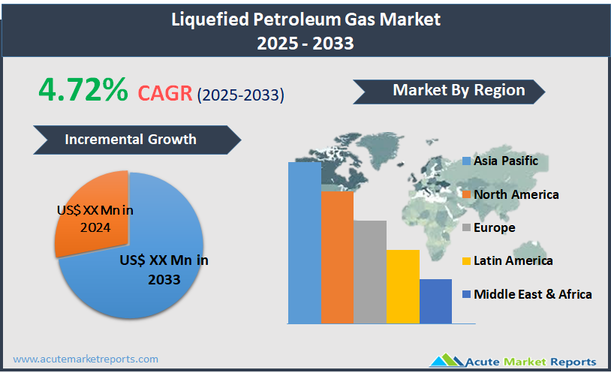

The liquefied petroleum gas (LPG) market refers to the global trade and consumption of hydrocarbon gases, primarily propane and butane, which are liquefied under moderate pressure for storage and transportation. LPG is a versatile, clean-burning fuel derived as a byproduct from natural gas processing and crude oil refining. It is commonly used for residential cooking and heating, industrial fuel applications, agricultural operations, transportation (autogas), and as a feedstock in petrochemical production. Its portability, energy efficiency, and relatively lower emissions compared to coal and traditional liquid fuels make it a widely adopted energy source across both developed and emerging economies. The global LPG market has seen steady growth in recent years, driven by rising energy demand, increasing emphasis on cleaner-burning fuels, and government policies promoting LPG adoption as an alternative to biomass and kerosene in residential sectors. In 2025, the market recorded moderate expansion due to continued urbanization, infrastructure development, and the shift toward LPG-based cooking in rural areas of Asia and Africa. Widespread use in industrial heating and the autogas segment also contributed to demand stability. The market is projected to grow at a compound annual growth rate (CAGR) of 4.72% from 2026 to 2034.

Government Policies Promoting LPG as a Cleaner Alternative to Traditional Fuels

One of the primary drivers of the global LPG market is the increasing implementation of government-backed initiatives aimed at promoting LPG as a cleaner alternative to traditional fuels such as biomass, coal, and kerosene, particularly for household and cooking use in developing regions. In many countries across Asia, Africa, and Latin America, large segments of the population historically relied on wood, dung, and charcoal for daily energy needs, contributing to indoor air pollution, deforestation, and health complications related to respiratory diseases. Recognizing these issues, governments have introduced subsidies, public distribution schemes, and awareness programs to increase LPG penetration in rural and underserved areas. For instance, national schemes have been rolled out to provide subsidized LPG connections and refill support to low-income households, driving millions of first-time users toward cleaner energy sources. The health and environmental benefits of transitioning to LPG (such as reduced indoor emissions, improved air quality, and decreased reliance on unsustainable fuel sources) have made it a central component in national energy strategies aimed at improving public health and reducing carbon intensity.

Expanding Use of LPG in Autogas and Industrial Applications

A major opportunity in the LPG market lies in the expanding application of LPG in the autogas and industrial sectors, driven by the need for cost-effective and lower-emission alternatives to conventional fuels such as gasoline, diesel, and coal. In the transportation sector, autogas (LPG used as a vehicle fuel) is gaining momentum in both developed and emerging economies due to its affordability, lower CO₂ and NOx emissions, and ease of infrastructure development compared to electric mobility solutions. Public transportation fleets, taxi services, and delivery vehicles are increasingly converting to LPG to capitalize on fuel cost savings and meet tightening emission regulations, particularly in urban areas facing air quality concerns. Simultaneously, in the industrial sector, LPG is being adopted for processes such as metal cutting, ceramic firing, food processing, and chemical manufacturing, where it serves as a cleaner and more efficient thermal energy source. Compared to diesel and coal, LPG offers faster heat transfer, lower sulfur content, and reduced greenhouse gas emissions, making it attractive to industries seeking energy cost optimization and compliance with environmental norms. In agricultural settings, LPG is being utilized for crop drying, greenhouse heating, and pest control, further broadening its use case. As industries across sectors increasingly focus on decarbonization and fuel diversification strategies, the versatility, portability, and cleaner combustion profile of LPG present a significant opportunity for market expansion. This growth is further supported by the development of hybrid energy systems and innovations in LPG-based engines and burners that enhance fuel efficiency and operational flexibility across commercial applications.

Price Volatility and Supply Chain Dependence on Fossil Fuel Markets

One of the key restraints limiting the growth potential of the LPG market is its inherent exposure to price volatility and supply chain fluctuations driven by the dynamics of the global fossil fuel industry. As a byproduct of crude oil refining and natural gas processing, the availability and pricing of LPG are closely tied to the upstream production levels, refinery throughput, and export-import balances of oil and gas-producing countries. This dependence creates significant market vulnerability during periods of geopolitical instability, production cuts, or disruptions in shipping and logistics. For instance, conflicts in major producing regions, sanctions, or OPEC+ policy shifts can lead to sudden LPG price hikes, directly impacting affordability for residential consumers and operating costs for commercial users. Additionally, fluctuations in crude oil and natural gas benchmarks such as Brent and Henry Hub can lead to uneven LPG pricing globally, creating disparities between net-importing and net-exporting regions. In developing economies where LPG affordability is crucial to sustain adoption (especially in rural and low-income segments) these price movements can lead to reduced refill rates, reversal to traditional fuels, and increased subsidy burdens for governments. Moreover, currency depreciation in some markets further amplifies import costs, pressuring household budgets and deterring long-term investment in LPG infrastructure. While efforts are being made to establish strategic reserves, diversify sourcing routes, and stabilize retail pricing through regulatory mechanisms, the market's close ties to fossil fuel supply dynamics remain a structural constraint that affects pricing predictability and long-term planning for stakeholders across the value chain.

