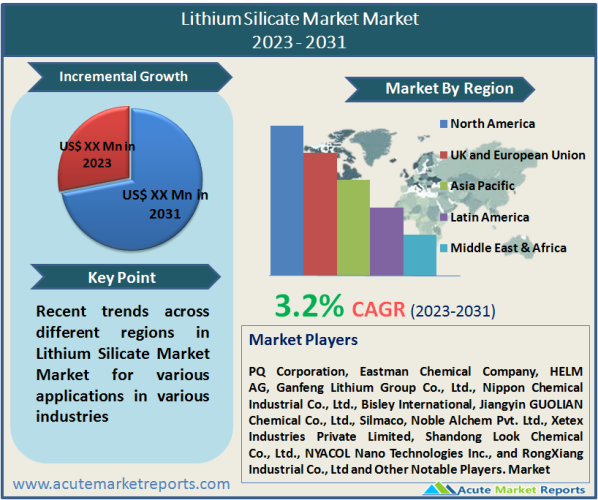

The global market for lithium silicate market is expected to grow at a CAGR of 3.2% during the forecast period of 2026 to 2034. During the forecast period, revenue growth on the global lithium silicate market is anticipated to be driven by the construction industry. As an architectural coating, lithium silicate is widely used in the construction industry. Population growth is anticipated to increase global demand for housing units, thereby bolstering market statistics. Increased discretionary income is likely to increase home improvement and renovation expenditures.Manufacturers and suppliers of lithium silicate are expanding their production capacities to meet the rising demand for their products. They are also investing heavily in research and development for new products in order to increase their lithium silicate market share.

Lithium silicate is a lithium oxide (Li2O) and colloidal silica aqueous solution (SiO2). It is typically employed in the production of refractory ceramics & glazes as well as specialty paints & coatings. Additionally, lithium silicate is utilised in concrete surface treatments. In lithium silicate, lithium serves as a silica transport agent.In the marine industry, lithium disilicate is utilised as a corrosion inhibitor. It is also utilised in the manufacturing of dental crowns. Additionally, lithium disilicate can be used as a bonding agent in fibreglass.Lithium silicates are utilised in the production of cement, concrete, asbestos tiles, ceramics, and coatings of aluminium, iron, wood, and synthetic resin, among other building materials. These silicates are ideal for moist environments and water-resistant decorative coatings. When sprayed on concrete surfaces, lithium silicates penetrate calcium hydroxide-saturated leak water channels and voids, making them popular as concrete floor hardeners.These silicates combine with free lime (calcium hydroxide) to form calcium silicate hydrate gels that are insoluble. These gels increase the surface density, strength, and durability of concrete that has been treated. This makes the concrete floor more abrasion-resistant. Therefore, the concrete floor is easier to maintain and requires less dusting. Additionally, liquid floor hardeners provide enhanced floor protection and a glossy finish.

Construction Industry Expansion Drives Lithium Silicate Market

Widespread use of lithium silicates in the production of concrete and ceramics. These silicates are used to increase the density and hardness of the surfaces of concrete. Population growth and the resulting increase in construction sector investment are anticipated to increase demand for lithium concrete sealers, lithium hardeners, lithium silicate solutions, lithium silicate sealers, and lithium silicate densifiers. It is anticipated that this will contribute to market growth in the near future.

Lithium Silicates Preferred Over Sodium and Potassium Silicates

Lithium hardeners inhibit or reduce the alkali-silica reaction. The reaction between silica and alkali oxides can produce Alkali-silica Reaction (ASR) gel, which expands when exposed to water. This causes concrete to fracture.When added to concrete, sodium and potassium hardeners directly contribute to the ASR problem. To produce durable concrete, it is necessary to decrease ASR. The addition of lithium salts prevents ASR-induced expansion. Lithium silicate is a cost-effective method for mitigating ASR. This will likely increase the size of the lithium silicate market in the near future.

On metal surfaces, lithium silicate can be used as a surface treatment agent. On steel surfaces, it can also be employed as an anti-rust liquid. In accordions, radios, and other instruments, lithium silicate is utilised as an anti-corrosion agent for metal parts. It is also employed in the decoration of non-ferrous metals and the preservation of light and colour in handicrafts. Due to their low water solubility, lithium silicates are utilised to reduce water-soluble byproducts and efflorescence. In the coming years, these advantages are likely to fuel lithium silicate market expansion.

HighDemand for Concrete Hardeners

According to the most recent market trends for lithium silicate, the concrete hardeners application segment is anticipated to lead the industry over the forecast period. Lithium hardeners increase the density and durability of concrete surfaces. They are typically inorganic and can be applied in dry or liquid form to either cured or uncured concrete surfaces.When chemical hardeners are added to a concrete surface, the free lime in the concrete reacts and forms a mixture of dicalcium and tricalcium silicates. Calcium silicate hydrate, also known as tobermorite gel, is produced when these dicalcium and tricalcium silicate complexes react further with the additional water present in concrete.

As chemical hardeners, lithium silicates provide strength, durability, and resistance to moisture, chemicals, and abrasion. Consequently, these silicates provide substantial cost savings during construction and facilitate the efficient application of concrete floors. The adoption of lithium silicates in residential, commercial, and industrial construction is driven by these benefits.Lithium hardeners interact with calcium components in concrete to form extremely stable and robust silicate structures, thereby enhancing and extending the lithium's reactivity. Lithium-based hardeners react more thoroughly and uniformly than their sodium and potassium counterparts. In addition, they do not cause map cracking or crazing, nor do they produce silica gel to seal the concrete surface. Lithium hardeners are less water-soluble and absorb water less readily than sodium and potassium hardeners. Therefore, the concrete is more resistant to water.

APAC to be the Global Leader

Asia-Pacific is anticipated to hold the largest share of the lithium silicate market during the forecast period 2026 to 2034, based on the most recent market forecasts. Rapid urbanisation and industrialization in developing nations such as China, India, Indonesia, and Malaysia are driving regional market growth. During the forecast period, China is anticipated to be the growth engine of the industry in Asia-Pacific.

Market Competition to Increase During the Forecast Period

The global market is highly fragmented, with a handful of large-scale companies controlling the majority of the share. Through research and development, the majority of businesses are concentrating on expanding their market share of lithium silicate. To expand their regional presence, vendors are also adopting partnerships, collaborations, and mergers & acquisitions. Key market participants include PQ Corporation, Eastman Chemical Company, HELM AG, Ganfeng Lithium Group Co., Ltd., Nippon Chemical Industrial Co., Ltd., Bisley International, Jiangyin GUOLIAN Chemical Co., Ltd., Silmaco, Noble Alchem Pvt. Ltd., Xetex Industries Private Limited, Shandong Look Chemical Co., Ltd., NYACOL Nano Technologies Inc., and RongXiang Industrial Co., Ltd And Others.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Lithium Silicate market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Application

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report