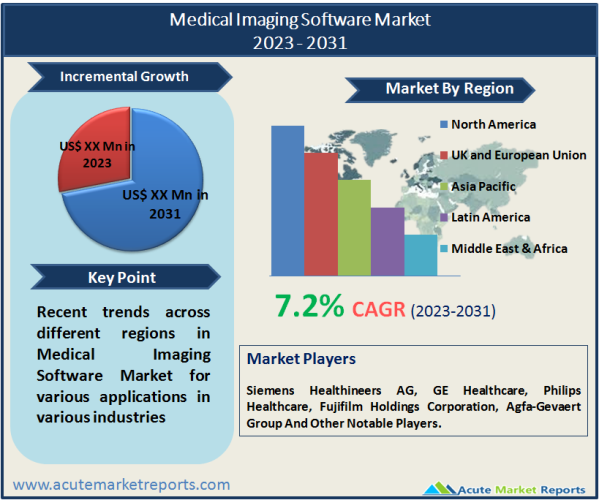

The global medical imaging software market is projected to grow at a CAGR of 7.2% during the forecast period of 2026 to 2034, driven by factors such as the increasing prevalence of chronic diseases, advancements in imaging technology, and the rising demand for efficient and accurate diagnostic solutions. This market encompasses software solutions that are crucial in acquiring, processing, visualizing, and analyzing medical images. These solutions enable healthcare professionals to effectively diagnose and treat various medical conditions by creating visual representations of the internal structures of the body. Medical imaging software offers features for image acquisition and processing, allowing the acquisition of medical images from modalities like X-ray, CT, MRI, ultrasound, and PET. It also includes tools for image enhancement, noise reduction, and image reconstruction. The software enables visualization and analysis of medical images through 2D and 3D rendering, multiplanar reconstruction, image fusion, and volume rendering. Additionally, it facilitates image storage, organization, and retrieval, often integrating with PACS and EMR systems for seamless access to patient data. Several trends are driving the growth of the medical imaging software market. The adoption of artificial intelligence (AI) in imaging software is on the rise, as it automates image analysis, improves diagnostic accuracy, and aids in early disease detection. The COVID-19 pandemic has accelerated the adoption of telemedicine and remote imaging solutions, which rely on medical imaging software for the transmission and interpretation of images remotely. Technological advancements in imaging, such as high-resolution imaging and real-time visualization, are also fueling market growth. Furthermore, the increasing healthcare expenditure and investments in healthcare infrastructure contribute to the demand for advanced medical imaging software.

Technological Advancements and Innovations

Technological advancements and innovations are major drivers propelling the growth of the medical imaging software market. Continuous advancements in imaging technology and software solutions have revolutionized medical imaging, enhancing diagnostic accuracy and improving patient outcomes. The integration of artificial intelligence (AI) in medical imaging software has enabled automated image analysis, precise lesion detection, and improved diagnostic accuracy. For example, AI algorithms can assist in the early detection of diseases like cancer by analyzing medical images with high precision. The advent of real-time imaging and 3D visualization techniques has provided healthcare professionals with more comprehensive and detailed information for diagnosis and treatment planning. Real-time imaging allows for dynamic monitoring of organs and systems, aiding in interventions and surgeries. The introduction of advanced image reconstruction techniques, such as iterative reconstruction and model-based iterative reconstruction, has improved image quality, reduced radiation dose, and enhanced diagnostic confidence.

Increasing Prevalence of Chronic Diseases

The rising prevalence of chronic diseases worldwide is a significant driver for the medical imaging software market. Chronic conditions such as cardiovascular diseases, cancer, and neurological disorders require frequent imaging for diagnosis, treatment planning, and monitoring. According to the World Health Organization (WHO), cancer is a leading cause of mortality worldwide. The increasing incidence of cancer has led to a higher demand for medical imaging software to aid in early detection, accurate staging, and treatment evaluation. The global population is aging, leading to an increased prevalence of age-related diseases such as cardiovascular disorders, orthopedic conditions, and neurodegenerative diseases. Medical imaging software plays a crucial role in diagnosing and managing these conditions. The burden of chronic diseases is rising globally, driven by factors such as sedentary lifestyles, unhealthy diets, and environmental factors. Medical imaging software is essential for diagnosing and monitoring conditions like diabetes, respiratory diseases, and musculoskeletal disorders.

