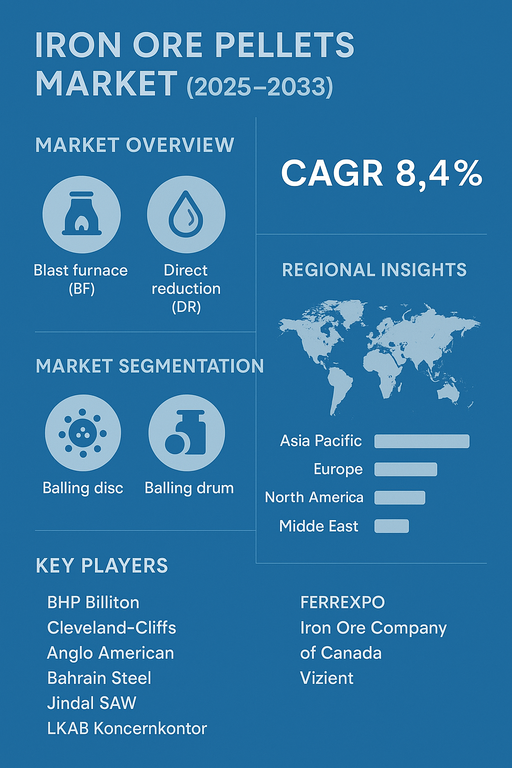

The global iron ore pellets market is projected to grow at a CAGR of 8.5% from 2025 to 2033, supported by rising steel production, increased demand for high-grade feedstock, and technological advancements in pelletizing processes. Iron ore pellets, small spherical balls of iron ore used as raw material in steelmaking, offer superior metallurgical properties, reduced impurities, and higher energy efficiency compared to sinter fines. The growing push for low-emission steelmaking and the adoption of direct reduction technologies are expected to strengthen market demand over the forecast period.

Rising Demand for Sustainable and Efficient Steelmaking

The iron ore pellets market is benefiting from the steel industry’s transition toward environmentally friendly and energy-efficient production methods. Pellets, due to their high iron content and uniform size, enhance blast furnace productivity and reduce fuel consumption. The growing adoption of direct reduction (DR) technology, which supports low-carbon steelmaking when combined with natural gas or hydrogen, is creating strong demand for DR-grade pellets. Increasing investments in green steel projects across Europe, North America, and Asia Pacific are accelerating market penetration.

Challenges: Supply Chain Constraints and Price Volatility

Despite positive growth, the iron ore pellets market faces challenges from volatile raw material prices and supply chain disruptions. Dependence on iron ore availability, geopolitical tensions, and transportation costs affect price stability. Additionally, pellet production is capital- and energy-intensive, limiting smaller players’ ability to compete. Environmental regulations on mining and pelletizing operations also increase compliance costs. However, long-term prospects remain strong, with governments and steelmakers investing in sustainable mining practices and pelletizing capacity expansions.

Market Segmentation by Grade

By grade, the market is segmented into blast furnace (BF) and direct reduction (DR). Blast furnace pellets currently dominate due to their extensive use in conventional steelmaking. However, DR-grade pellets are the fastest-growing segment, driven by rising adoption of direct reduced iron (DRI) and hot briquetted iron (HBI) in green steel projects. The shift toward hydrogen-based reduction is expected to make DR-grade pellets critical in the decarbonization of steelmaking.

Market Segmentation by Balling Technologies

By balling technologies, the market is divided into balling disc and balling drum. Balling discs remain widely used due to their ability to produce uniform-sized pellets with high productivity. Balling drums, while less common, are favored for large-scale operations and provide efficient mixing and granulation of iron ore fines. The choice of technology often depends on capacity requirements, operational flexibility, and pellet size distribution needs.

Regional Insights

In 2024, Asia Pacific led the iron ore pellets market, with China and India as the largest consumers due to their massive steel production capacity. Europe followed, supported by green steel initiatives and growing demand for DR-grade pellets. North America is also a key market, with the U.S. and Canada investing in pelletizing plants to support domestic steel industries and reduce reliance on imports. Latin America, led by Brazil, benefits from its position as a major iron ore exporter with growing pelletizing operations. The Middle East is emerging as a strategic hub, with investments in DR-grade pellets supporting the region’s hydrogen-based steelmaking projects.

Competitive Landscape

The 2024 market was shaped by leading mining and steel companies with strong pelletizing operations. BHP Billiton and Anglo American maintain significant global presence through integrated mining and pelletizing. Cleveland-Cliffs is a dominant North American supplier with a strong focus on DR-grade pellet production. LKAB Koncernkontor leads in Europe, leveraging its high-grade iron ore reserves to support low-carbon steelmaking. Bahrain Steel and Jindal SAW are expanding regional supply in the Middle East and India. METALLOINVEST, Evraz, and FERREXPO strengthen their presence in Eastern Europe and CIS markets. The Iron Ore Company of Canada remains a key North American exporter. Competitive differentiation is driven by pellet grade, cost efficiency, technological innovation, and alignment with green steel initiatives.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Iron Ore Pellets market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Grade

| |

Balling Technologies

| |

Application

| |

Technology

| |

Product Source

| |

Pelletizing Process

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report