The global market for molded plastics is expected to grow at a CAGR of 4.5% during the forecast period of 2026 to 2034. Molded plastics are non-metallic compounds that have been manufactured synthetically and may be molded into a variety of shapes for use in commercial applications. These are quite versatile, effective, and bendable, and they can be made more rigid if that is the consistency that is required. These are utilized in the process of constructing smaller components that include an incredible level of detailing and perfection. Because of their high ductility, tensile strength, impact resistance, and moisture resistance, as well as their greater design flexibility, these are used in a variety of applications, including building and construction, automotive and transportation, consumable and electronic products, packaging, and others, including medical, stationary, and textiles. This is due to the fact that these have greater design flexibility. In addition, these are utilized during the production of automobile fascia, bumpers, grilles, headlight pods, panels, fenders, wheel wells, engine covers, table components, air flow ducts, equipment, and exterior fascia and ornamental panels, and other parts and pieces. These are put to use in the manufacturing of electrical conduits, rainwater, and sewage pipes, plumbing, gas distribution pipes, storage tanks, flooring tiles and rolls, PVC sheets, insulating membranes, and various other types of construction materials.

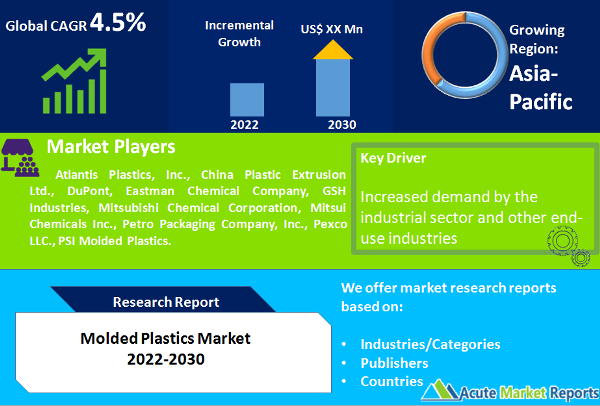

The market is expected to be driven by the rising demand for plastic components from a variety of end-use sectors, such as the automobile industry, the packaging industry, the home appliance industry, the electrical and electronics industry, and the medical device industry. Over the course of the time covered by this estimate, the expansion of the market is anticipated to be hampered by the fluctuating prices of raw materials including benzene, ethylene, propylene, and styrene, as well as by growing concerns surrounding the disposal of these materials.

Focus on Agri Tech Propelling Market for Molded Plastics

The expanding use of high-tech farming equipment is the primary factor driving growth in the molded plastics industry. Molded plastics also have a significant role to play in the agricultural industry. The market for molded plastics is anticipated to be driven by the steadily growing demand for plastics coming from this industry. Farmers have been able to increase crop yield and improve food quality as a result of the rising usage of plastics in this industry.

PE, PP, PVC, and PET are the four types of molded plastics that are utilized most frequently in agricultural applications. Greenhouses, tunnels, mulching, reservoirs and irrigation systems, silage, fitting and spray cones, and nets that are used to shade the interior of a greenhouse are all constructed using this type of plastic. The use of plastic irrigation pipes that are made from PVC helps to reduce the amount of water and nutrients that are lost through waste. The collection of rainfall is aided by reservoirs made of plastics, which are constructed. By confining crop cultivation within an enclosed space, such as that provided by greenhouses and mulching, farmers are able to reduce their reliance on pesticides. Utilizing plastic tunnels allows for the productive cultivation of a variety of vegetables, including watermelon and asparagus.

Increased Demand from Packaging Sector

An increase in awareness regarding activities that are related to hygiene has led to a growth in the packaging sector, which is where molded plastics are widely used in the production of complex and intricately shaped plastics. This growth has led to an increase in overall awareness regarding hygiene-related activities. For example, research that was issued in October 2021 by the National Investment Promotion and Facilitation Agency stated that the value of the packaging sector was over $917 billion in 2019, and it is anticipated that it would reach $1.05 trillion by 2026, rising at a CAGR of 2.8 percent. During the time frame covered by the forecast, this is one of the primary factors that will contribute to the growth of the molded plastics market. Due to an increase in demand for commercial space such as offices, hotels, malls, industrial corridors, and other similar establishments, the building and construction sector is growing rapidly in both developed and developing economies including the United States, China, India, and other similar nations such as these. In addition, a spike in expenditures in building infrastructure has led to significant growth in the building and construction sector, which has contributed to the overall expansion. Invest India published a report in August 2022 stating that the Indian government has an investment budget of $1.4 trillion for the development of infrastructure, of which 16% of the total amount is contributed toward the development of urban infrastructure. One example of this is that the Indian government has an investment budget of $1.4 trillion for the development of urban infrastructure. Bending, molding, and extruding are three design techniques that can be used to create endless possibilities with molded plastics. Due to the fact that they are poor heat and electrical conductors, they find widespread application as insulating materials, cladding panels, and pipes in places of business, shopping malls, residential facilities, and other construction sites. These are the most important drivers driving growth in the molded plastics market.