Infrastructure Limitations and Uneven Access in Emerging Economies

A significant challenge confronting the LPG market is the infrastructure gap that persists in many emerging and remote regions, where limited storage, transportation, and distribution networks restrict reliable and safe access to LPG. Despite strong government push and rising demand, several rural and peri-urban areas across Asia, Africa, and Latin America still face logistical barriers such as inadequate bottling plants, insufficient cylinder distribution, lack of road connectivity, and poor maintenance of refill points. This underdeveloped supply chain makes last-mile delivery of LPG both operationally difficult and economically unviable for private distributors, leading to stockouts, long refill cycles, and inconsistent product availability. Safety is another critical concern, as lack of awareness and training among users and local retailers can result in unsafe cylinder handling, substandard installations, and an increased risk of fire or explosion, thereby undermining consumer trust and adoption. Moreover, in regions where informal fuel markets thrive, consumers often rely on illegal or unregulated refilling practices due to either convenience or affordability, further complicating efforts to build a standardized and accountable LPG ecosystem. Addressing these challenges requires coordinated investment in rural infrastructure, community-level education programs, and incentivized participation of local entrepreneurs in LPG distribution. However, the scale of the problem and the capital-intensive nature of infrastructure development pose hurdles, particularly in low-income countries with competing budgetary priorities. Without systemic improvements in logistical capacity and safety awareness, achieving universal and equitable LPG access will remain a complex challenge despite favorable market dynamics and policy intentions.

Market Segmentation by Source

Based on source, the liquefied petroleum gas (LPG) market is segmented into Refinery, Associated Gas, and Non-associated Gas. In 2025, Refinery held the highest revenue share as refineries continued to serve as the primary source of LPG production globally, particularly in regions where crude oil refining capacity is well-established. During the refining process, LPG is recovered as a byproduct of cracking and reforming operations, and it is subsequently separated and liquefied for distribution. Refineries supply a steady flow of propane and butane to meet domestic and industrial demand, especially in countries with high vehicle fuel requirements and extensive urban cooking markets. This segment benefitted from the stable integration of LPG recovery with existing fuel production systems, making it a cost-effective and logistically viable source. However, Non-associated Gas is expected to register the highest CAGR from 2026 to 2034, driven by increasing investments in natural gas field development and gas processing facilities that specifically extract LPG components independent of crude oil production. As global focus shifts toward cleaner energy sources, non-associated gas projects are gaining momentum, particularly in regions with abundant natural gas reserves like the United States, Qatar, Russia, and Australia. These fields offer scalable and more predictable LPG yields, while also aligning with national strategies to monetize natural gas assets and reduce flaring. The technological advancement in gas separation and liquefaction units has further enhanced the feasibility of tapping LPG from non-associated gas fields. Meanwhile, Associated Gas, which refers to LPG extracted from natural gas co-produced during crude oil extraction, maintains a moderate market share. While it offers a useful supplementary supply source, its production volume is directly linked to oil output levels, making it vulnerable to volatility in crude oil markets. Associated gas is particularly significant in oil-rich nations such as Saudi Arabia, Nigeria, and Venezuela, where oil exploration contributes significantly to overall LPG production. Across all three sources, refiners currently lead the market in terms of volume and infrastructure, but the non-associated gas segment is anticipated to grow the fastest, benefiting from policy shifts toward gas monetization, lower carbon intensity, and diversification of energy sources across both developed and emerging economies during the 2026 to 2034 forecast period.

Market Segmentation by End-user

By end-user, the liquefied petroleum gas market is segmented into Residential/Commercial, Petrochemical & Refinery, Industrial, Transportation, and Others. In 2025, Residential/Commercial applications generated the highest revenue, owing to widespread use of LPG for cooking, water heating, and space heating across households and commercial establishments in both urban and rural settings. This segment is especially dominant in emerging economies such as India, Indonesia, and Brazil, where government-led programs and subsidies have significantly boosted LPG access and affordability. The convenience, clean-burning nature, and portability of LPG cylinders make it the preferred choice for domestic energy needs, while commercial users like restaurants and small businesses rely on it for uninterrupted thermal energy supply. However, Transportation is expected to record the highest CAGR from 2026 to 2034, driven by rising adoption of LPG as an alternative automotive fuel (autogas), particularly in regions looking to reduce vehicular emissions and fuel costs. Autogas usage is increasing in countries such as South Korea, Turkey, Poland, and parts of Latin America, where favorable policies, vehicle conversion incentives, and lower pump prices are encouraging the transition from gasoline and diesel to LPG. Fleet operators, taxis, and public transportation services are turning to LPG for its cost savings and environmental benefits. Petrochemical & Refinery applications hold a strong market share as LPG serves as a key feedstock for ethylene and propylene production in steam crackers. The sector benefits from the steady demand for plastics, polymers, and intermediates, especially in Asia Pacific and North America. Industrial usage is also significant, with LPG utilized in processes such as metal cutting, drying, and heating in sectors like ceramics, food processing, and manufacturing, where uniform heating and portability are essential. The Others category, including agriculture and recreational use, represents a smaller but growing segment, particularly in rural areas where LPG supports greenhouse heating and crop drying. Overall, residential and commercial applications continue to lead in revenue due to their large and consistent user base, but transportation is anticipated to expand at the fastest pace, supported by clean fuel mandates, fleet transition initiatives, and the comparative economic advantages of autogas over conventional fuels during the forecast period.

