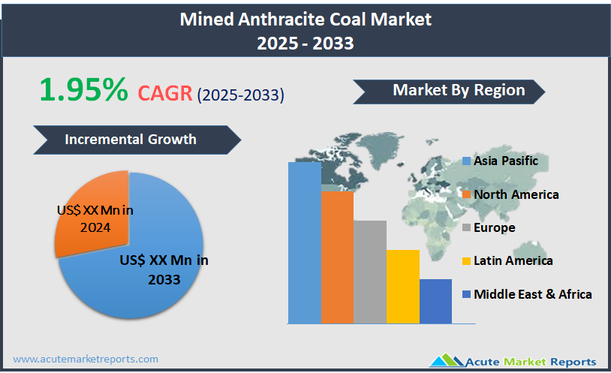

The mined anthracite coal market involves the extraction and processing of anthracite coal, which is a hard, compact variety of coal that has the highest carbon content, the fewest impurities, and the highest calorific content of all types of coal. Anthracite is notably harder and more brittle than other coal types and is used primarily for heating residential and commercial buildings and in metallurgical applications due to its high energy density and ability to burn at a high temperature with a low smoke and flame profile. The mined anthracite coal market is projected to grow at a Compound Annual Growth Rate (CAGR) of 1.95% over the forecast period.

High Demand in Metallurgical Applications

A significant driver for the mined anthracite coal market is its essential use in metallurgical processes. Anthracite coal's high carbon content and exceptional burning characteristics, such as a high heat value and low sulfur content, make it ideal for metallurgy, especially in the steel manufacturing process where it is used as a reductant. The steel industry, vital to global infrastructure and construction sectors, relies heavily on this type of coal to produce high-quality steel. For example, in regions like Eastern Europe and Asia, where large steel production facilities exist, the demand for anthracite coal remains robust despite the global shift towards cleaner energy sources. This ongoing requirement is driven by the coal's efficiency in enhancing the metal smelting process, which significantly influences the performance and quality of the final steel products.

Development of Niche Markets

An opportunity within the mined anthracite coal market lies in the development and expansion of niche markets where the unique properties of anthracite can be utilized. One such application is in water filtration, where anthracite is used due to its high porosity and density characteristics. Expanding the use of anthracite in such environmental and specialized applications could open new revenue streams for producers. Furthermore, the market could see growth in regions with limited access to alternative fuels, where anthracite's higher efficiency as a heating source can be marketed as a superior product compared to other coal types or even certain renewable sources in terms of reliability and heat output.

Shift Towards Renewable Energy

A major restraint impacting the mined anthracite coal market is the global shift towards renewable energy sources driven by environmental concerns and policy changes. As countries implement stricter emissions standards and invest in cleaner energy infrastructure, the demand for coal, including anthracite, faces significant declines. This shift is particularly evident in developed economies, which are rapidly transitioning to wind, solar, and other renewable energy sources to mitigate the environmental impact of fossil fuels. The trend poses a continuous threat to the long-term viability of anthracite coal markets, as both public sentiment and regulatory frameworks move increasingly away from coal-based energy solutions.

Environmental Regulations

One of the foremost challenges facing the mined anthracite coal market is navigating the increasingly stringent environmental regulations. Governments worldwide are setting ambitious carbon reduction targets and implementing policies that restrict coal mining and consumption due to its association with high carbon emissions and environmental degradation. These regulations not only limit production capacities but also increase the costs associated with mining operations, as companies are required to invest in cleaner technologies and adhere to rehabilitative mining practices. Moreover, securing permits and approvals for new mining projects has become more challenging, significantly extending project timelines and increasing the uncertainty of investments in the anthracite coal sector.

Market Segmentation by Grade

In the mined anthracite coal market, segmentation by grade includes Standard Grade, High Grade, and Ultra-high Grade. The High Grade segment holds the highest revenue, primarily because of its preferred use in high-temperature industrial processes, such as metal smelting and other metallurgical applications where its higher carbon content and energy efficiency are crucial. High-grade anthracite is valued for its ability to burn hotter and cleaner than lower grades, making it a favored choice for industries aiming to optimize performance while controlling emissions. Meanwhile, the Ultra-high Grade segment is projected to experience the highest Compound Annual Growth Rate (CAGR). This anticipated growth is due to its increasing use in specialized applications that require the purest form of anthracite with minimal impurities, such as in water filtration systems and certain chemical processing industries where ultra-high grade anthracite's superior properties significantly enhance product quality and process efficiency.

Market Segmentation by Mining Type

The mined anthracite coal market is also segmented by mining type, categorized into Surface Mining and Underground Mining. Underground Mining accounts for the highest revenue within the market due to the depth at which most high-quality anthracite deposits are found, necessitating sophisticated and extensive underground operations. This method is predominant in areas with rich anthracite reserves, where deeper seams that yield higher-quality coal are accessed. On the other hand, Surface Mining is expected to register the highest CAGR from 2025 to 2033. This growth can be attributed to technological advancements in mining equipment and techniques that reduce the cost and increase the efficiency of surface mining operations. Additionally, surface mining's lesser environmental impact compared to underground mining makes it more favorable in regions with strict mining regulations, contributing to its faster growth rate in the global market.

Geographic Segment

The mined anthracite coal market demonstrates distinct geographic trends, with Asia Pacific historically generating the highest revenue in 2024. This dominance is primarily driven by countries like China and India, where industrial growth and energy demands are substantial. Asia Pacific's large-scale consumption of anthracite for power generation, metal processing, and manufacturing industries supports this significant revenue stream. Moving forward from 2025 to 2033, Africa is expected to exhibit the highest Compound Annual Growth Rate (CAGR). The region's growth potential is largely untapped, with countries like South Africa and Nigeria beginning to expand their mining operations. The demand in Africa is driven by increasing industrialization and the need for high-quality anthracite in metal smelting and other industrial processes.

Competitive Trends and Key Strategies

In the mined anthracite coal market, major players include Glencore, Siberian Coal Energy Company, Feishang Anthracite Resources Limited, Jindal Steel & Power Ltd, Coal India Ltd, Reading Anthracite Coal, Blaschak Coal Corporation, Atrum Coal Limited, Shanxi Jincheng Anthracite Coal Mining Group Co., Ltd., Celtic Energy Ltd, Sadovaya Group, Zululand Anthracite Colliery (Pty) Ltd., and Carbones Holding GmbH. In 2024, these companies focused on optimizing mining operations and expanding market reach. Strategies such as increasing production capacity, enhancing supply chain efficiencies, and entering new markets were common. For instance, companies like Glencore and Coal India Ltd leveraged their large-scale operations to meet global demand efficiently. From 2025 to 2033, these players are expected to focus on sustainability and innovation in mining technologies. There will be an increased emphasis on reducing environmental impact through the adoption of cleaner mining technologies and practices. Strategic partnerships and acquisitions are also anticipated to play a crucial role in expanding their geographical footprint and accessing untapped markets. Additionally, the companies are likely to invest in developing infrastructure and technologies that improve the quality of extracted anthracite, aiming to meet the stringent requirements of high-grade consumers in industries such as steel manufacturing and chemical processing. These strategies will be crucial for maintaining competitive edges in a market that is increasingly influenced by environmental regulations and shifting economic dynamics.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Mined Anthracite Coal market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Grade

| |

Mining Type

| |

Application

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report