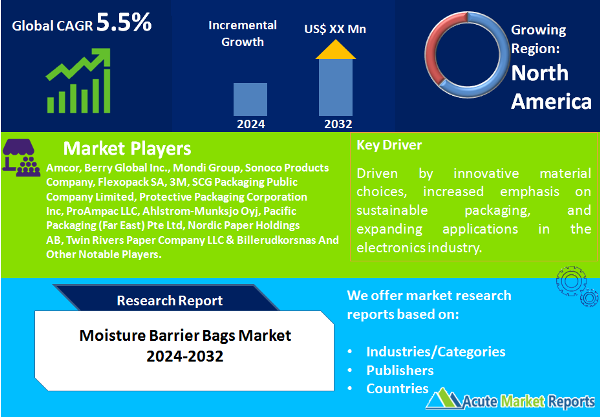

The moisture barrier bags market is expected to grow at a CAGR of 5.5% during the forecast period of 2026 to 2034, driven by innovative material choices, increased emphasis on sustainable packaging, and expanding applications in the electronics industry. Despite challenges associated with material disposal, the market demonstrated resilience. One of the most rapidly expanding sectors within the FMCG manufacturing industry is flexible packaging. Therefore, firms operating in the moisture barrier bag market are advancing flexible packaging solutions specifically designed for the food industry. As the utility of bags increases, so does the interest of packaging manufacturers. Therefore, in response to consumer demand, manufacturers in the moisture barrier bags market are introducing innovative moisture-resistant bags. In response to the perpetual issue of limited storage space in residential settings, moisture barrier bag manufacturers are creating multi-layer pouches that offer, among other things, resistance to air, puncture, moisture, and vermin. As a result, purses are creating additional prospects owing to their considerable popularity in both commercial and residential environments. Aluminum foils are becoming increasingly prevalent in the moisture barrier bag market. While aluminum foils may not possess a substantial market share in terms of volume and value when compared to plastic, they are increasingly being utilized in the packaging of dairy products in confectionery. Geographically, North America led in revenue, while the Asia-Pacific region showcased the highest growth potential.

Key Market Drivers

Innovative Material Choices: The market experienced a significant driver in the form of innovative material choices for moisture barrier bags. Evidences include the growing utilization of Aluminum Foil bags, particularly in the food and pharmaceutical sectors. The superior moisture-resistant properties of Aluminum Foil contributed to its prominence, ensuring extended shelf life for sensitive products.

Increased Emphasis on Sustainable Packaging: A pivotal driver for the moisture barrier bags market was the increased emphasis on sustainable packaging solutions. Evidence includes the rising adoption of eco-friendly materials such as Paper, driven by consumer demand for environmentally responsible packaging. Companies across industries, including food and beverages, made substantial efforts to reduce their carbon footprint through sustainable packaging choices.

Expanding Applications in the Electronics Industry: The Electronics industry served as a driving force for the moisture barrier bags market, with a notable increase in demand for Static Shielding bags. Evidence includes the surge in electronic components requiring protection from moisture and static electricity. The adoption of Poly moisture barrier bags also witnessed growth, providing effective protection for sensitive electronic devices during storage and transportation.

Restraint

Despite the positive drivers, the moisture barrier bags market faced a significant restraint related to Material Disposal Challenges. Evidence indicates the complexities associated with the disposal of Plastic-based moisture barrier bags. The environmental impact and the absence of standardized recycling processes for plastic materials pose challenges for sustainable waste management.

Key Market Segmentation Analysis

Material Preferences Define Packaging Dynamics

Material-based segmentation is integral to understanding the preferences and applications of moisture barrier bags. Aluminum Foil bags, exhibiting superior moisture resistance properties, emerged as the revenue leader in this segment. The aluminum foil's impermeable barrier against moisture and gases makes it a preferred choice for packaging perishable goods, pharmaceuticals, and sensitive electronic components. Despite environmental concerns, Plastic bags demonstrated a sustained demand, particularly due to their versatility, cost-effectiveness, and widespread use across various industries. The segment exhibited the highest Compound Annual Growth Rate (CAGR) during the forecast period of 2026 to 2034, suggesting ongoing adoption despite the push towards eco-friendly alternatives. Paper bags considered an environmentally responsible option, showcased steady growth, primarily driven by the increasing emphasis on sustainable packaging practices.

