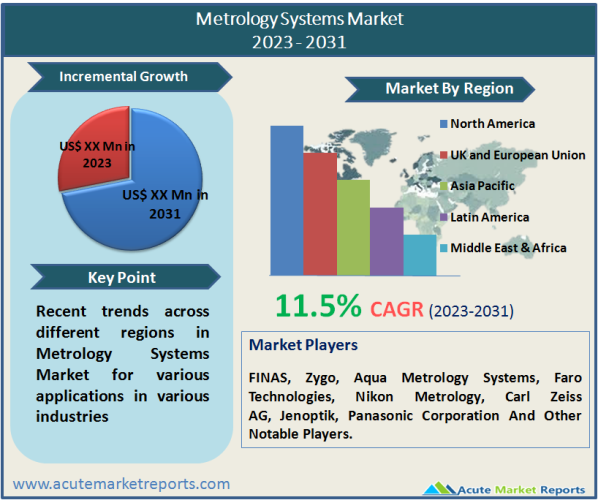

The global market for metrology systems is anticipated to grow at a CAGR of 11.5% during the forecast period of 2026 to 2034. Due to technological advancements and a greater demand for precision, metrology systems are projected to experience substantial growth. To perform metrology functions more efficiently and effectively, automated processes and systems are being developed, and automation is expected to become more prevalent in metrology systems. With the addition of AI-driven algorithms, it is anticipated that metrology systems will become more precise and reliable.In recent years, there has been a significant shift in the field of metrology systems towards automation. The use of robots and artificial intelligence (AI) to replace manual labour. In addition, portable metrology systems for on-site and remote measurement applications have been developed. Using the latest innovations in image processing and optical metrology, precision and speed are being enhanced. The cloud is becoming an increasingly popular method for data analysis, which will make it faster and more precise in the future. FINAS, Zygo, Aqua Metrology Systems, Faro Technologies, Nikon Metrology, Carl Zeiss AG, Jenoptik, and Panasonic Corporation are the leading companies on the global metrology systems market. These competitors are concentrating on introducing innovative products and services to expand their customer base and strengthen their market position.

Autonomous robotic metrology systems will be increasingly relied upon by industrial applications for faster and more precise measurements. The range of applications for 3D laser scanning and imaging technology is likely to expand. The application of automated vision systems will facilitate quality control and inspection. Increasingly, big data analytics and artificial intelligence will be required to analyse and interpret the vast amounts of data produced by metrology systems (AI).In addition, technological advancements will improve data analysis algorithms and increase the versatility and sophistication of software packages. Additionally, the popularity of wireless and cloud-based metrology systems will increase in the future. In addition to allowing other users and metrology operators to benefit from remote monitoring and data sharing, this will enhance collaboration between users and metrology operators.

Manufacturers in North America are placing a greater emphasis on quality improvement and cost reduction, which is increasing the value of metrology systems. The Asia-Pacific region is anticipated to provide lucrative opportunities for market leaders. The growth of information and technology in nations like India, China, and South Korea is anticipated to significantly expand the market. Using metrology systems, manufacturers can determine areas for improvement in addition to gaining a deeper understanding of their processes. Manufacturers can also use metrology systems to remain competitive on the global market in the face of fluctuating customer demands.

Technical Barriers to Trade (TBT) Agreements, which are administered by the World Trade Organization (WTO), permit countries to harmonise national requirements by referencing international documentary standards (norms) in their national technical regulations. A system of mutual recognition and assessment of conformity will also be considered, and signatory states are expected to participate in the process as part of the agreement.

Industry 4.0 will further acknowledge businesses whose value creation is closely tied to manufacturing and information technology. Scientists are increasingly focusing on developing scientific and applied metrology to determine how nanomaterials can be applied in order to address societal needs.During the forecast period, the metrology systems market is anticipated to be driven by an increase in the use of these systems for aerospace, defence, and automotive applications. Through the use of in-line metrology systems, automation, precision, and dependability of measurements are increasing in prevalence. In contrast to existing metrology systems, the next-generation systems are more intuitive, highly perceptive, and adaptable, allowing companies to automate their production processes in the future; this will contribute to the widespread adoption of these systems across numerous industries.

The manufacturing, process, and instrumentation industries rely heavily on metrology, the science of measurement. Due to the increasing demand for reducing errors during the manufacturing process and expanding the product life cycle, the demand for metrology systems is high in the manufacturing industry.In QC labs, engineering labs, and research departments, metrology systems are highly perceptive, customizable, and user-friendly in order to satisfy all instrumentation and measurement requirements. This enables businesses to achieve total automation and increase production. Measuring the sight dimensions of various difficult-to-measure objects, the metrology system employs cutting-edge technology that saves time and money on product development.The application of the metrology system has seen an increase in the adoption of precision engineering methods by manufacturers with a focus on reliability and precision in product manufacturing.

The advantages of metrology systems in terms of precision, cost reduction, and measurement accuracy have led to a rise in the adoption of metrology systems in various industries. Increased demand for 3D metrology systems is a result of the development of metrology systems.The 3D metrology system is primarily used for quality control to ensure production accuracy. This system consists of industrial 3D scanning technology, an optical 3D coordinate measuring machine, a 3D motion sensor, and a 3D measuring machine.In the aerospace, energy and power, automotive, and construction industries, the 3D metrology system is gaining rapid traction. Utilization of the 3D metrology system is increasing as the demand for quality output in industrial applications grows.

Coordinate measuring machines (CMM) enable manufacturing processes to be automated, thereby increasing production efficiency and product quality. These CMM devices consist of an optical CMM, a handheld scanner, an articulated arm, laser scanning devices, and other devices that enhance operational efficiency.In the manufacturing and assembly process, the CMM metrology system is used to assemble and test components against the predetermined design. Adoption of the CMM metrology system in the automated manufacturing industry reduces total operational costs, improves quality, and maintains a continuous production flow, thereby increasing demand for the metrology system.For example, in January 2021, LK Metrology introduced a new CMM measurement services section for performing contract dimensional inspection using the most recent metrology software.

During the forecast period of 2026 to 2034, North America is anticipated to hold a dominant share of the global market. The presence of market leaders is a key factor propelling the metrology systems market in the region. Asia-Pacific is anticipated to create significant opportunities for market leaders. Due to the expansion of the information & technology industry in countries such as Japan, China, South Korea, India, and the Philippines, the metrology systems market in the region is anticipated to grow substantially. The market for metrology systems in Asia-Pacific is expected to grow during the forecast period due to expanding application areas and infrastructure development in emerging economies. The metrology systems market in Middle East & Africa and South America is anticipated to be driven by the rise in infrastructure development in these regions.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Metrology Systems market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Component

|

|

Industry

|

|

Type

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report