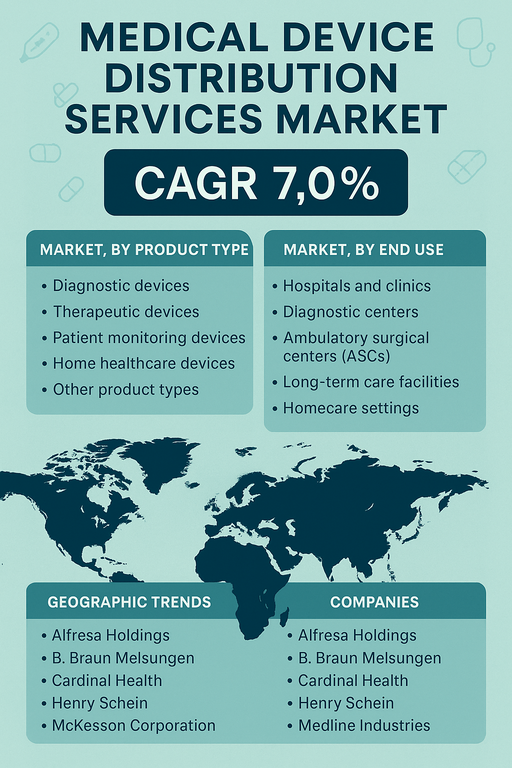

The global medical device distribution services market is projected to grow at a CAGR of 7.0% between 2026 and 2034. Growth is driven by increasing healthcare infrastructure, the rising prevalence of chronic diseases, and an expanding base of healthcare facilities demanding timely and efficient device supply chains. Continued innovation in logistics management, temperature-controlled shipping, and digital inventory tracking will support sustainable growth across diverse geographies and end-user segments.

Market Drivers

Expanding healthcare networks and higher surgical volumes enhance demand for efficient and compliant distribution services for diverse device types. Rising home healthcare adoption and the need for rapid device availability bolster sustained demand across hospitals, diagnostic centers, and homecare settings. Partnerships with OEMs and advanced logistics solutions further enhance the capabilities of specialized medical device distributors.

Market Restraint

Despite growth, stringent regulatory requirements and device-specific handling protocols add complexity to logistics and can slow service expansion. High service costs and reimbursement uncertainties in developing countries also present challenges. Additionally, the need to maintain cold chains and prevent counterfeiting may restrict the pace of growth in less-regulated markets.

Market By Product Type

By product type, therapeutic devices accounted for the largest share in 2025 due to demand across surgical, cardiovascular, and orthopedic procedures. Patient monitoring devices and diagnostic devices also remain significant contributors driven by increased chronic disease prevalence and preventative health checkups. Home healthcare devices are anticipated to register the highest CAGR as patients and providers embrace remote monitoring, self-care tools, and wearable technology. Other product types include specialized surgical instruments and consumables.

Market By End Use

By end use, hospitals and clinics held the largest share in 2025, supported by established procurement networks and higher patient throughput. Diagnostic centers and ambulatory surgical centers (ASCs) continue to grow rapidly as healthcare delivery shifts toward outpatient care. Homecare settings will record the highest CAGR driven by the preference for at-home treatment options, especially among aging populations. Long-term care facilities also present significant demand as chronic care needs and rehabilitative services rise worldwide.

Geographic Trends

North America and Europe led the market in 2025 owing to advanced healthcare systems, broad reimbursement structures, and strong supplier relationships. Asia Pacific is projected to register the highest CAGR due to increasing investments in healthcare logistics, modernization of healthcare infrastructure, and rising demand for affordable medical devices across India, China, and Southeast Asia. Latin America and the Middle East & Africa present long-term opportunities driven by improving healthcare access and expanding private healthcare investments.

Competitive Trends

The competitive landscape is diverse and features prominent companies including Alfresa Holdings, B. Braun Melsungen, Cardinal Health, Henry Schein, McKesson Corporation, Medline Industries, Meditek, Medtronic, Nipro, Owens & Minor, Patterson Companies, Soquelec, Southmedic, Stat Medical, and The Stevens Company. Major players leverage broad global distribution networks, advanced warehouse automation, temperature-controlled storage, and collaborative partnerships with medical device manufacturers. Going forward, strategic mergers, investments in digital supply chain solutions, regional expansions, and sustainable distribution practices will help companies enhance market share and operational efficiency in the medical device distribution services market.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Medical Device Distribution Services market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Product Type

|

|

End Use

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report