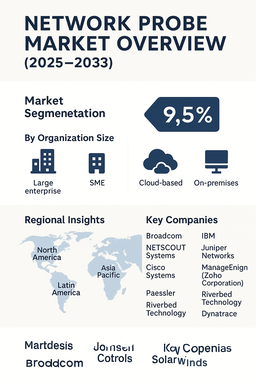

The global network probe market is projected to grow at a CAGR of 9.5% from 2025 to 2033, supported by the rising demand for network visibility, security, and performance monitoring in increasingly complex IT infrastructures. Network probes are specialized tools used to capture, analyze, and monitor network traffic, enabling enterprises to detect anomalies, improve troubleshooting, and optimize resource usage. The market’s growth is being driven by rising cyber threats, expansion of cloud services, and the adoption of next-generation networking technologies including 5G, IoT, and edge computing.

Rising Demand for Network Visibility and Security

With enterprises undergoing rapid digital transformation, network environments are becoming more distributed and complex. Organizations are turning to network probes for real-time monitoring of bandwidth usage, application performance, and data security. The increasing frequency of cyberattacks is amplifying the need for advanced visibility solutions to detect malicious activities at the packet level. Cloud migration and adoption of hybrid IT infrastructures are further boosting demand, as businesses require seamless monitoring across on-premises and cloud environments. The emergence of AI-driven analytics and automation in probe solutions is improving response time and network resilience, strengthening adoption among both large enterprises and SMEs.

Challenges: Cost, Data Volume, and Integration

Despite robust growth, the network probe market faces challenges. High costs of deployment and integration limit adoption among SMEs with constrained IT budgets. The exponential rise in data traffic creates scalability issues, requiring probes with advanced filtering and storage capabilities. Integration complexity with legacy network systems also hampers smooth deployment in traditional enterprise environments. Moreover, data privacy and compliance requirements add additional pressure on probe vendors to ensure secure monitoring. However, advancements in software-defined networking (SDN), affordable cloud-based models, and increasing vendor focus on SME-friendly solutions are expected to mitigate these challenges over time.

Market Segmentation by Organization Size

By organization size, the market is segmented into large enterprises and SMEs. Large enterprises dominate the market due to higher budgets, complex network structures, and stringent security needs. These organizations invest heavily in network probes to manage performance across global operations. SMEs, however, represent the fastest-growing segment, as they increasingly adopt digital platforms, cloud computing, and remote work environments. Affordable, subscription-based probe solutions are making advanced monitoring accessible to smaller businesses, fueling adoption in this segment.

Market Segmentation by Deployment Mode

By deployment mode, the market is categorized into cloud-based and on-premises. On-premises deployments currently account for a significant share, particularly in industries where security and compliance are critical. However, cloud-based probes are experiencing rapid growth due to scalability, cost efficiency, and integration with broader cloud infrastructure monitoring tools. As hybrid and multi-cloud environments expand, cloud-based deployment models are expected to surpass on-premises solutions in the forecast period.

Regional Insights

In 2024, North America led the network probe market, driven by advanced IT infrastructure, early technology adoption, and strong presence of global vendors. Europe followed, with significant uptake across Germany, the UK, and France due to stringent data security regulations and rising enterprise cloud adoption. Asia Pacific is projected to be the fastest-growing region, with China, India, and Southeast Asia driving demand through rapid digital transformation, 5G rollout, and expanding e-commerce sectors. Latin America and Middle East & Africa (MEA) are emerging regions where network modernization, government digitalization initiatives, and rising cybersecurity concerns are gradually boosting adoption.

Competitive Landscape

The 2024 network probe market was shaped by a mix of global technology leaders and specialized monitoring providers. Broadcom, NETSCOUT Systems, and Cisco Systems hold strong market positions through comprehensive networking and monitoring portfolios. SolarWinds Worldwide, Paessler, and ManageEngine (Zoho Corporation) are recognized for delivering user-friendly and cost-effective solutions, particularly attractive for SMEs. IBM, Juniper Networks, and Riverbed Technology are leveraging their expertise in enterprise IT infrastructure and network optimization to expand their share. Dynatrace is emerging as a strong player with AI-powered observability and advanced cloud monitoring capabilities. Competitive differentiation in the market is being driven by AI integration, automation of network monitoring, scalability for large-scale traffic analysis, and the ability to seamlessly support hybrid and multi-cloud environments.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Network Probe market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Component

| |

Organization Size

| |

Deployment mode

| |

End Use

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report