The global marine scrubber systems market is projected to grow at a CAGR of 9.2% from 2025 to 2033, supported by continued enforcement of sulfur-emission limits, fleet retrofits, and installation on newbuild vessels. Scrubber systems remove SOx from exhaust gas so ships can operate on higher-sulfur fuels while meeting regulations. Demand is sustained by cost differentials between very low sulfur fuel oil (VLSFO) and high sulfur fuel oil (HSFO), compliance certainty for global and regional emission control areas (ECAs), and shipowners’ focus on lifecycle operating cost. Integration with digital monitoring and hybrid configurations is improving system reliability and total cost of ownership.

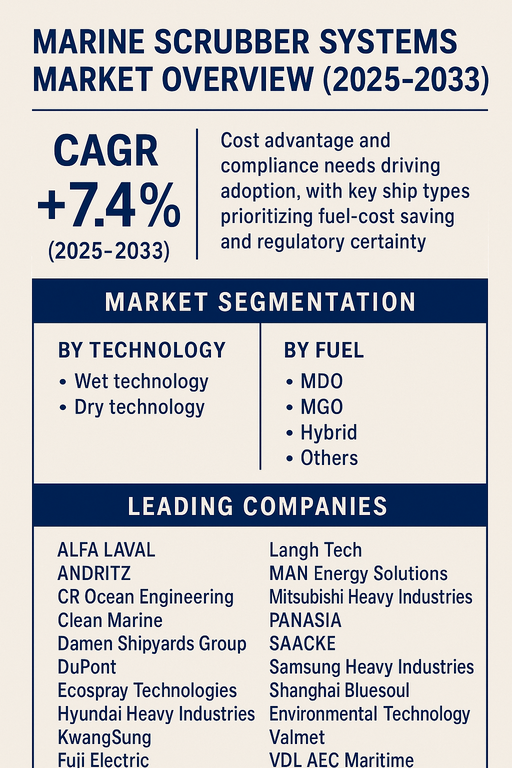

Cost Advantage and Compliance Needs Driving Adoption

Ship operators are prioritizing scrubbers where fuel-cost savings over vessel trading patterns can offset capital and operating costs. Bulk carriers, container ships, and large tankers remain key adopters due to high fuel consumption and predictable routes. Port-state and charterer scrutiny is pushing standardized continuous emissions monitoring, better wash-water handling, and performance guarantees. Newbuild activity in Asia, combined with retrofit pipelines in Europe and the Middle East, is supporting steady demand. Hybrid and closed-loop variants enable flexible operation across open seas and ECAs, reducing operational risk and downtime.

Challenges: Capex, Space Constraints, and Water Discharge Limits

Barriers include high upfront costs, limited space in engine rooms (especially for retrofits on smaller tonnage), and downtime during installation. Water discharge restrictions in certain ports create operational complexity for open-loop systems and favor hybrid/closed-loop solutions. Maintenance burden (pumps, nozzles, circulation systems), sludge handling, and the need for reliable alkalinity supply (e.g., caustic soda) add to OPEX. Uncertainty around long-term decarbonization pathways (LNG, methanol, ammonia, and carbon capture) can delay investment decisions; however, payback remains attractive on heavy fuel consumers and where HSFO–VLSFO spreads are stable.

Market Segmentation by Technology

By technology, the market is divided into wet technology and dry technology. Wet systems (open-loop, closed-loop, and hybrid) account for the major share due to proven performance, broad supplier base, and scalability for large oceangoing vessels. Open-loop remains common for deep-sea trades with compliant wash-water, while hybrid variants are selected for flexible switching to closed-loop in ECAs or discharge-restricted ports. Dry technology—which uses sorbents without wash-water—serves niche applications where water use is constrained, on smaller vessels, or where simpler installation is required, but adoption is smaller compared with wet systems.

Market Segmentation by Fuel

By fuel, adoption aligns with fuel strategies across fleets: MDO and MGO segments are smaller as these fuels already meet sulfur limits but see demand where scrubbers are paired with engines optimized for operational flexibility. Hybrid fuel strategies—using HSFO on high-seas with scrubbers and switching to compliant fuels in port—support the Hybrid segment in this classification. Others covers HSFO-centric operations with scrubbers, blends, and emerging ties to future fuels where scrubbers may complement dual-fuel engines for compliance on non-ECA legs. Overall, scrubbers remain most attractive where HSFO use provides a clear cost advantage.

Regional Insights

In 2024, Asia Pacific led the market, driven by high newbuild activity in China and South Korea and availability of major shipyards for turnkey installations. Europe followed, supported by stringent regional policies, dense ECA coverage, and strong retrofit demand across short-sea and deep-sea operators. North America showed steady uptake linked to ECA compliance on the Atlantic and Pacific coasts and retrofit programs among tanker and container fleets. Middle East demand is linked to large crude and product tanker operators prioritizing operating economics on long-haul routes. Latin America and Africa are emerging, with installations tied to specific export routes and port regulations.

Competitive Landscape

The market in 2024 featured a mix of marine OEMs, engineering specialists, and shipyards providing full-scope solutions and aftersales service. Wärtsilä, ALFA LAVAL, Yara International, Ecospray Technologies, CR Ocean Engineering, Langh Tech, PANASIA, SAACKE, VDL AEC Maritime, and Clean Marine offer broad wet scrubber portfolios including open-loop, closed-loop, and hybrid systems with integrated control and monitoring. MAN Energy Solutions and Mitsubishi Heavy Industries provide engine-aligned solutions and lifecycle support. Valmet and ANDRITZ leverage process and filtration expertise for efficient water treatment and sludge management. Samsung Heavy Industries, Hyundai Heavy Industries, and Damen Shipyards Group support design-to-installation at scale on newbuilds and complex retrofits. DuPont contributes materials and emission-control know-how, while KwangSung and Shanghai Bluesoul Environmental Technology expand regional supply. Fuji Electric supplies power and control components complementing system integration. Competition centers on proven compliance, lifecycle economics, footprint optimization for retrofits, reliable wash-water treatment, and global service networks.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Marine Scrubber Systems market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Technology

| |

Fuel

| |

Application

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report