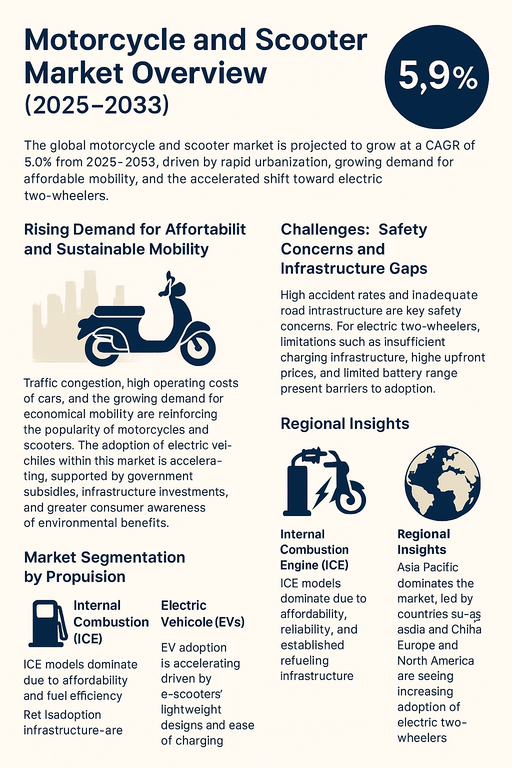

The global motorcycle and scooter market is projected to grow at a CAGR of 5.9% from 2025 to 2033, driven by rapid urbanization, growing demand for affordable mobility, and the accelerated shift toward electric two-wheelers. Motorcycles and scooters remain indispensable for millions of daily commuters, particularly in emerging economies where they serve as primary transportation. At the same time, developed markets are seeing increasing adoption of electric two-wheelers for urban commuting and sustainability goals. Expanding last-mile connectivity needs, rising fuel prices, and flexible financing options are also contributing to the steady growth of this sector.

Rising Demand for Affordable and Sustainable Mobility

Traffic congestion, high operating costs of cars, and the growing demand for economical mobility are reinforcing the popularity of motorcycles and scooters. In particular, scooters are emerging as highly preferred vehicles due to their compact design, affordability, and suitability for short-distance commuting and last-mile deliveries. The adoption of electric vehicles within this market is accelerating, supported by government subsidies, infrastructure investments, and greater consumer awareness of environmental benefits. Electric scooters and motorcycles are being increasingly positioned as sustainable urban solutions, offering low maintenance and zero tailpipe emissions.

Challenges: Safety Concerns and Infrastructure Gaps

Despite favorable growth trends, the market faces notable challenges. High accident rates and inadequate road infrastructure remain key safety concerns in many developing economies. For electric two-wheelers, limitations such as insufficient charging infrastructure, higher upfront prices compared to ICE models, and limited battery range present barriers to adoption. In addition, performance concerns around high-speed electric motorcycles and consumer hesitancy in some markets slow penetration in premium segments. Nevertheless, improvements in battery technology, growing investments in charging networks, and policy support from governments are expected to mitigate these challenges and encourage long-term market expansion.

Market Segmentation by Propulsion

The propulsion landscape of the motorcycle and scooter market remains dominated by internal combustion engine (ICE) models due to their affordability, reliability, and established refueling infrastructure. These vehicles continue to meet the needs of daily commuters in developing countries where fuel distribution networks are extensive and cost sensitivity is high. However, electric vehicles are gaining momentum at a rapid pace. Electric scooters, in particular, are driving adoption in urban centers with their lightweight designs, ease of charging, and lower running costs. Electric motorcycles are beginning to appeal to premium buyers, aided by advances in range, speed, and performance.

Market Segmentation by Engine Displacement

The under 250cc segment continues to lead the global market, especially across Asia Pacific, where affordability and fuel efficiency drive consumer preference. Motorcycles and scooters in the 250cc–500cc range are gaining attention among younger riders seeking a balance between performance and daily usability, particularly in urban areas. The 500cc–1000cc segment caters more to developed regions, where motorcycles are often used for lifestyle and recreational purposes. Above 1000cc motorcycles form a niche but steadily expanding segment that attracts premium customers in North America and Europe, where leisure motorcycling culture remains strong.

Regional Insights

Asia Pacific dominates the global motorcycle and scooter market, led by countries such as India, China, and Indonesia where two-wheelers are indispensable for daily mobility. Government initiatives promoting electric two-wheelers in China and India are expected to drive strong growth in EV adoption over the coming years. North America is witnessing increasing demand for premium motorcycles, supported by lifestyle preferences and the growing adoption of electric scooters for urban commuting. Europe is rapidly advancing toward electrification, with strong regulatory backing for low-emission transport and urban mobility programs in countries such as Germany, France, and Italy. Latin America continues to be an important market, particularly in Brazil and Mexico, where motorcycles are widely used as cost-effective transport. The Middle East & Africa (MEA) region is emerging as a growth opportunity, fueled by rising disposable incomes and increasing demand for affordable mobility solutions in urban and semi-urban regions.

Competitive Landscape

The 2024 motorcycle and scooter market was shaped by a mix of established global manufacturers and emerging EV-focused players. Honda and Hero continue to dominate volume sales, particularly in Asia Pacific, where their broad product offerings and affordability resonate strongly with consumers. Bajaj Motorcycles and TVS have consolidated their positions in India and are aggressively expanding into export markets. Yamaha and Suzuki maintain their competitive edge in the mid- to high-performance motorcycle categories while investing in electric mobility. Piaggio holds a premium position in Europe through brands such as Vespa, with growing initiatives in electric scooters. In India, OLA and ATHER are key disruptors, driving innovation and affordability in the electric scooter segment with advanced features and strong consumer appeal. Classic Legends is reviving heritage motorcycle brands and gaining attention in the retro-style niche. The competitive environment is evolving rapidly, with differentiation driven by electric mobility, affordability, advanced connectivity, and performance features. Continuous advancements in battery technology, AI-based intelligence systems, and consumer-focused aftersales strategies are expected to further shape the industry’s evolution over the forecast period.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Motorcycle and Scooter market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Product

| |

Propulsion

| |

Engine Displacement

| |

Distribution Channel

| |

End Use

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report