Diverse Product Types Cater to Varied Needs

Product type segmentation provides insights into the specific applications and requirements met by different moisture barrier bag variants. Static Shielding bags, designed to protect electronic components from static electricity and moisture, emerged as the revenue leader. The continuous expansion of the electronics industry, coupled with the increasing complexity of electronic devices, sustained the demand for these specialized bags. Poly moisture barrier bags, exhibiting versatility across a range of end-use sectors, demonstrated the highest CAGR during the forecast period of 2026 to 2034 within this segment. The demand for poly moisture barrier bags stems from their effectiveness in protecting a wide array of products, including pharmaceuticals, food items, and industrial components, against moisture damage.

Package Designs Reflect Industry Dynamics

Package type segmentation sheds light on the design preferences within the moisture barrier bags market. Flat Bags, offering standard packaging solutions for various products, led in terms of revenue. Their simplicity, ease of use, and suitability for a wide range of applications contribute to their market dominance. However, Gusseted Bags, characterized by expandable sides that accommodate larger volumes, exhibited the highest CAGR during the forecast period of 2026 to 2034. This indicates a growing preference for flexible packaging solutions that can adapt to varying product sizes and shapes. The gusseted design enhances the bags' versatility, making them suitable for a broad spectrum of industries, including agriculture, chemicals, and manufacturing.

Varied Capacities Address Different Market Segments

Capacity-based segmentation offers insights into the diverse needs of end-users based on the volume of products to be packaged. Bags with a capacity of Up to 10 Kg led in revenue, catering to the requirements of small-scale applications and industries. Their prevalence in sectors such as retail, food services, and pharmaceuticals contributes to their revenue dominance. On the other hand, Bags with a capacity of Above 25 Kg exhibited the highest CAGR during the forecast period of 2026 to 2034. This points towards the increasing demand for bulk packaging solutions in industries such as agriculture, chemicals, and manufacturing, where large quantities of products need secure and moisture-resistant packaging.

End-Use Applications Highlight Market Versatility

End-use segmentation underscores the diverse applications of moisture barrier bags across various industries. Food & Beverages emerged as the revenue leader, reflecting the stringent packaging requirements for perishable goods. The demand for moisture-resistant packaging in the food and beverage sector is driven by the need to extend shelf life, maintain product quality, and prevent spoilage. However, Pharmaceuticals & Medical demonstrated the highest CAGR during the forecast period of 2026 to 2034, indicating the critical role of moisture barrier bags in preserving the integrity of pharmaceutical products. The pharmaceutical industry's adherence to strict quality standards and regulations further propels the demand for specialized packaging solutions. The versatility of moisture barrier bags is further highlighted by their applications in the Electrical & Electronics sector, where Static Shielding and Poly moisture barrier bags play a pivotal role in protecting sensitive electronic components during storage and transportation.

North America Remains the Global Leader

Geographically, the moisture barrier bags market displayed distinct trends. North America led in terms of revenue in 2025, propelled by the demand for innovative packaging solutions in the United States. However, the Asia-Pacific region exhibited the highest CAGR during the forecast period of 2026 to 2034, driven by the expanding electronics industry and increasing awareness about sustainable packaging practices.

Market Competition to Intensify during the Forecast Period

Top players in the moisture barrier bags market employed diverse strategies to maintain their positions. Companies such as Amcor, Berry Global Inc., Mondi Group, Sonoco Products Company, Flexopack SA, 3M, SCG Packaging Public Company Limited, Protective Packaging Corporation Inc, ProAmpac LLC, Ahlstrom-Munksjo Oyj, Pacific Packaging (Far East) Pte Ltd, Nordic Paper Holdings AB, and Twin Rivers Paper Company LLC & Billerudkorsnas Ab showcased a strong focus on innovation, sustainability, and strategic partnerships. As of 2026, these players collectively dominated the market, with an expected continuation of their strategic initiatives during the forecast period from 2026 to 2034.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Moisture Barrier Bags market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Material

|

|

Product

|

|

Package Type

|

|

Capacity

|

|

End Use

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report