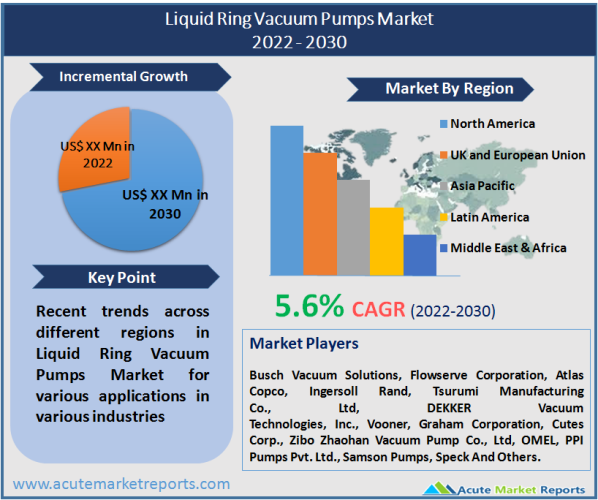

In 2022, the global market for liquid ring vacuum pumps was valued at a CAGR of 5.6% during the period covered by the forecast. Over the course of the forthcoming time period, the growth of the market is driven by important factors such as the expanding use of the product in the chemical industry, the growing demand for the market from a variety of industries, and the relatively low costs of maintenance and operation.

A liquid ring pump is a type of rotating positive-displacement pump that is typically utilised in applications such as gas compression and vacuum pumping. These pumps belong to a special category because they do not pulsate and their primary purpose is to evacuate gas. Liquid ring vacuum pumps, in contrast to other types of vacuum pumps, have a lower overall maintenance requirement and come with longer warranties.The liquid ring vacuum pump system is a dependable and low-cost option that was developed in large part to cater to the particular requirements of individual customers.

The liquid ring vacuum pump system is a dependable and low-cost option that was developed in large part to cater to the particular requirements of individual customers. Dry gas or dry air compression is compressed by a liquid ring vacuum pump in the same way that it is compressed by any other displacement pump, with the exception that a liquid ring pump is even more condensed than any other pump in the caw se of a liquid ring pump. It is allowed for there to be a small gap in the system so that a flow of compressed gas can be created that is free to move around the ring. By forcing the liquid into a tube that is narrow but long enough to allow a steady stream of compressed gas to pass through while leaving no space for the residual gases to collect, the pump can generate a vacuum. This is accomplished by pushing the liquid into the tube from the top. Radial and concentric liquid ring vacuum pumps are the two primary varieties that can be purchased for use in a variety of applications. The first one is made up of a rotor that is housed within a housing, and the second one is made up of two concentric discs, one of which is located at the bottom of the housing and the other at the top of the housing.

Increased energy consumption drives the market for liquid ring vacuum pumps

Over the course of the past few decades, the market has been witness to extensive developments that have been supported by various factors including increased energy consumption as well as rising demand from general process industries. For example, the International Energy Agency (IEA) estimates that in 2019, the coal sector will contribute 9.5%, the oil sector will contribute 40.4%, natural gas will contribute 16.4%, biofuels and waste will contribute 10.4%, electricity will contribute 19.7%, and other sectors will contribute 3.6% to the total energy consumption. As a result, the rise in the consumption of energy has brought about an increase in the demand for liquid ring machines, which is the primary factor propelling the expansion of the industry.

Applications in the chemical industry drive the liquid ring vacuum pumps

The chemical processing industries make extensive use of liquid vacuum pumps, particularly those processes that require vacuum filtration, solvent recovery, and vapour recovery. In addition, certain applications, such as the compression of hydrogen or chlorine, necessitate the use of vacuum pumps in addition to liquid ring vacuum pumps. As a result, factors such as these are anticipated to be a primary driver of growth in the global liquid ring vacuum market. Growing applications in the chemical industry are anticipated to drive growth in the global market for liquid ring vacuum pumps.

Biodiesel & bioethanol sectorcontribute to the growing liquid ring vacuum pumps market

The expansion of the bioethanol and biodiesel industries on a global scale is another significant factor that is driving revenue growth in the market for liquid ring vacuum pumps and compressors. Because of its high octane content and its ability to reduce greenhouse gas emissions, governments in a number of different countries are considering increasing their production of ethanol.It is anticipated that conversion capacity will increase at a faster rate of growth in comparison to distillation capacity, which will result in increased conversion capacities of refineries that are already in operation. In applications involving refinery operations, liquid ring vacuum pumps and steam ejectors provide dependable options for the process of vacuum distillation. It is anticipated that this factor will stimulate increased demand for liquid ring vacuum pumps.

