaAs Avalanche Photodiode (InGaAs APD) market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Wavelength Range

|

|

Type

|

|

Application

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report