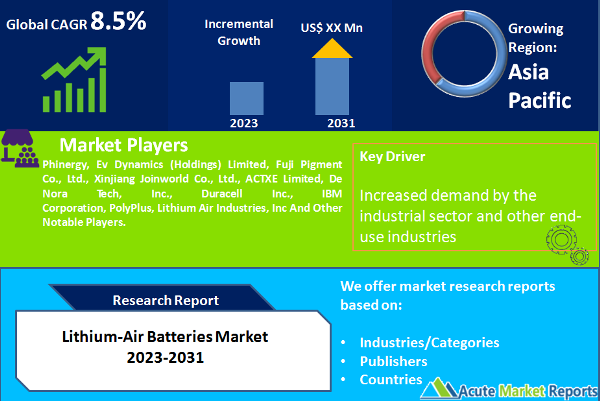

Lithium-air batteries are electrochemical batteries that oxidize lithium at the anode and reduce oxygen drawn from the surrounding air at the cathode. Lithium-air batteries utilize ambient air, which reduces the battery's weight and volume, resulting in a greater energy storage capacity than lithium-ion batteries. Increasing renewable energy sources and the need for energy storage systems are two of the key factors driving the global lithium-air battery market. Aside from this, the increasing use of lithium-air batteries in consumer electronics, automobiles, and medical equipment is expected to expand the global lithium-air battery market. The fact that lithium-air batteries have a lifespan of approximately two months and a low storage capacity, as well as a very low charging rate, are the primary market restraints for lithium-air batteries. During the forecast period of 2026 to 2034, the lithium-air battery market is expected to grow at a CAGR of more than 8.5%. The COVID-19 outbreak in the first quarter of 2021 had not had a significant impact. The lithium-air battery market is anticipated to grow as a result of factors such as the expansion of renewable energy sources and rising demand for energy storage devices. Lithium-air batteries have tremendous potential for use in transportation, including both light and heavy vehicles. It can also function in the power distribution network, driving the market for lithium-air batteries. However, the lithium-air battery is less stable, has low energy efficiency, and a shorter cycle life, which is anticipated to restrain the market's expansion.

Increasing Demand for Electric Vehicles

Numerous governments around the world are concentrating on reducing their carbon footprint. Due to the impending depletion of fossil fuel reserves, major automakers are investing heavily in the development and launch of electric vehicles (EVs). These factors motivate research and development in sustainable energy solutions. This is anticipated to stimulate the growth of the lithium-air battery market in the near future. On a single charge cycle, conventional lithium-ion batteries provide approximately 100 miles of driving range. Consequently, these batteries are regarded as expensive for use in EVs. In comparison to lithium-ion batteries, lithium-air batteries provide superior performance at a lower cost.

Researchers at the National Institute of Materials (NIMS) and Softbank Corp. in Japan announced the development of a lithium-air battery with an energy density of over 500Wh/kg in January 2026. This is significantly greater than the energy density of current lithium-ion batteries. Thus, it is anticipated that the high energy density of lithium-ion batteries will drive the market development of lithium-air batteries in the coming years. By the end of 2021, the global EV stock had reached 11.21 million units, with China accounting for a significant share of 5.4 million units. According to the International Energy Agency (IEA), registrations of electric vehicles rose by 41% in 2021. Consequently, the rise in EV adoption is anticipated to increase lithium-air battery market statistics in the near future.

Conventional lithium-ion batteries provide approximately 100 miles of driving range on a single charge cycle and are regarded as the most expensive component in the production of an electric vehicle. As a result, the new and innovative lithium-air batteries are gaining traction in the automotive industry due to their low cost and high performance. The global demand for electric vehicles is bolstering the advancement of lithium-air battery technology, which uses ambient air as an active cathode for electricity generation, thereby reducing the overall weight of automobiles. Due to its increased environmental relevance, the lightweight design of a new range of engineered EV models and brands would increase sales and demand for electric vehicles. In addition, Li-O2 batteries can store 700% more energy than standard Li-Ion batteries, allowing an electric vehicle to travel 500 miles on a single charge at an average cost of $10. As a result, the growing preference for battery-powered cars over fuel-powered vehicles has environmental and economic benefits, which would continue to drive innovations and improvements in the lithium-air battery market.

