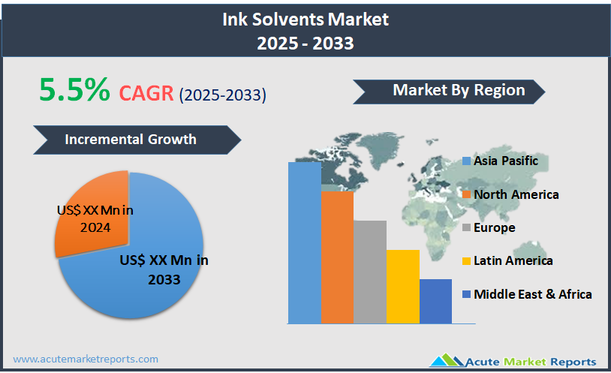

The ink solvents market encompasses the production and distribution of solvents used in the formulation of various types of inks. Solvents are essential components in ink manufacturing, providing the necessary medium for dissolving or dispersing the pigment and other constituents, aiding in the application process, and influencing drying rates. These solvents are selected based on their evaporation rate, toxicity, odor, and interaction with other ink components. Common types of solvents used in ink include alcohols, esters, ketones, and hydrocarbons, each serving different types of printing processes such as flexographic, lithographic, and rotogravure. The ink solvents market is projected to grow at a compound annual growth rate (CAGR) of 5.5%. This growth is driven by the expanding printing industry, particularly in packaging, labeling, and publishing. The demand for ink solvents is closely tied to the production of consumer goods, where packaging aesthetics play a critical role in marketing strategies. As the global economy grows and consumer spending increases, the need for attractive, durable, and effective packaging solutions boosts the ink solvents market. Furthermore, technological advancements in printing techniques have led to the development of new ink formulations that require specialized solvents to meet the criteria for speed, quality, and environmental compliance. The shift towards more environmentally friendly solvents is also a significant factor propelling market growth, as industries adapt to stricter environmental regulations and consumer preferences for sustainable products. This trend is particularly evident in the rise of bio-based and green solvent formulations that offer reduced VOC emissions and lower toxicity.

Expanding Packaging Industry

A key driver for the ink solvents market is the expansion of the global packaging industry, propelled by increasing consumer demand for packaged goods, which is influenced by rising global incomes and changing lifestyles. Packaging not only serves to protect and preserve products but also plays a critical role in marketing, with vibrant and appealing designs crucial for brand differentiation. Solvents are essential in producing inks that deliver high-quality prints and durable finishes, suitable for various packaging materials and methods. As the retail sector grows, especially with the rise of e-commerce, there is a heightened demand for effective packaging solutions across different industries, from food and beverages to electronics, which requires robust ink solutions capable of handling diverse packaging requirements.

Shift Towards Eco-friendly Solvents

An emerging opportunity within the ink solvents market is the shift towards eco-friendly solvents. This shift is driven by increasing environmental regulations and growing consumer awareness about the environmental impact of printing and packaging materials. Companies are increasingly seeking green solvent options that reduce emissions of volatile organic compounds (VOCs) and are less toxic. The development and adoption of bio-based solvents or those derived from renewable resources present a significant growth avenue, as these solvents provide an environmentally friendly alternative to traditional petroleum-based products without compromising on the quality and efficiency of printing processes.

Regulatory Compliance Costs

A major restraint in the ink solvents market is the cost associated with compliance with environmental regulations. As governments worldwide impose stricter regulations on VOC emissions and chemical safety to protect environmental and public health, ink manufacturers face increasing pressure to reformulate their products to meet these standards. This often involves significant investment in research and development to find substitutes for conventional solvents that can achieve the same results without harmful effects. These regulatory pressures can lead to increased production costs and necessitate ongoing compliance efforts, which can be particularly challenging for smaller manufacturers.

Technological Advancements in Ink Formulation

A significant challenge facing the ink solvents market is keeping pace with technological advancements in ink formulation and printing technology. As digital printing technologies evolve, they often require specialized ink formulations that can meet new performance standards, such as faster drying times, improved adhesion, and enhanced color quality. Developing solvents that can work effectively with these new technologies necessitates continuous innovation and adaptation, which can strain resources and require substantial investments in technology and expertise. Moreover, the industry must balance these advancements while also addressing environmental concerns, making the formulation process even more complex.

Market Segmentation by Solvent Type

In the ink solvents market, segmentation by solvent type includes Alcohols, Ketones, Hydrocarbons, and Others (including Esters and Ethers). Alcohols, particularly ethanol and isopropanol, lead the segment in terms of both revenue and anticipated CAGR. Their widespread use is driven by their effectiveness in dissolving various ink components, their relatively fast evaporation rate, and their lower toxicity compared to other solvent types, making them highly suitable for printing applications that require quick drying times and high-quality print finishes. Ketones, such as acetone and methyl ethyl ketone, are also prominently used due to their powerful solvency capabilities, although they are generally more regulated due to environmental and health concerns. Hydrocarbons and esters are extensively used as well but tend to have slower growth rates due to stricter regulations on VOC emissions and the shift towards greener alternatives.

Market Segmentation by Type

Regarding the market segmentation by type, it includes Conventional and Bio-based ink solvents. The Conventional segment currently holds the highest revenue share in the market due to its entrenched position and widespread adoption across various printing industries. However, the Bio-based segment is expected to grow at the highest CAGR over the forecast period. This growth is driven by the increasing environmental regulations and the rising demand from consumers and manufacturers for sustainable and eco-friendly products. Bio-based solvents, derived from renewable resources, offer a lower environmental impact and are seen as a key area of innovation within the industry. As regulatory pressures increase and technology improves, bio-based solvents are becoming more competitive in terms of performance and cost, aligning with the market's shift towards sustainability.

Geographic Segment

The ink solvents market has shown significant geographic trends, with Asia Pacific leading in terms of both highest revenue and highest CAGR as of 2025. This dominance is primarily due to the rapid industrialization and expansion of the printing and packaging industries in major economies such as China, India, and Japan. The region's growth is bolstered by increasing consumer demand for packaged goods, which drives the need for printing inks and, consequently, solvents. North America and Europe also maintain substantial market shares, supported by advanced manufacturing practices and stringent environmental regulations that push for the adoption of safer, more sustainable solvent solutions. These regions have seen a shift towards bio-based solvents in response to growing environmental concerns and regulatory pressures.

Competitive Trends

In 2025, the competitive landscape of the ink solvents market was characterized by the strategic activities of key players such as LyondellBasell Industries Holdings B.V., DowDuPont Inc., Exxon Mobil Corporation, Royal Dutch Shell plc, Eastman Chemical Company, Celanese Corporation, INEOS AG, Vertec Biosolvents, ALTANA, Sun Chemical, Sasol Limited Group, INX International Ink Co., and Yip’s Chemical Holdings Limited. These companies focused on innovation and sustainability, developing new solvent formulations that meet the evolving demands of the printing industry while adhering to environmental standards. Investments in R&D were significant, aimed at enhancing the efficiency, safety, and environmental profile of solvents. Strategic partnerships and expansions into emerging markets were also common as firms sought to capitalize on growth opportunities in regions experiencing rapid industrial growth. From 2026 to 2034, these players are expected to continue their focus on sustainability, with increased efforts in developing and commercializing bio-based and green solvents that offer reduced environmental impacts. The market leaders will likely expand their product offerings to include solvents that are compliant with international safety and environmental regulations, aiming to strengthen their positions in global markets while addressing the regulatory challenges that vary by region.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Ink Solvents market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Solvent Type

|

|

Type

|

|

Process

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report