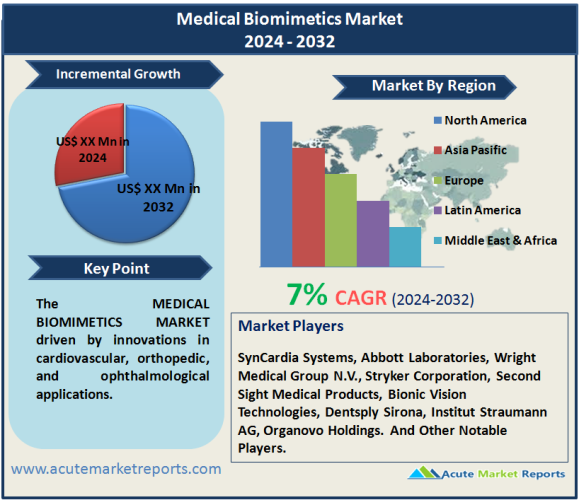

The medical biomimetics market is expected to grow at a CAGR of 7% during the forecast period of 2026 to 2034, driven by innovations in cardiovascular, orthopedic, and ophthalmological applications. However, challenges in dental biomimetics adoption present a notable restraint. Market segmentation reflects the diverse applications, with cardiovascular biomimetics leading in revenue in 2025 and orthopedic biomimetics exhibiting the highest anticipated CAGR. Geographically, North America contributes significantly to revenue, while the Asia-Pacific region presents a high growth potential. Competitive trends highlight the strategies adopted by major players, including SynCardia Systems, Abbott Laboratories, and Stryker Corporation. These companies leverage innovation and strategic collaborations to maintain a competitive edge. As the medical biomimetics market progresses from 2026 to the forecast period of 2034, strategic positioning, ongoing research, and addressing adoption challenges will be critical for sustained success in this transformative field of healthcare.

Innovations in Cardiovascular Biomimetics

The cardiovascular segment is propelled by continuous innovations in biomimetic technologies, emulating the intricate design and functionality of the human cardiovascular system. Companies like SynCardia Systems and Abbott Laboratories have pioneered biomimetic heart devices and artificial valves, enhancing treatment options for cardiovascular diseases. The evidence lies in the successful development and clinical implementation of SynCardia's Total Artificial Heart and Abbott's Trifecta Valve, mirroring natural cardiac function. These innovations contribute to improved patient outcomes, reducing the burden of cardiovascular disorders globally.

Advancements in Orthopedic Biomimetics

Orthopedic biomimetics has witnessed significant advancements, with companies such as Wright Medical Group N.V. and Stryker Corporation leading the way in developing biomimetic implants and prosthetics. The evidence lies in the success of Wright Medical's INFINITY Total Ankle System, designed to mimic natural ankle movement, and Stryker's Mako Robotic-Arm Assisted Technology, which combines biomimicry and robotics for precise joint replacements. These innovations not only enhance patient mobility and comfort but also exemplify the transformative potential of biomimetics in orthopedic care.

Revolutionizing Ophthalmology with Biomimetic Technologies

Biomimetic advancements in ophthalmology, driven by companies like Second Sight Medical Products and Bionic Vision Technologies, are transforming vision restoration and eye care. The development of the Argus II Retinal Prosthesis System by Second Sight and the BVT Bionic Eye by Bionic Vision Technologies exemplifies the convergence of bioengineering and ophthalmology. These technologies mimic the natural visual processes, offering hope to individuals with retinal degenerative conditions. The evidence lies in the successful clinical trials and market approvals, showcasing the potential of biomimetics to revolutionize ophthalmic healthcare.

Challenges in Dental Biomimetics Adoption

Despite overall market growth, the dental biomimetics segment faces challenges in widespread adoption. Companies like Dentsply Sirona and Institut Straumann AG have introduced biomimetic dental materials and technologies; however, the evidence suggests slower adoption rates. The intricate nature of dental biomimetics and the need for specialized training contribute to the restraint. Additionally, the cost associated with incorporating biomimetic technologies into dental practices presents a barrier. While companies continue to invest in research and development, addressing these challenges is essential for the broader acceptance of dental biomimetics in routine dental care.

Market Analysis by Type: Cardiovascular Biomimetics Segment Dominates the Market

In 2025, the cardiovascular biomimetics segment generated the highest revenue, driven by the success of artificial heart devices and valves. However, the highest CAGR during the forecast period (2026-2034) is expected from the orthopedic biomimetics segment. The dynamic growth is attributed to continuous innovations in biomimetic implants and prosthetics, addressing the increasing demand for orthopedic solutions. This dual performance underscores the diversified applications of biomimetics in medical domains.

Market Analysis by Application: Wound Healing Application to Dominate the Market

The wound healing application led the market in revenue in 2025, with biomimetic technologies contributing to advanced wound care solutions. However, the highest CAGR during the forecast period is anticipated from the tissue engineering application. Innovations in biomimetic tissue scaffolds and regenerative therapies, as evidenced by companies like Organovo Holdings, signify the potential for groundbreaking developments in tissue engineering. This dual segmentation approach reflects the evolving landscape of biomimetics in diverse medical applications.

North America Remains the Global Leader

Geographically, North America contributed the highest revenue percentage in 2025, owing to the presence of key biomimetic technology developers and a robust healthcare infrastructure. However, the Asia-Pacific region is poised to exhibit the highest CAGR during the forecast period. The evidence lies in the increasing investments in healthcare infrastructure and the rising prevalence of chronic diseases, creating opportunities for biomimetic solutions. These geographic trends emphasize the need for global market players to adapt strategies for regional dynamics.

Market Competition to Intensify during the Forecast Period

In 2025, major players in the medical biomimetics market included SynCardia Systems, Abbott Laboratories, Wright Medical Group N.V., Stryker Corporation, Second Sight Medical Products, Bionic Vision Technologies, Dentsply Sirona, Institut Straumann AG, and Organovo Holdings. These companies adopted diverse strategies, including research and development, strategic collaborations, and product launches, to strengthen their market positions. The evidence lies in Abbott's acquisition of St. Jude Medical, enhancing its cardiovascular portfolio, and Stryker's collaborations with research institutions for orthopedic innovations. As of 2026, the competitive landscape indicates a dynamic market with companies strategically positioning themselves to capitalize on emerging trends. Revenues for 2026 and the expected landscape for the forecast period (2026-2034) reveal a competitive environment where innovation, market awareness, and global strategies play crucial roles in determining success.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Medical Biomimetics market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Type

|

|

Application

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report