Volatile Costing Significantly Hindering the Market Growth

However, the primary feedstocks utilized in the production of petrochemicals, which are then used in the creation of a wide variety of molded plastic products, include sources such as crude oil, naphtha, and natural gas. As a result, the dependence of molded plastic manufacturers on these highly volatile commodities may have a direct effect on the ability of molded plastic manufacturers to scale their operations and maintain a profit margin.

Plastic Hazards Limiting the Use Across Countries

The current levels of plastic utilization have resulted in enormous amounts of garbage disposal, which in turn has caused a number of environmental issues. When plastic products are thrown away and released into the environment, hazardous chemicals in the form of pollutants are released into the atmosphere. Compounds like benzene and dioxins, in addition to heavy metals like lead and cadmium, are the primary components of these pollutant substances. These heavy metals and compounds are responsible for the discharge of toxic substances into the environment.

A number of nations like Taiwan, Bangladesh, the United Kingdom, China, and others have taken steps toward outlawing the use of a variety of products that are based on plastic. Because of this, the leading manufacturers of molded plastics have experienced a setback in their production. In addition, microplastic particles of a wide variety of shapes, sizes, and concentrations have been found in food and drinking water. These particles have the potential to cause a variety of adverse health effects, including irritation in the eye, impaired vision, respiratory issues, vertigo, genotoxic effects, cardiovascular issues, and gastrointestinal issues. These limitations prevent the market for molded plastics from expanding to their full potential.

Bioplastics Promising Largest Opportunity During the Forecast Period

The term "bioplastics" refers to a wide variety of different types of materials. The initial generation of bioplastics were created from typical renewable and agricultural resources such as soybeans, corn, and sugar cane. These were the materials that were used to create the first generation of bioplastics. The second generation of sources moved away from food and toward non-food renewable sources, such as hemp, sawdust, switchgrass, and castor beans. Additionally, the byproducts of first-generation feedstocks, which include peels and husks, were incorporated into this generation of sources. Methanobacteria and algae that have been genetically engineered are examples of third-generation sources. In addition, studies are being conducted to identify potential new resources for the production of bioplastics.

Plastics that can be molded are organic polymers that can be processed in a variety of ways, depending on the molding technology that is used. Because there are a variety of molding processes, raw materials, additives, and operational properties, such as formability, elasticity, hardness, stiffness, and chemical and heat resistance, can be tailored to the individual application by choosing the appropriate molding method. Molded plastics are favored in commercial and industrial applications because of their lower cost and lower weight in comparison to their alternative materials, such as metals. They are almost entirely sourced from fossil fuels, the most common of which are crude oil, natural gas, and naphtha. The negative effects that molded plastics made from petroleum have had on the environment have been a driving force behind the creation of plastics made from bio-based materials.

PP Led the Market Revenues in 2022

As a result of the growing demand for polypropylene (PP) in automotive components, household goods, and packaging applications, the PP segment held the greatest revenue share in 2022, which was more than 35%. It is projected that the polypropylene segment would expand at a compound annual growth rate (CAGR) of 4.0 % during the forecast period of 2026 to 2034. Over the course of the projection period, it is predicted that growing PP-based product penetration in protective caps in electrical connections and battery housings as well as food packaging will further fuel its demand. Because it is resistant to corrosion and has excellent electrical insulating qualities, polypropylene components are finding widespread use in food packaging, automobile as well as electrical contact applications. Other applications include Some of these applications include the dashboard, bumpers, grills, bottle caps, audio systems, wire spools, storage containers, one-piece chairs, seat panels, and mechanical parts. In addition, polypropylene molded plastics are more resistant to chemicals than other forms of molded plastics, in addition to being durable, translucent, and has a lower coefficient of friction than other types of molded plastics. As a result of the considerations indicated above, it is anticipated that this particular segment would experience the most rapid growth over the forecast period.

