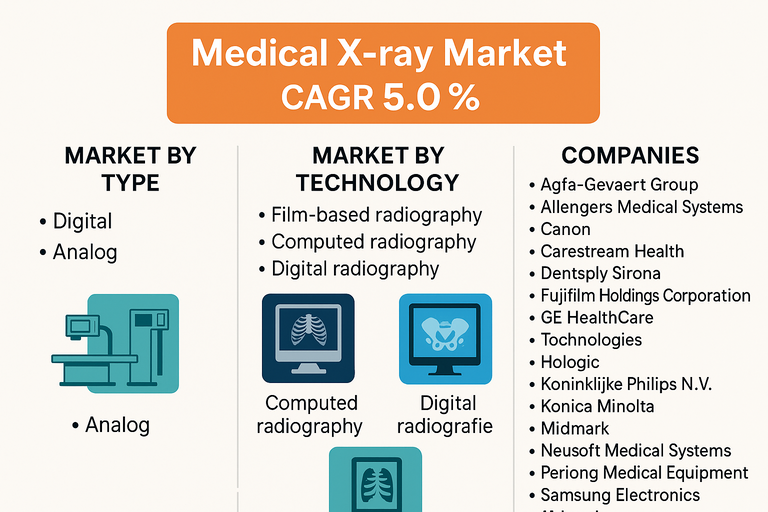

The medical X-ray market is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.0% from 2025 to 2033, fueled by the rising prevalence of chronic diseases, increasing diagnostic imaging procedures, and the ongoing global transition from analog to digital radiography systems. X-ray imaging remains a fundamental tool in healthcare, widely used across emergency care, outpatient diagnostics, dental clinics, and inpatient hospital settings. The increasing adoption of minimally invasive diagnostics and preventive care, coupled with advancements in high-resolution digital imaging, are reinforcing market growth across developed and emerging economies.

Market Drivers

Rising Demand for Diagnostic Imaging Amid Chronic Disease Prevalence

The global burden of cardiovascular diseases, cancer, musculoskeletal disorders, and respiratory illnesses is leading to higher utilization of diagnostic imaging services. X-rays are the first-line imaging modality for evaluating fractures, chest abnormalities, joint conditions, and tumor progression. With aging populations in countries such as Japan, Germany, and the U.S., the need for accessible and cost-efficient imaging solutions is intensifying. Additionally, rising awareness of early disease detection and expanding insurance coverage for diagnostic imaging are supporting increased patient throughput in radiology departments.

Transition Toward Digital Radiography and Workflow Optimization

Healthcare facilities are steadily transitioning from analog and film-based systems to digital radiography platforms that offer superior image quality, faster processing times, and reduced radiation exposure. Digital systems enhance workflow efficiency by integrating with PACS (Picture Archiving and Communication Systems) and HIS (Hospital Information Systems), enabling faster diagnosis, seamless storage, and remote consultation. Moreover, digital radiography improves image manipulation, contrast resolution, and dose optimization, which is crucial for pediatric and sensitive patient groups. This shift is being supported by regulatory initiatives, funding programs, and vendor-led upgrade campaigns.

Expansion of Dental and Outpatient Imaging Centers

The proliferation of standalone diagnostic centers, urgent care clinics, and dental chains is creating demand for compact, portable, and cost-effective X-ray systems. Dental X-rays, in particular, represent a growing segment, driven by rising dental care awareness and cosmetic dentistry procedures. Outpatient centers prefer mobile and integrated digital X-ray units that provide point-of-care imaging with minimal footprint and maintenance. The modularity, low-dose radiation profiles, and wireless functionality of new-age X-ray systems are enhancing their usability across diverse clinical environments.

Market Restraint

High Equipment Costs and Infrastructure Barriers in Emerging Economies

Despite technological benefits, the upfront cost of digital X-ray equipment, installation, and IT integration remains a significant barrier, especially for small healthcare providers in low-income regions. Infrastructure limitations such as unreliable power supply, lack of digital data infrastructure, and limited technician training also restrict the adoption of advanced X-ray systems in rural and underserved areas. Moreover, regulatory compliance and periodic equipment calibration requirements add to operational complexity. These constraints create opportunities for mid-tier analog and hybrid systems, but also slow the pace of complete digitization in cost-sensitive markets.

Market Segmentation by Type

The medical X-ray market is segmented into Digital and Analog systems. In 2024, Digital X-ray systems held the dominant market share due to their higher efficiency, improved imaging resolution, and reduced operational costs over time. These systems are favored in urban hospitals, diagnostic chains, and specialty clinics for their ease of integration and rapid image output. However, Analog X-ray systems continue to serve in smaller clinics, primary health centers, and resource-constrained regions where affordability and simple functionality take precedence. Hybrid solutions enabling stepwise digital transition are gaining ground in mid-sized healthcare setups.

Market Segmentation by Technology

By technology, the market includes Film-Based Radiography, Computed Radiography (CR), and Digital Radiography (DR). In 2024, Digital Radiography led the market in revenue share, supported by rising adoption across secondary and tertiary care centers globally. DR systems offer high-quality images with immediate access and lower radiation doses, making them the preferred choice in modern facilities. Computed Radiography, acting as a transitional format, remains popular in regions upgrading from film systems due to its relative affordability and compatibility with existing infrastructure. Film-Based Radiography, while declining in usage, still exists in certain rural and military applications due to low maintenance requirements and familiarity.

Geographic Trends

North America led the medical X-ray market in 2024, attributed to high imaging volumes, established hospital infrastructure, and continuous investment in radiology upgrades. The U.S. in particular is driving demand for digital radiography in outpatient and specialty care centers. Europe followed, supported by government-funded healthcare systems and advanced reimbursement models in countries like Germany, France, and the UK. Asia Pacific is expected to register the highest CAGR from 2025 to 2033, driven by healthcare infrastructure expansion, aging population, and increased accessibility in countries such as China, India, South Korea, and Indonesia. Growing private investments and public health initiatives are promoting digitalization in diagnostic imaging across the region. Latin America and Middle East & Africa represent emerging markets where basic diagnostic access is expanding, and analog-to-digital transitions are gaining momentum via donor aid and localized manufacturing.

Competitive Trends

The medical X-ray market is characterized by global medical device manufacturers offering comprehensive imaging portfolios and aftersales service networks. In 2024, Siemens Healthineers, GE HealthCare Technologies, Canon, and Fujifilm Holdings Corporation led the market with a wide range of digital and hybrid systems for both general and specialty imaging. Philips, Samsung Electronics, and Shimadzu offered compact, mobile, and AI-enabled radiography systems tailored for high-throughput environments. Hologic maintained strong positioning in women’s health imaging, while Carestream Health and Agfa-Gevaert Group focused on radiology informatics integration. Regional players such as Allengers Medical Systems, Trivitron Healthcare, and Perlong Medical Equipment addressed price-sensitive segments with durable analog and computed radiography systems. Konica Minolta, Dentsply Sirona, Neusoft Medical Systems, and Midmark provided specialized solutions for dental, outpatient, and portable imaging needs. Through partnerships, innovation in AI-based image processing, and expanded service offerings, market players are expected to strengthen their competitive edge through 2033.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Medical X-ray market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Type

| |

Technology

| |

Portability

| |

Application

| |

End Use

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report