Demand for Efficient Diagnostic Solutions

The growing demand for efficient and accurate diagnostic solutions is driving the adoption of medical imaging software. Healthcare providers and professionals are seeking advanced imaging tools to improve the speed, accuracy, and reliability of diagnoses. The shift towards precision medicine requires precise diagnostic tools to tailor treatment plans to individual patients. Medical imaging software enables personalized imaging-based assessments, aiding in the selection of appropriate therapies and monitoring treatment responses. In critical cases, quick and accurate diagnosis is crucial for initiating timely interventions. Advanced imaging software allows for rapid image acquisition, efficient data analysis, and seamless image interpretation, supporting prompt diagnosis. Medical imaging software offers features such as automated image processing, integration with electronic health records (EHRs), and seamless data sharing, improving workflow efficiency and reducing the time required for diagnosis and treatment decisions.

Data Security and Privacy Concerns

Data security and privacy concerns pose a significant restraint to the growth of the medical imaging software market. As medical imaging involves the storage and transmission of sensitive patient information, ensuring the security and privacy of this data is crucial. However, challenges in safeguarding patient data can hinder the widespread adoption of medical imaging software. Medical imaging software relies on storing and transmitting large volumes of patient data, including images and personal health information. The increasing sophistication of cyber threats poses risks of data breaches, unauthorized access, and potential misuse of patient information. Healthcare providers and software developers must comply with stringent data protection regulations, such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States and the General Data Protection Regulation (GDPR) in the European Union. Adhering to these regulations and ensuring data privacy can be complex and resource-intensive. Medical imaging software often needs to integrate with various healthcare systems and devices, leading to interoperability challenges. Ensuring secure and seamless data exchange between different platforms and maintaining data integrity can be a technical challenge, potentially impacting data security. The lack of standardized security protocols and practices across different medical imaging software solutions can create vulnerabilities. The absence of uniform security measures increases the risk of data breaches and unauthorized access, hampering the adoption of medical imaging software.

Market Size of Integrated Software in the Medical Imaging Software Market

The medical imaging software market can be categorized into two main types: integrated software and standalone software. Each type offers unique advantages and serves different needs within the healthcare industry. Integrated medical imaging software refers to solutions that are integrated with other healthcare systems and platforms, such as picture archiving and communication systems (PACS) or electronic medical record (EMR) systems. These software solutions provide seamless integration and interoperability, allowing healthcare providers to access and manage patient data and medical images from a centralized platform. Integrated software solutions typically have a higher revenue percentage compared to standalone software. It is common to see integrated software occupying a significant portion of the market, with estimates ranging from around 60% to 80% of the total revenue share. These solutions are widely adopted by healthcare providers for their seamless integration with existing healthcare systems and improved workflow efficiency.

North America: Dominance in the Medical Imaging Software Market

North America holds approximately 40% to 50% share in the medical imaging software market due to well-established healthcare infrastructure, advanced technology adoption, and favorable government initiatives. The region witnesses a high demand for advanced imaging solutions, contributing to substantial revenue generation.

Key trends and insights:

Competitive Landscape

The medical imaging software market is characterized by intense competition among several key players who continuously strive to differentiate themselves and gain market share. Prominent companies in the market include Siemens Healthineers AG, GE Healthcare, Philips Healthcare, Fujifilm Holdings Corporation, and Agfa-Gevaert Group. These market players focus on technological advancements, such as integrating AI and machine learning algorithms into their software solutions, to deliver more accurate diagnostics and improved workflow efficiency. Strategic partnerships and collaborations are also common, with companies seeking to leverage complementary expertise and expand their market presence. Additionally, there is a growing emphasis on cloud-based solutions, interoperability, user-friendly interfaces, and optimization of healthcare workflows. Mergers and acquisitions are prevalent as companies aim to strengthen their product portfolios and enter new geographic markets.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Medical Imaging Software market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Software

|

|

Modality

|

|

Imaging Type

|

|

Application

|

|

End Use

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report