However, in order to prevent the spread of the coronavirus, production activities were slowed down or stopped entirely. This has resulted in a decrease in the consumption of PP and has had a detrimental influence on the demand for it in a variety of applications. Because of logistical constraints and limits on the movement of people, producers are having trouble running their production units, which has further hampered the demand for their products. These constraints are a result of restrictions placed on the movement of people. In 2022, Acrylonitrile Butadiene Styrene, more commonly known as ABS, became the second most important raw material. It is anticipated that rising demand for ABS components in the manufacturing of medical devices, automotive components, electronic housings, and consumer appliances would drive the expansion of this market during the course of the projected period.

Injection Technology Led the Technology Market

The injection molding sector was the most dominating market in terms of technology in 2022 and is projected to witness a CAGR of 4.4 % during the forecast period of 2026 to 2034. This can be related to the fact that injection molding technology is utilized the most frequently in the production of molded plastics. In addition to this, it makes use of automated procedures to cut down on the overall cost of production as well as the amount of waste produced throughout the manufacturing process.

Packaging, the Core Application Market, Medical Devices to Lead the Growth During the Forecast Period

In the year 2022, the packaging market category was responsible for more than 30% of the total revenue share. The finished goods that are used in packaging go through several steps of development in order to comply with the regulatory criteria and the requirements of the end-user. Plastics need to fulfill certain requirements in order to be used in packaging applications, including the capacity to extend the shelf life of food goods, improved resistance to wear and tear, and high durability. Injection-molded plastics have a huge amount of untapped potential, especially in the fields of medicine and automobile manufacturing.

The market for medical devices and components is anticipated to grow the fastest during the forecast period of 2026 to 2034. Demand for products in the medical business is anticipated to be driven by characteristics such as optical clarity, biocompatibility, and technique of manufacture that is economical. It is projected that a stringent regulatory environment regulating the employment of medical-grade polymers in the healthcare industries will drive the growth. Over the course of the projection period, there is expected to be an increase in the demand for biodegradable polymers among producers of medical devices, which is predicted to provide profitable prospects in the medical industry.

The Asia Pacific is a Clear Global Leader

The size of the molded plastics market in the Asia-Pacific region is predicted to increase at the highest CAGR of 4.3% during the forecast period. In 2022, the Asia-Pacific region accounted for 48% of the total market share for molded plastics. This can be linked to the growing need for molded plastics in the building and construction sector as well as the consumer electronics sector. In both of these industries, molded plastics are utilized as a primary insulating material. For example, according to a report that was released by the United Nations Statistics Division in the month of July 2022, China was responsible for around 28.7% of the total manufacturing output worldwide for consumer electronic devices. In addition to this, countries such as India and Australia have seen a rapid increase in the automotive sectors of their economies. In these countries, molded plastics are widely used in the production of components such as car fascia, bumpers, grilles, headlight pods, panels, fenders, wheel wells, engine cover, table components, air flow ducts, equipment, exterior fascia, and decorative panels, and other components. For example, a report that was released by the India Brands Equity Foundation in December 2022 stated that the number of passenger vehicles in March 2022 stood at 279,745 units, marking an increase of 28.39 percent when compared to the 217,879 units that were in March 2021.

Europe is also one of the key markets for molded plastics. Cosmetics and other toiletries, pharmaceuticals, and household chemicals are some of the products that Europe's non-food and beverage packaging industry caters to. It is anticipated that the demand from the consumables and electronics application sector will be driven by the growing need for electronic appliances like laptops and cellular phones, notably in the United Kingdom, Germany, and France. Over the course of the projected period, it is anticipated that the expansion of the automotive industry in Europe would also contribute to the regional demand. The presence of the most important manufacturers of molded plastics is the primary factor that distinguishes the market in North America. Because there is an abundance of raw materials in this location, the producers there are concentrating on increasing their production capacity so that they may benefit from relatively low costs of production.

Fierce Competition as Market is Showing no Signs of Consolidation

The global market for molded plastics is extremely fragmented. This is especially true in the Asia-Pacific and Latin American regions. Companies, especially companies that hail from the Asia Pacific region, have been on an ongoing search for large capacity additions over the course of the previous few years in order to benefit from operational excellence and obtain economies of scale. The market is made more competitive in terms of price and distribution channels by having a varied product range and product differentiation. Atlantis Plastics, Inc., China Plastic Extrusion Ltd., DuPont, Eastman Chemical Company, GSH Industries, Mitsubishi Chemical Corporation, Mitsui Chemicals Inc., Petro Packaging Company, Inc., Pexco LLC., and PSI Molded Plastics are some of the most important companies operating in the molded plastics market.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Molded Plastics market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Product

|

|

Technology

|

|

Application

|

|

Raw Material

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report