Geographic Segment

In 2025, Asia Pacific accounted for the highest revenue share in the global liquefied petroleum gas (LPG) market, driven by surging residential and commercial demand in densely populated countries such as China, India, Indonesia, and Bangladesh. The region experienced strong consumption growth due to large-scale government programs promoting LPG as a cleaner substitute for traditional biomass and kerosene, especially in rural households. India's continued expansion of LPG penetration under government-subsidized schemes contributed significantly to overall volume, while China's rising petrochemical feedstock demand also supported LPG imports. The region benefitted from improved infrastructure, growing middle-class populations, and rapid urbanization, which further fueled usage in domestic cooking, space heating, and small-scale commercial applications. North America ranked second in revenue share, owing to the region’s well-established natural gas processing capacity, high autogas usage in niche segments, and strong industrial demand for LPG in the U.S. and Canada. The U.S. emerged as a net exporter of LPG, driven by shale gas production and significant export infrastructure at Gulf Coast terminals. Europe maintained a steady market share, supported by widespread autogas infrastructure in countries such as Turkey, Poland, and Italy, along with petrochemical sector demand for LPG as a feedstock. Subsidies, vehicle conversion programs, and emission reduction targets reinforced LPG's role in transportation and industrial segments. However, the Middle East & Africa is expected to register the highest CAGR from 2026 to 2034, driven by rising domestic consumption in countries like Saudi Arabia, Egypt, and South Africa, combined with favorable energy diversification policies and increased LPG availability from regional refining and gas processing. Additionally, the UAE and Qatar are expected to scale up domestic consumption while continuing to serve as key suppliers to global markets. Sub-Saharan Africa is also expected to show high growth due to ongoing transitions from biomass to LPG for cooking, supported by donor programs and public-private partnerships aimed at improving household energy access. Latin America is projected to grow at a moderate pace, with Brazil, Mexico, and Argentina driving demand for residential use and autogas, despite price sensitivity and occasional infrastructure limitations. Across all regions, the global shift toward cleaner energy sources, coupled with efforts to reduce deforestation and improve indoor air quality, is expected to drive steady LPG demand, positioning Asia Pacific as the largest market by revenue and the Middle East & Africa as the fastest-growing region during the 2026 to 2034 forecast period.

Competitive Trends and Key Strategies

In 2025, the liquefied petroleum gas market was characterized by strong competition among vertically integrated energy conglomerates, regional distributors, and specialized LPG marketers, with companies adopting multi-pronged strategies to enhance market presence, operational efficiency, and downstream integration. Royal Dutch Shell plc maintained a prominent position by leveraging its global refining assets and extensive supply chain network to serve both retail and industrial LPG segments while expanding its autogas distribution partnerships in Europe and Asia. Exxon Mobil Corporation focused on leveraging its natural gas processing operations in North America and integrated trading capabilities to supply bulk LPG to industrial users and petrochemical clients, especially in high-demand regions such as Asia Pacific. bp p.l.c. emphasized retail LPG distribution and infrastructure investment in emerging markets, alongside sustainability-focused initiatives including low-carbon LPG alternatives and digitalized delivery systems. UGI Corporation (through subsidiaries like AmeriGas) remained a key player in North America by enhancing logistics, safety, and rural market penetration, while also investing in renewable LPG and customer service platforms. Origin Energy Limited and Kleenheat continued to lead in the Australian market, offering diversified LPG solutions to households, agriculture, and industry while integrating renewable energy with conventional gas services. China Gas Holdings Ltd expanded its LPG import and distribution capacity across mainland China, targeting smaller cities and industrial parks with flexible delivery models. Copagaz strengthened its market share in Brazil through regional acquisitions and fleet modernization to improve rural access and distribution reliability. Repsol S.A. enhanced its footprint in Europe and Latin America by optimizing refinery-linked LPG supply and expanding autogas networks, with a focus on customer-centric innovation. SHV Energy, one of the largest global LPG distributors, pursued aggressive international expansion through acquisitions and partnerships, focusing on digital transformation, renewable LPG investments, and enhancing cylinder logistics systems in high-growth regions.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Liquefied Petroleum Gas market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Source

|

|

End-user

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report