Demand Increased from the General Process Industries

Increasing output in process industries has led to an increase in demand for liquid ring vacuum pumps and compressors. This is especially true in the textiles, pulp & paper, sugar processing, pharmaceuticals, and food & beverage industries.In developed nations, the growing demand for energy-efficient manufacturing operations is expected to lead to an increase in expenditures on new pumping equipment, which will, in turn, drive the demand for liquid ring vacuum pumps. A major factor that is driving sales of liquid ring vacuum pumps is the rising demand for these pumps from small and medium-sized businesses (SMEs), particularly in the developing economies of India and China. On the other hand, it is anticipated that a significant portion of this demand will originate from the sugar, paper and pulp, and chemical process industries, and will be for pumps with capacities of less than 1000 cfm.

With the exponential growth in e-Commerce, paper and pulp industry is set to see good growth

The global paper and pulp industry has been relatively stagnant over the past few years; however, with the exponential growth in e-Commerce, it is expected that the demand for paper used for packaging applications will revive growth in the paper and pulp industry. The revival of growth rates in the global textile industry is being further aided by the expansion of the middle class in developing countries. Through 2019, it is anticipated that China will experience the second-highest growth rate in paper and paperboard production, behind only India.

Increasing number of small business owners focused on sugar processing, food and beverage, andpharmaceuticals will boost the market for liquid ring vacuum pumps

The growth of the market for liquid ring vacuum pumps is anticipated to be fuelled in the not-too-distant future by these factors as well as an increasing number of small business owners in the markets of India and China who are concentrating on sugar processing, food and beverage, and pharmaceuticals.However, these companies are primarily focusing their attention on markets that require pumps with a low capacity but are not overly concerned with safety, such as the sugar, pharmaceutical, and paper and pulp manufacturing industries. In addition, a number of pumps are designed specifically for use in chemical processing units in applications that require only a limited amount of capacity. These pumps have prices that are a significant amount lower compared to their equivalents manufactured by global manufacturers.

Strict adherence to the law poses the greatest challenge to the industry's growth over the forecast period

On the other hand, strict adherence to the law is the factor that poses the greatest threat to the industry's growth over the forecast period. Because of the high initial cost and the trend toward hybrid technologies, the global market for liquid ring vacuum pumps is likely to experience some level of restraint in the near future. The initial installation cost of a liquid ring vacuum pump can be quite high due to the capacity, power, type of material, and safety measures that are required in the industry. The price of a liquid ring machine or compressor can range anywhere from one thousand to fifty thousand United States dollars, with the more expensive pumps and compressors being utilised for more specialised applications. As a consequence of this, the majority of companies use multiple devices in conjunction with one another rather than a solitary high-power, high-capacity liquid ring machine.

Market for liquid ring vacuum pumps will be boosted by regulatory regulations issued by the EPA concerning flare gas

The growth of the global market for liquid ring vacuum pumps is anticipated to be boosted over the forecast period by the increasing number of regulatory regulations issued by the EPA concerning flare gas. In order to adhere to the stringent environmental regulations that govern the flaring of natural gas, liquid ring vacuum compressors are an indispensable piece of equipment. These compressors find their primary application in the recovery of fuel gas and the condensation of valuable hydrocarbons; as a result, businesses are able to increase their overall revenue. The Environmental Protection Agency (EPA) in the United States is steadily tightening the regulations it has in place concerning the flaring of natural gas, and it is anticipated that the implementation of such regulations will become even more stringent in the near future. Furthermore, prominent manufacturers from all over the world are now offering complete systems for flare gas management. These systems not only condense the gas, but they also clean and cool the gas as it is being condensed, doing away with the requirement for downstream condensers and scrubbers.

Opportunity for Growth in the Global Liquid Ring Vacuum Pumps Market

The growing awareness of the importance of water conservation has compelled market participants to develop new products that are more effective. For example, in 2014, Gardner Denver Nash introduced the NASH 2BE5 series of liquid ring vacuum pumps. These pumps have a once-through mode that reduces water consumption by 25% and increases efficiency by 10% compared to their previous models. TiTan single and double stage liquid ring vacuum pumps were introduced by Dekker Vacuum Technologies in 2015. These pumps have a higher efficiency and cut the amount of sealing liquid required by more than half compared to previous models.

