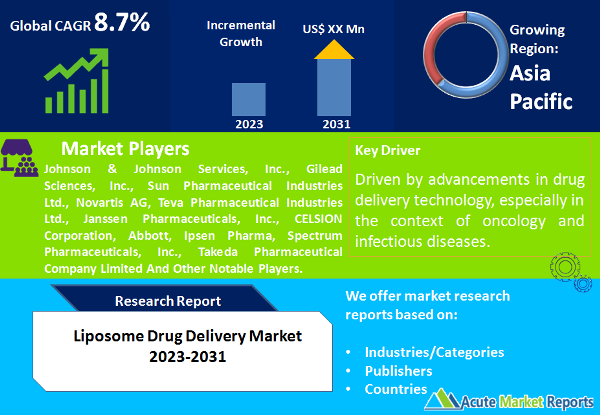

The liposome drug delivery market is expected to witness a CAGR of 8.7% during the forecast period of 2026 to 2034. The liposome drug delivery is driven by advancements in drug delivery technology, especially in the context of oncology and infectious diseases. However, manufacturing challenges and the absence of standardization remain significant restraints. The industry is poised for further innovation with evolving liposome structures and product development. North America is projected to lead in terms of CAGR, while Asia-Pacific will continue to dominate in revenue. The future of this market is promising as it addresses unmet medical needs and continues to drive innovation in drug delivery systems to enhance therapeutic outcomes and patient care.

Advancements in Drug Delivery Technology

A key driver for the Liposome Drug Delivery market is the continuous advancement in drug delivery technology. Liposomes have gained attention as a drug delivery system due to their ability to encapsulate both hydrophilic and hydrophobic drugs, allowing targeted and sustained release. Recent developments in liposome formulations, including pegylation and surface modification, have improved drug bioavailability and reduced side effects. This is evidenced by the increasing number of liposomal drug approvals by regulatory agencies, signaling their effectiveness and the pharmaceutical industry's growing interest in this technology.

Growing Oncology Applications

The growth of liposomal drug delivery is prominently driven by its expanding applications in oncology. Liposomal formulations of chemotherapeutic agents like Doxorubicin and Paclitaxel have demonstrated enhanced efficacy and reduced toxicity, making them valuable in the treatment of various cancers. The growing incidence of cancer and the need for more effective and less toxic treatments have led to the increased adoption of liposomal drug delivery in oncology. This trend is reflected in the expanding range of liposomal anticancer drugs and the high revenue generated in this segment.

Increasing Prevalence of Infectious Diseases

Liposomes have found substantial applications in addressing infectious diseases. In particular, Liposomal Amphotericin B is a breakthrough in treating fungal and parasitic infections, with higher safety and efficacy compared to conventional formulations. The rise in infectious diseases, particularly in tropical regions, has led to a growing demand for liposomal drug delivery systems to combat these infections effectively. This is evidenced by the rising number of cases and research studies on liposomal drug delivery for infectious diseases.

Challenges in Manufacturing and Standardization

A significant restraint in the Liposome Drug Delivery market is the challenges associated with manufacturing and standardization. The production of liposomal drug formulations requires precision in size, composition, and encapsulation, which can be technically demanding. Ensuring batch-to-batch consistency and product quality remains a challenge. The absence of standardized manufacturing processes may lead to variations in liposome drug products, impacting their efficacy and safety. This restraint is observed in reported instances of manufacturing variability and the need for regulatory guidelines to standardize liposome drug production.

Liposome Structure: Multilamellar Liposomes Dominate the Market

In 2025, the Liposome Drug Delivery market featured various liposome structures, with multilamellar liposomes generating significant revenue due to their ability to encapsulate a wide range of drugs. However, during the forecast period from 2026 to 2034, the highest Compound Annual Growth Rate (CAGR) is anticipated in the "others" category. Innovative liposome structures and formulations are expected to drive this growth as researchers explore new ways to optimize drug delivery and bioavailability.

Product: Liposomal Doxorubicin Dominates the Market

In 2025, the Liposomal Doxorubicin segment generated substantial revenue due to its established applications in oncology. However, during the forecast period from 2026 to 2034, the highest CAGR is expected in the Liposomal Paclitaxel segment, driven by its growing adoption in cancer treatment. The development of new liposomal drug products is likely to bolster the growth of the "others" segment, underscoring the dynamism of this market.

APAC Remains as the Global Leader

During the forecast period from 2026 to 2034, North America is expected to exhibit the highest CAGR in the Liposome Drug Delivery market. This growth can be attributed to the region's advanced healthcare infrastructure and robust R&D activities. Asia-Pacific, with its expanding pharmaceutical sector, is anticipated to maintain the highest revenue percentage during the same period, particularly in the oncology and infectious disease treatment segments.

Market Competition to Intensify during the Forecast Period

In 2025, the Liposome Drug Delivery market was characterized by several key players, including pharmaceutical companies specializing in liposomal drug formulations. These companies are expected to maintain their dominant positions during the forecast period from 2026 to 2034. Key strategies for industry leaders will revolve around product innovation, expanding liposomal drug portfolios, and global market expansion to cater to the increasing demand for advanced drug delivery systems.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Liposome Drug Delivery market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Liposome Structure

|

|

Product

|

|

Technology

|

|

Application

|

|

End-User

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report