Increasing Demand in the Consumer Electronics Market:

The increasing penetration of lithium batteries in consumer goods and electronic appliances such as smartphones, smart wearables, and smart home appliances, among others, is creating growth opportunities in the global lithium-air battery market. Increasing consumer demand for thinner, more compact, and high-performance battery products is accelerating the adoption of lithium-air batteries in smart devices, laptops, computers, etc. In addition, the miniaturization of mobile electronics is driving the demand for lightweight and less expensive lithium-air battery cells and packs to meet the energy and power needs of the portable device industry.

Increased Demand for Inexpensive Energy Storage Systems

In the field of energy storage systems, the price of materials with a higher energy density is a major obstacle. This has led to substantial investment in the R&D of less expensive energy storage solutions, thereby fueling the market growth of lithium-air batteries. Researchers at the Massachusetts Institute of Technology (MIT) announced in 2017 the development of an "air-breathing" battery capable of storing electricity for extended periods. The battery has the potential to store energy at a significantly lower cost than existing technologies (roughly US$ 20 to US$ 30 per kWh as opposed to US$ 100 per kWh). In addition, it could have few location restrictions and zero emissions. The use of lithium-air batteries as an ultra-cheap solution for grid storage is possible. In addition to having a low chemical cost, these batteries are manufactured with inexpensive materials. Consequently, the low price of lithium-air batteries is anticipated to boost market dynamics in the coming years.

Aprotic Lithium-air Battery To Emerge as the Fastest Growing Type Segment

According to the most recent lithium-air batteries market trends, the aprotic lithium-air battery segment is projected to lead the industry with a CAGR of 10.5% over the forecast period. Since they do not require a cathode material and can use atmospheric oxygen as the oxidant, apriotic lithium-air batteries have a much higher energy density than conventional lithium-ion batteries.

Automotive Segment Dominates the Market by End Use

The automotive segment contributed the largest revenue share in 2025 among the end-use segment. The need to reduce transportation's reliance on imported oil and emissions has spurred the development of electric vehicles (EVs). In addition, governments worldwide are pushing for the widespread adoption of EVs. Several measures have been taken, including a significant decrease in prices and an expansion of the selection of electric vehicles (EVs). On a single charge cycle, conventional lithium-ion batteries provide approximately 100 miles of driving range. Therefore, they are regarded as expensive components in the production of an electric vehicle. As a result, the new and innovative lithium-air batteries are gaining traction in the automotive industry as a result of their high performance and low cost. In January 2026, researchers from Japan's National Institute of Materials (NIMS) and Softbank Corp. announced the development of a lithium-air battery with a significantly higher energy density than current lithium-ion batteries.

MIT research indicates that lithium-air and zinc-air batteries are the best options for the next generation of secondary batteries for electric vehicle applications. In addition, the Samsung Advanced Institute of Technology (SAIT) has been conducting extensive research on next-generation LIB electrode materials and post-Lithium-ion battery systems, including all-solid-state and lithium-air battery technologies. This is anticipated to make the range of EVs comparable to that of conventional vehicles. Similarly, other companies, such as Toyota and IBM, have taken a keen interest in developing these batteries for EVs by increasing their R&D expenditures and R&D activities in response to technological advances.

APAC Remains as the Global Leader

According to the most recent market forecast for lithium-air batteries, Asia Pacific is expected to hold the largest share from 2026 to 2034. In 2025, the region accounted for a 51.5% share. Rapid industrialization and increased demand for lithium-air batteries in the defense and aerospace industries are expanding the region's market share. China is poised to be the industry's growth engine in Asia-Pacific, driven by the expansion of its automotive, electronics, and energy sectors. In 2025, North America held a 25% share. In the near future, growth in the automotive and transportation industries is anticipated to drive market revenue in the region. In 2025, Latin America and Middle East & Africa accounted for a small portion of the market.

Innovation and Strategic Collaborations Remain the Key to Enhance Market Share

A small number of large-scale companies control the majority of the market share worldwide. The majority of businesses are investing significantly in extensive research and development, primarily to develop eco-friendly products. Expansion of product lines and mergers and acquisitions are two of the most important strategies utilized by prominent players. Key market participants include Phinergy, Ev Dynamics (Holdings) Limited, Fuji Pigment Co., Ltd., Xinjiang Joinworld Co., Ltd., ACTXE Limited, De Nora Tech, Inc., Duracell Inc., IBM Corporation, PolyPlus, Lithium Air Industries, Inc and others.

Recent development in the Lithium-Air Battery market include:

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Lithium-Air Batteries market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Type

|

|

Capacity

|

|

End-use

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report