Different applications for liquid ring vacuum pumps and compressors across chemical process industries

There are many different applications for liquid ring vacuum pumps and compressors across the majority of chemical process industries. These pumps and compressors are particularly useful in processes that require the recovery of solvents, vacuum filtration, and vapour recovery. In addition, specialised applications that require vacuum pumps, such as the compression of chlorine or hydrogen, the recovery of vinyl chloride monomer, etc., find that liquid ring vacuum pumps are the most effective choice. The rotating positive displacement machines known as liquid ring vacuum pumps find applications in a wide variety of industries, including those dealing with chemicals, electrical power, the environment, the food and beverage processing industry, mining, oil and gas, pharmaceuticals, pulp and paper, and textiles. Because of its straightforward operation and absence of moving parts, a liquid ring vacuum pump is an option that is both risk-free and dependable for managing contaminated and potentially hazardous gas streams.

They are used to remove gas and air molecules from a process in a variety of industries and applications. Some examples of these include the food and beverage industry, the semiconductor and electronics industry, the pulp and paper industry, the medical industry, the plastics industry, and the woodworking industry. Applications of liquid ring vacuum pumps include bottle filling, bottle holding, bottle lifting, and pick-and-place machines. Other applications include drying components. In addition, pumps and compressors like these are utilised in the majority of chemical processing industries. This is particularly true of industries that require solvent recovery and vapour recovery. In addition, these pumps are necessary for specialised applications such as the compression of hydrogen, the recovery of ViCl2 monomer, and other similar processes.

Two-stage segment will hold the majority share of the market for liquid ring vacuum pumps

During the years 2022-2034, it is anticipated that the two-stage segment will hold the majority share of the market for liquid ring vacuum pumps.It is anticipated that the two-stage segment will lead the market in terms of type. This market is expanding as a result of an increase in the number of investments being made to carry out industrialization in the Asia Pacific region, as well as an increase in the demand for two-stage liquid ring vacuum pumps across industries.

Stainless steel segment of the liquid ring vacuum pumps market will account for the largest share

It is anticipated that, in terms of value, the stainless steel segment of the liquid ring vacuum pumps market will account for the largest share of the overall market by the end of the forecast period in the year 2022. Demand for stainless steel liquid ring vacuum pumps is anticipated to increase over the course of the forecast period as a result of characteristics such as high cavitation resistance, which extends the amount of time a liquid ring vacuum pump is expected to remain in service.

The segment ranging from 600 to 3000 m3/h accounted for the largest share of the market in terms of value in the year 2022

In terms of flow rate, the segment ranging from 600 to 3000 m3/h accounted for the largest share of the market in terms of value in the year 2022. The flow rates of 600-3000 m3/h and 3,000-10,000 m3/h are considered to be medium capacity for liquid ring vacuum pumps. Large capacity liquid ring vacuum pumps have flow rates of over 10,000 m3/h. The expansion of this market segment is being aided by the persistently expanding demand for industrial vacuum applications, which is coming primarily from the chemical, pulp and paper, and power generation industries.

Developing economies driving the demand for the liquid ring vacuum pumps

One of the primary factors that is anticipated to fuel the demand for liquid ring vacuum pumps in Egypt, Uganda, Nigeria, Taiwan, Malaysia, and India over the course of the forecast period is the establishment of new refinery projects and the expansion of existing ones in these countries.

Asia Pacific will hold the majority share of the market for liquid ring vacuum pumps

During the years 2022-2027, analysts anticipate that Asia Pacific will hold the majority share of the market for liquid ring vacuum pumps.In the year 2022, the Asia Pacific region was the market leader for liquid ring vacuum pumps worldwide. This region is seeing an increase in the number of industrial activities thanks to the low costs of manufacturing and the support of the local governments. Additionally, rising investments in research and development activities are propelling the growth of the market for liquid ring vacuum pumps in the Asia Pacific region.

Increasing investments in the oil and gas sector by the companies

It is anticipated that increasing investments in the oil and gas sector will drive growth in the market for liquid ring vacuum pumps. Specifically in the downstream sector, there has been an increase in investments in the oil and gas industry, which has led to an increase in demand for liquid ring vacuum pumps. The global investment in new downstream oil refining and integrated chemicals capacity will average $55 billion per year from now until 2026. This will cause the capacity of crude distillation units (CDUs) to increase by 1.7% each year. Because of these investments, the market for liquid ring vacuums is expected to continue growing. As a result, increasing investments in the oil and gas industry are acting as a primary driver for the expansion of the market for liquid ring vacuum pumps.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Liquid Ring Vacuum Pumps market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Materials

|

|

Capacity

|

|

Stages

|

|

End-use

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report