Industry Outlook

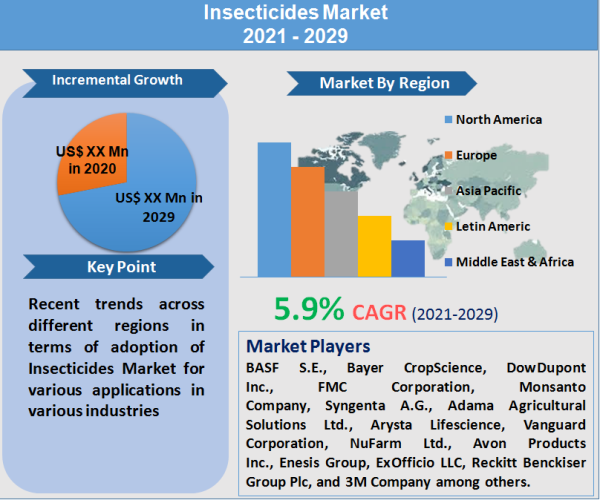

The global insecticides market was valued at US$ 18.47 Bn in 2021 and expected to reach US$ 30.62 Bn by the end of the forecast period, expanding at a CAGR of 5.9% during the forecast period from 2022 to 2030. Latin America led the market in 2021 and expected display similar trend in the coming years as well. However, Asia Pacific is expected to be the fastest growing market for insecticides during the forecast period.

Insecticides are solutions that are formulated to harm, repel, kill or mitigate one or more species of insects. Some insecticides are responsible for the disruption of the nervous system of the insects while the others damage the exoskeletons. Insecticides can be packaged in several forms that are inclusive of sprays and various others. Insecticides are highly used for crop protection. Growing food & beverages industry has raised concerns over effective crop protection, which is a key factor driving the growth of insecticides market. The crop protection industry is expected to display a CAGR of 3% during the forecast period. Further, the global market for crop protection was valued at US$ 49.92 Bn in 2016. The global population stood at 7.8 Bn in 2021 and the population is expected to cross the 9.5 Bn mark by the end of 2050. Rapid growth of the population coupled with growing income in developing countries have resulted in the increased demand for food, and the demand is expected to rise by more than 50% by 2050. The demand can only be met by increasing crop production, either by enhancing the productivity, or by increasing the amount of arable land. These factors have called for an increased demand for crop protection, which in turn is augmenting market growth of insecticides.

Moreover, the demand for insecticides in the residential sector has seen an increase over the past few years and is expected to display the same trend in the coming years as well. Outbreak of several diseases such as malaria, chikungunya, and dengue among others are some of the key reasons augmenting the growth of the insecticides market. These diseases are prominent in parts of South East Asia and the Pacific Islands. Further, the demand for insecticides is also fuelled by the rising demand for natural products, as consumers are willingly replacing synthetic chemical infused products owing to their hazardous nature, with natural ingredients.

"Agriculture Sector, based on End-use Expected to Continue Dominating the Insecticides Market in the Coming Years"

Based on end-use, the agriculture sector dominated the global insecticides market in 2021 and is expected to retain its position throughout the forecast period. Food & agribusiness is a US$ 5 Trn industry and is showing positive signs of growth, and with this trend, caloric demand is expected to rise by at least 50 percent, while demand for animal feed and human consumption is expected to increase by approximately 100 percent. The fruits & vegetables industry comprise of the cornerstones for human consumption and is considered to be vital for a balanced and a healthy diet. More than 1 billion metric tons of vegetables are produced every year, with tomatoes leading the production. Fruits & vegetables in the U.S. are considered to be a top snacking product. The fruits & vegetables industry in the U.S. heavily relies on advanced technologies in order to keep the products fresh for a longer period of time. Rising vegan population base in the country is another major factor pushing the demand for fruits & vegetables, thereby complementing the growth of the agricultural sector. These factors have increased the demand for crop protection in the agricultural sector, which in turn is augmenting market growth of insecticides.

However, insecticides in the residential sector is gaining rapid importance among consumers due to the outbreak of several fatal diseases and consumer awareness regarding such diseases. West Nile Fever is an infection that is spread by mosquitoes. Prevalence of West Nile virus has increased significantly in the Southern and Central Parts of Europe in 2021 in the past four years. High temperatures, dry weather and extended rainy spells are some of the key reasons for extensive mosquito breeding. European Union member states reported 23 West Nile Virus infections during the period from 31st October to 8th November 2021, with most of the cases being recorded in Italy. These factors have raised serious concerns and have given way to the rapid adoption of various types of home insecticide products, thereby pushing market growth. Further, rising incidences of dengue, malaria and chikungunya have created a stir among consumers to take appropriate protective measures, which has created several opportunities for the growth of the insecticides market in the residential sector.

"Latin America Captured the Major Chunk of the Market in 2021, and Expected to Display Similar Trend in the Coming Years"

Latin America dominated the global insecticides market in 2021, closely followed by Asia Pacific. It is expected that Asia Pacific will surpass Latin America in the coming years. Brazil is the key economic driver for insecticides in Latin America. The countries in Latin America operate different economic systems, but agriculture plays an imperative role in every country. The agricultural sector in Latin America covers a wide range of practices and farming structures, from smallholders in Central America to professionalized mega farmers in Argentina and Brazil. Soybean and corn are the main cultivable crops in the region, mostly concentrated in Mexico, Brazil and Argentina. Supportive conditions have paved the way for double cropping in several countries, increasing the agricultural potential of Latin America. Further, the region plays an important role in the global agricultural trade as Argentina and Brazil are ranked as the top exporters of crop and soybean. The total agribusiness market in Latin America was valued at US$ 27.4 Bn in 2016, with crop protection & seed treatment accounting for the majority share. These statistics signify the positive growth of the insecticide market in Latin America.

Asia Pacific emerged as the second largest region in the global insecticides market. China, Japan and India are the front runners to the growth of the industry. The region is characterized by a conglomerate of countries with varied languages, economic and political systems and cultural backgrounds. Food security is of high priority for local governments in the developing countries, which allows for greater usage of crop protection, thereby fuelling market growth of insecticides. Moreover, demand for home insecticides in Asia Pacific is also on the rise. Outbreak of several diseases such as malaria, dengue are some of the key reasons boosting market growth of home insecticides. 2021 witnessed 11,500 more cases of dengue in India compared to the previous year, and the number of deaths recorded from this disease stood at 46, which is 11 more compared to the previous year. According to the National Vector Borne Disease Control Program (NVBDCP), dengue cases in the country climbed to 28,702 in 2021, up from 16,870 in 2016. These factors have called for a growing need for home insecticide products, which is pushing the growth of the market.

"Product Development is One of the Key Strategies of the Companies Operating in the Insecticides Market"

Notable players operating in the global insecticides market include BASF S.E., Bayer A.G., DowDupont Inc., FMC Corporation, Monsanto Company, Syngenta A.G., Adama Agricultural Solutions Ltd., Arysta Lifescience, Vanguard Corporation, NuFarm Ltd., Avon Products Inc., Enesis Group, ExOfficio LLC, Reckitt Benckiser Group Plc, and 3M Company among others.

In April 2021, Syngenta A.G. announced the early development of a new insecticide active ingredient that will address resistance in the control of malaria vectors. The latest active ingredient is a result of a collaboration between the Innovative Vector Control Consortium (IVCC) and Syngenta in order to identify and develop new lead areas of novel chemistry that is suitable for the control of vector mosquitoes. This development is expected to bring about a change in the insecticides market in the coming years.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Insecticides market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Active Ingredient

|

|

Source

|

|

Form

|

|

End-use

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report