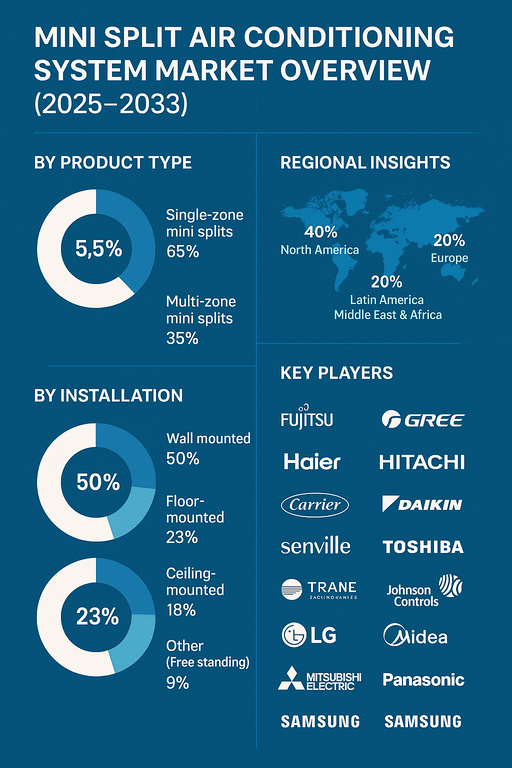

The global mini split air conditioning system market is projected to grow at a CAGR of 5.5% from 2025 to 2033, supported by rising demand for energy-efficient cooling solutions, rapid urbanization, and growing adoption of residential and commercial HVAC upgrades. Mini split systems, also known as ductless systems, provide zoned cooling and heating without requiring complex ductwork, making them ideal for retrofitting and space-constrained environments. The market is benefiting from increasing awareness of energy savings, government incentives promoting eco-friendly appliances, and technological advancements in inverter-driven systems.

Rising Demand for Energy Efficiency and Comfort

Growing consumer preference for energy-efficient appliances is driving adoption of mini split systems. Unlike traditional central air conditioning, mini splits allow individualized temperature control, reducing energy wastage. Inverter technology, smart connectivity, and integration with home automation systems are enhancing product appeal. The shift toward sustainable building practices, coupled with stricter energy efficiency standards across North America, Europe, and Asia Pacific, is fueling growth. Additionally, the rise of smart homes and IoT-enabled devices is boosting demand for connected and remote-controlled mini split systems.

Challenges: High Installation Costs and Market Fragmentation

Despite strong growth, the market faces challenges such as higher upfront installation costs compared to conventional systems. Complex multi-zone systems require professional installation, which can limit adoption in price-sensitive regions. Market fragmentation, with multiple regional and international players, creates strong price competition, particularly in emerging markets. Furthermore, reliance on refrigerants with high global warming potential (GWP) remains a concern, though regulatory initiatives are accelerating the adoption of eco-friendly alternatives such as R-32 and R-410A.

Market Segmentation by Product Type

By product type, the market is segmented into single-zone and multi-zone mini splits. Single-zone systems hold the largest share, favored for residential applications where one indoor unit is connected to one outdoor unit. Multi-zone systems, connecting multiple indoor units to a single outdoor unit, are the fastest-growing segment, supported by rising adoption in large residential complexes, commercial spaces, and offices seeking flexible cooling solutions.

Market Segmentation by Installation

By installation type, the market is divided into wall-mounted, floor-mounted, ceiling-mounted, and other freestanding systems. Wall-mounted systems dominate due to cost efficiency, ease of installation, and widespread application in residential and small commercial buildings. Floor-mounted and ceiling-mounted systems are expanding their presence in premium residential and commercial segments. Freestanding units, while niche, provide portable solutions in flexible-use environments.

Regional Insights

In 2024, Asia Pacific led the mini split air conditioning system market, with China, Japan, and South Korea driving adoption due to hot climates, dense urban populations, and strong manufacturing presence. North America followed, with growing demand for ductless retrofitting solutions and energy-efficient upgrades in residential homes. Europe is also a significant market, supported by stringent energy efficiency regulations and rising adoption of green building technologies. Latin America and the Middle East & Africa (MEA) are emerging markets, where rising disposable incomes and increasing demand for modern housing are fueling growth.

Competitive Landscape

The 2024 market was shaped by strong global players and regional manufacturers. Daikin Industries, Mitsubishi Electric, and Fujitsu General lead in advanced inverter technologies and global distribution. LG Electronics, Samsung Electronics, Panasonic Corporation, and Midea Group strengthen their presence with competitive portfolios and smart home integration. Carrier Corporation, Trane Technologies, and Johnson Controls International leverage their commercial HVAC expertise to expand in the ductless market. GREE Electric Appliances and Haier Group dominate in Asia, offering affordable yet efficient solutions. Senville is gaining traction in North America with cost-effective models. Competitive differentiation is being driven by energy efficiency, smart connectivity, eco-friendly refrigerants, and design flexibility.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Mini Split Air Conditioning System market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Product Type

| |

Installation

| |

Price

| |

End Use

| |

Distribution Channel

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report