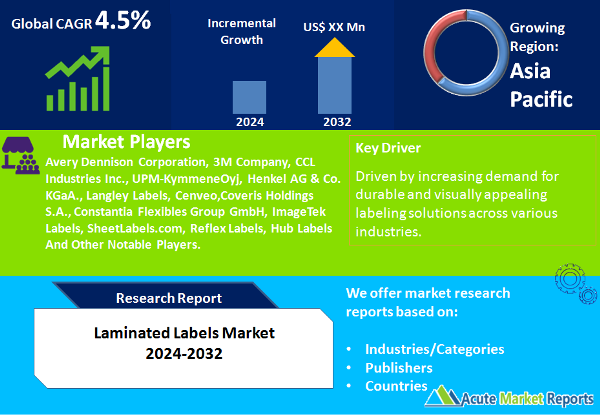

The laminated labels market is expected to witness steady growth with an expected CAGR of 4.5% during the forecast period of 2026 to 2034, driven by increasing demand for durable and visually appealing labeling solutions across various industries. Key conclusions drawn from market analysis reveal a robust growth trajectory fueled by factors such as technological advancements in label printing, rising consumer awareness regarding product information and safety, and expanding application scope across diverse end-user industries. However, environmental concerns pose challenges to market sustainability, necessitating the adoption of eco-friendly labeling solutions. By leveraging detailed market segmentation, understanding competitive dynamics, and embracing sustainable practices, industry stakeholders can capitalize on growth opportunities and navigate market challenges effectively, ensuring long-term success and profitability.

Key Market Drivers

Technological Advancements in Label Printing:

Technological innovations in label printing, including digital printing techniques and advanced finishing capabilities, have revolutionized the laminated labels market. These advancements enable high-quality printing with vibrant colors, intricate designs, and variable data printing, catering to diverse labeling requirements across industries. Moreover, digital printing offers flexibility, cost-effectiveness, and shorter lead times, driving its adoption among manufacturers seeking customizable and on-demand labeling solutions.

Growing Consumer Awareness and Regulatory Compliance:

Increasing consumer awareness regarding product information, safety, and authenticity has propelled the demand for laminated labels, particularly in industries such as food and beverages, pharmaceuticals, and personal care. Regulatory mandates governing labeling standards, including food labeling regulations and pharmaceutical packaging requirements, further drive market growth. Laminated labels ensure compliance with regulatory guidelines, including tamper-evident features, product traceability, and adherence to industry-specific standards, enhancing consumer trust and brand reputation.

Expanding Application Scope across Industries:

The laminated labels market continues to witness expansion across diverse end-user industries, including food and beverages, consumer durables, pharmaceuticals, retail, and industrial sectors. Laminated labels offer versatility, durability, and customization options, making them ideal for various applications such as product branding, packaging decoration, information labeling, and promotional campaigns. The growing trend of product premiumization, brand differentiation, and visual aesthetics further drives market demand, especially in sectors emphasizing product presentation and shelf appeal.

Restraint

Environmental Concerns and Sustainability Challenges: Despite the market's growth prospects, environmental concerns and sustainability challenges pose significant restraints to the laminated labels market. The use of synthetic materials, adhesives, and coatings in laminated labels contributes to environmental pollution, waste generation, and carbon footprint. Moreover, the disposal of laminated labels poses challenges in recycling and waste management, exacerbating environmental impacts. Stakeholders in the laminated labels industry face increasing pressure to adopt sustainable practices, explore eco-friendly materials, and develop recyclable and biodegradable label solutions to mitigate environmental risks and meet regulatory mandates.

Market Segmentation Analysis

Market by Composition: The laminated labels market is segmented by composition into laminate, face stock, adhesive, and release liner components. In 2025, the laminate segment accounted for the highest revenue, driven by its crucial role in providing protection and durability to the label. The face stock segment also contributed significantly to revenue, followed by adhesive and release liner components. During the forecast period of 2026 to 2034, the face stock segment is expected to experience the highest CAGR, attributed to increasing demand for printable surfaces for branding and information.

Market Segmentation by Laminate Type

Within the laminated labels market, segmentation by laminate type includes polyester, polypropylene, UV sunscreen polyester, UL-approved laminates, and other specialized materials. In 2025, polyester labels generated the highest revenue due to their durability and suitability for various applications. Polypropylene labels also contributed significantly to revenue, followed by UV sunscreen polyester and UL-approved laminates. However, during the forecast period of 2026 to 2034, UL-approved laminates are expected to exhibit the highest CAGR, driven by their compliance with safety standards for use in electrical equipment.

Market Segmentation by Form

Market segmentation by form encompasses reels and sheets. Reel formats accounted for the highest revenue in 2025, favored for their efficiency and cost-effectiveness in high-volume label printing and automated labeling processes. Sheet formats also contributed significantly to revenue, catering to small-batch printing and manual application needs. Over the forecast period, reels are expected to maintain their dominance in terms of revenue, although sheets may experience a higher CAGR due to increasing demand for versatility and customization.

Market Segmentation by Application

Laminated labels find applications across various industries, including food and beverages, consumer durables, home and personal care, pharmaceuticals, retail labels, and other specialized sectors. In 2025, the food and beverage industry generated the highest revenue from laminated labels, driven by stringent labeling regulations and brand differentiation strategies. Consumer durables and pharmaceuticals also contributed significantly to revenue, followed by home and personal care and retail labels. However, during the forecast period, pharmaceuticals are expected to exhibit the highest CAGR, attributed to increasing demand for tamper-evident and informative labels for product authentication and regulatory compliance.

APAC Region Expected to be the Fastest Growing Market

The laminated labels market exhibits geographic trends with regions such as North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa driving market growth. Asia Pacific is expected to witness the highest CAGR during the forecast period, fueled by rapid industrialization, urbanization, and expanding manufacturing sectors. North America and Europe are projected to maintain significant market shares, driven by technological advancements, stringent regulatory frameworks, and consumer demand for sustainable labeling solutions.

Market Competition to Intensify during the Forecast Period

The laminated labels market is characterized by the presence of several key players adopting competitive strategies such as product innovation, mergers and acquisitions, partnerships, and geographic expansions to strengthen their market position. Leading players include Avery Dennison Corporation, 3M Company, CCL Industries Inc., UPM-KymmeneOyj, Henkel AG & Co. KGaA., Langley Labels, Cenveo,Coveris Holdings S.A., Constantia Flexibles Group GmbH, ImageTek Labels, SheetLabels.com, Reflex Labels and Hub Labels. These companies focus on expanding their product portfolios, enhancing manufacturing capabilities, and establishing strategic collaborations with end-user industries to capitalize on emerging market opportunities and gain a competitive edge.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Laminated Labels market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Composition

|

|

Laminate Type

|

|

Form

|

|

Application

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report