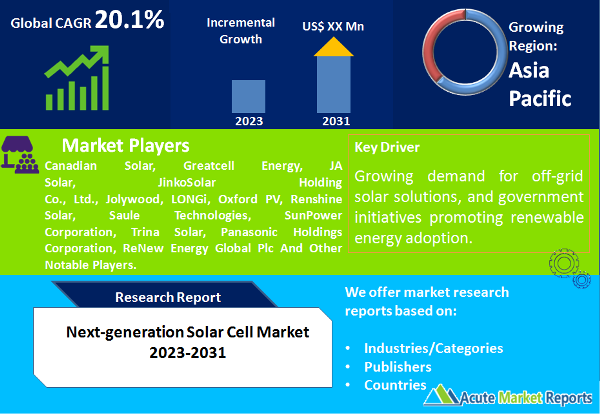

Next-generation solar cell market is expected to witness a CAGR of 20.1% during the forecast period of 2026 to 2034. The next-generation solar cell market is driven by advancements in third-generation materials, growing demand for off-grid solar solutions, and government initiatives promoting renewable energy adoption. However, challenges in commercialization and scalability pose restraints on market growth. Second-generation materials and off-grid deployments are expected to experience the highest growth rates. The Asia-Pacific region is projected to lead in terms of CAGR, while North America will maintain revenue dominance. Competitive trends will focus on innovation and partnerships to address scalability challenges. Overall, the market's future is promising, as it plays a crucial role in expanding access to clean and sustainable energy sources.

Advancements in Third-generation Materials

A primary driver of the next-generation solar cell market is the continuous advancements in third-generation materials. Third-generation materials, such as perovskite and organic photovoltaics, have shown significant promise in improving the efficiency and cost-effectiveness of solar cells. These materials offer advantages like flexibility, lightweight properties, and the ability to be integrated into various surfaces. Evidence of this driver's impact can be observed in the increasing investments in research and development of third-generation materials by both academia and industry players. As these materials mature and become commercially viable, they are expected to drive the adoption of next-generation solar cells.

Growing Demand for Off-grid Solar Solutions

Another significant driver in the next-generation solar cell market is the growing demand for off-grid solar solutions. Off-grid solar solutions, powered by next-generation solar cells, are increasingly sought after for remote and rural electrification, disaster relief, and applications in regions with limited access to traditional power sources. Evidence of this driver's impact can be seen in the expansion of off-grid solar projects, particularly in emerging economies and underserved areas. As the global focus on clean energy access intensifies, the demand for next-generation solar cells for off-grid solutions is expected to rise.

Government Initiatives and Incentives

Government initiatives and incentives aimed at promoting renewable energy adoption serve as a key driver for the next-generation solar cell market. Various governments around the world are offering subsidies, tax credits, and favorable policies to encourage the deployment of solar energy systems. Evidence of this driver's impact can be observed in the significant growth of solar installations, both on-grid and off-grid, supported by government incentives. As governments continue to prioritize clean energy and environmental sustainability, the demand for next-generation solar cells is expected to be further boosted.

Challenges in Commercialization and Scalability

A significant restraint in the next-generation solar cell market is the challenges associated with commercialization and scalability. While next-generation materials offer advantages, transitioning from research and development to large-scale commercial production has proven to be complex. Evidence of this restraint's impact can be seen in the time and investment required to bring new materials and technologies to market. The commercialization process often faces hurdles related to stability, manufacturing processes, and cost efficiency. To mitigate this restraint, industry players must focus on addressing these challenges through collaboration, innovation, and streamlined production methods.

Material Type: Third-Generation Materials Dominate the Market

In 2025, the next-generation solar cell market witnessed significant demand for third-generation materials due to their potential for high efficiency and versatility. However, during the forecast period from 2026 to 2034, the highest Compound Annual Growth Rate (CAGR) is expected in the second-generation material segment. Second-generation materials, like thin-film solar cells, are well-established and offer a balance between efficiency and cost-effectiveness, making them attractive for various applications and markets.

Deployment: On-Grid Solar Solutions Dominate the Market

In 2025, the highest revenue in the next-generation solar cell market was generated from on-grid solar solutions, which are integrated into the traditional power grid. However, during the forecast period from 2026 to 2034, the highest CAGR is anticipated in the off-grid deployment segment. The off-grid solar market is expected to experience robust growth as it addresses the energy needs of remote and underserved regions, providing sustainable and reliable power sources.

North America Remains the Global Leader

During the forecast period from 2026 to 2034, the Asia-Pacific region is expected to exhibit the highest CAGR in the next-generation solar cell market. This growth can be attributed to the region's rapid urbanization, increasing energy demand, and government initiatives to promote renewable energy adoption. North America is anticipated to maintain the highest revenue percentage during the same period, primarily due to its mature solar market and continued investments in clean energy technologies.

Market Competition to Intensify during the Forecast Period

In 2025, the next-generation solar cell market featured several key players, including established solar cell manufacturers and emerging startups. These companies are expected to maintain their positions during the forecast period from 2026 to 2034. Key strategies for industry leaders will revolve around innovation, research and development, and partnerships to enhance the efficiency and scalability of next-generation solar cells. The market is poised to witness intensified competition as companies strive to capture a larger share of the growing solar energy market while addressing scalability challenges.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Next-generation Solar Cell market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Material Type

|

|

Deployment

|

|

Application

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report