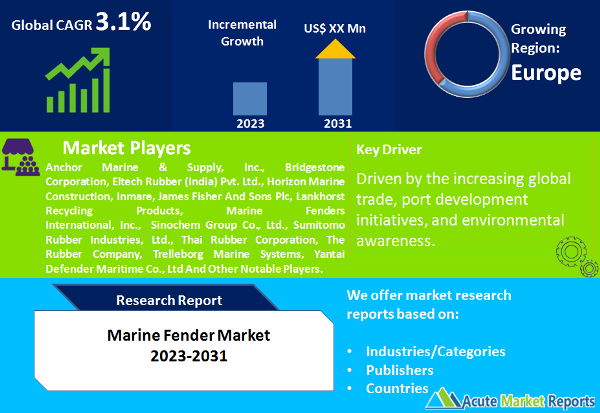

Marine fenders are specialized devices or equipment used in the maritime industry to protect ships, vessels, and port infrastructure from damage during berthing and docking operations. They serve as a cushioning and shock-absorbing barrier between the vessel and the quay (dock) or other structures, helping to distribute and dissipate the kinetic energy generated during the impact. Marine fenders market is projected to grow at a CAGR of 3.1% from 2026 to 2034,driven by the increasing global trade, port development initiatives, and environmental awareness. While challenges related to materials and sustainability exist, the market is expected to respond with innovative solutions. As the maritime industry continues to evolve, marine fenders will remain a critical component for ensuring the safety and efficiency of vessels and port operations.

Increasing Global Trade and Seaborne Transportation

Global trade and seaborne transportation have been growing steadily, driven by the expansion of international commerce and the globalization of supply chains. In 2025, despite challenges posed by the COVID-19 pandemic, seaborne trade volumes rebounded, highlighting the resilience of the maritime industry. The demand for marine fenders, which are crucial for the safe berthing and docking of vessels, is closely linked to the growth of seaborne trade. Ports and terminals around the world have been upgrading and expanding their infrastructure to accommodate larger vessels and handle higher cargo volumes. This has resulted in a substantial demand for marine fenders, especially larger and more advanced types, to ensure safe and efficient operations. The trend of increasing global trade is expected to continue into the forecast period (2026-2034), supporting the growth of the marine fender market.

Focus on Port Development and Infrastructure Upgrades

Ports are the lifelines of international trade, and governments and port authorities worldwide are investing heavily in port development and infrastructure upgrades. Modern ports are designed to handle larger vessels, including container ships, bulk carriers, and cruise liners. These larger vessels require robust fender systems to absorb the energy generated during berthing and to prevent damage to both the vessels and the port structures. Port authorities are increasingly recognizing the importance of high-performance marine fenders to enhance safety and reduce maintenance costs. In 2025, numerous port expansion and development projects were underway, driving the demand for marine fender systems. As these projects continue and new ones are initiated, the marine fender market is expected to witness sustained growth.

Growing Awareness of Environmental Protection

Environmental concerns and regulations have had a significant impact on the marine industry, leading to the development and adoption of eco-friendly and sustainable practices. This includes the use of marine fender systems designed to minimize the impact on marine ecosystems and reduce the emission of pollutants. In 2025, the focus on environmental protection prompted ports and terminal operators to invest in innovative and low-impact fendering solutions. These solutions often incorporate materials and designs that are less harmful to the marine environment. As environmental regulations become more stringent and public awareness of sustainability issues increases, the demand for environmentally friendly marine fender systems is expected to grow, driving innovation in the market.

Challenges in Material Availability and Sustainability

The marine fender market faces challenges related to the availability of suitable materials and sustainability concerns. Traditional fender materials, such as rubber and foam, have been widely used but may have limitations in terms of durability and environmental impact. The sourcing of high-quality rubber and other materials for fender production can be subject to fluctuations in supply and pricing. Additionally, as sustainability becomes a more prominent consideration in the maritime industry, there is a growing need for eco-friendly and recyclable fender materials. Meeting these requirements while ensuring the same level of performance poses a challenge for manufacturers. Developing sustainable fender materials that meet the stringent requirements of the marine environment is a priority for the industry as it moves forward.

Rubber Fenders Dominated the Market by Fender Type

Rubber Fenders are the most common type of fenders, known for their durability and versatility.Foam-filled fenders are lightweight and highly resistant to wear and tear.Pneumatic fenders use air pressure to absorb impact energy and are commonly used in ship-to-ship transfers.Timber fenders are often used in older port facilities and are known for their natural buoyancy. Other includes specialized fender types, such as cylindrical and cone fenders.In terms of both compound annual growth rate (CAGR) and revenue, rubber fenders dominated the market in 2025, primarily due to their widespread use in various maritime applications.

Public Ports and terminals Dominates the Market by Ownership Type

Public Ports and terminals are operated by government authorities or port authorities.Private Ports and Terminals: are operated by private entities or corporations.In 2025, public ports and terminals accounted for the highest revenue share due to their significant presence and role in global trade. However, private ports and terminals exhibited the highest CAGR, driven by investments in modernization and efficiency enhancements.

Europe remain as a Global Leader

Geographic trends in the marine fender market reflect variations in demand and growth across regions. Asia-Pacific is expected to exhibit the highest CAGR during the forecast period, driven by the expansion of ports in countries like China and India to accommodate larger vessels. In terms of revenue percentage, Europe is expected to maintain its position as the leading region in 2025, owing to its extensive port network and emphasis on environmental sustainability. Additionally, North America is anticipated to witness significant growth, supported by the expansion of container shipping and cruise tourism.

Competitive Trends

The marine fender market features several key players, including Anchor Marine & Supply, Inc., Bridgestone Corporation, Doshin Rubber Products (M) Sdn. Bhd, Eltech Rubber (India) Pvt. Ltd., Horizon Marine Construction, Inmare, J.C. Macelroy Company, Inc., James Fisher And Sons Plc, Lalizas Italia S.R.L., Lankhorst Recycling Products, Malaysian Consortium Of Rubber Products Sdn. Bhd., Marine Fenders International, Inc., Max Groups Marine Corporation, Prosertek Group S.L., Qingdao Jier Engineering Rubber Co., Ltd., Sinochem Group Co., Ltd., Sri Trang Agro-Industry Plc, Sumitomo Rubber Industries, Ltd., Thai Rubber Corporation, The Rubber Company, The Yokohama Rubber Co., Ltd., Trelleborg Marine Systems, Von Bundit Co., Ltd., And Yantai Defender Maritime Co., Ltd. These companies employ various strategies to maintain their market position and drive growth. Key strategies include product innovation, research and development investments, and global expansion. In 2025, these top players collectively generated substantial revenue, and they are expected to continue leading the market throughout the forecast period. The competitive landscape remains dynamic, with players focused on meeting the evolving needs of the maritime industry, including sustainability and performance enhancements.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Marine Fender market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Fender Type

|

|

Ownership Type

|

|

End-Use

|

|

Component

|

|

Manufacturing Process

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report