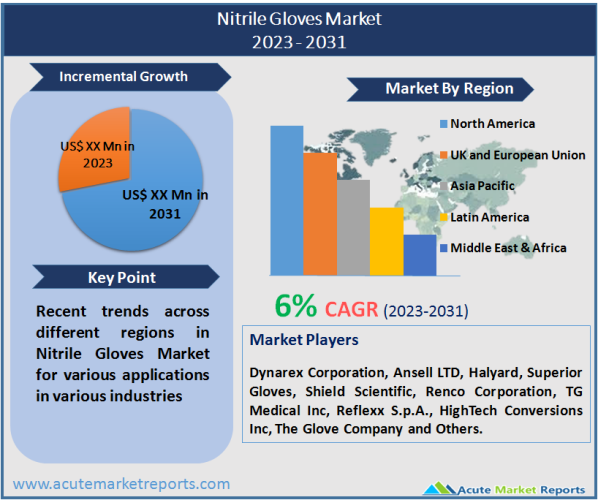

The global market for nitrile gloves is projected to expand at a CAGR of 6% during the forecast period of 2026 to 2034. Popularly used for disposable gloves, Nitrile gloves are made from a synthetic rubber material. Nitrile has existed for a long time, but in recent years it has become significantly more cost-effective, which explains why it is gaining popularity in the health-care, food, and cleaning industries. Nitrile is the glove material with the highest puncture resistance. Nitrile gloves have greater chemical resistance than latex or vinyl gloves.

In addition, various product variations and technological advancements will be significant growth drivers over the forecast period. As the utility of nitrile gloves expands across multiple industries, there will be a substantial increase in demand. Oil and gas, chemical, pharmaceutical, medical and tending, and the automotive industry are among the industries that may be significant consumers of these gloves.Hygiene is gaining prominence in the healthcare, beauty, and food care industries, especially as global awareness of viral and bacterial infections increases. It is important to note that the cost of nitrile gloves significantly contributes to their dependability and utility. During the forecast period, this factor would present numerous opportunities for growth to market participants.

Pressure to Provide Safety-Compliant, Cost-Effective Products

The glove manufacturing supply chain was burdened by unanticipated difficulties at the beginning of 2022. In particular, there is a high demand for nitrile gloves, but this vital personal protective equipment is in short supply. This has resulted in a plethora of problems for end-users, glove manufacturers, and everyone in between.In addition, only a few companies in the United States manufacture nitrile gloves. This was never an issue in the past, but due to the sudden increase in demand for nitrile protective gloves, many local distributors were forced to seek out international suppliers.

Since market demand for nitrile gloves is high and there is a shortage, price increases are inevitable. In addition to the scarcity of raw materials and everything else, the insufficiency of manufacturers able to keep up with demand has resulted in significant price increases for distributors. Consequently, it affects end users, who must now pay a higher price.Consequently, sacrificing quality and increasing prices may hinder market growth during the given forecast period.

Powder-Free Gloves Captured the Lion’s Share of Market by Product

In 2025, powder-free gloves held approximately 85% of the total nitrile gloves market.

In a medical facility, powdered protective gloves have been identified as the single largest source of latex aeroallergens. Attaching latex proteins to powdered gloves enables aerosolization. In addition to its superior chemical and puncture resistance properties, Nitrile's primary advantage as a disposable glove material is its comfortable fit and 100% latex-free construction. Even employees with a latex allergy can wear these nitrile gloves for extended periods without discomfort. Nitrile gloves are available with a variety of cuff lengths to accommodate various applications. Standard short-cuff gloves are suitable for the majority of applications and general use.

As powder free gloves undergo a chlorination process or polymer coatings such as acrylics, silicones, and hydrogels, they are less form fitting; consequently, healthcare facilities have replaced latex gloves with powder free nitrile gloves. Powder-free gloves are suitable for use in the automotive industry because they leave no residue.The market for powdered nitrile gloves is anticipated to increase by 4.5% during the forecast period of 2026 to 2034. Powdered nitrile gloves have either a coating of cornflour or calcium carbonate, which makes them easier to put on, improves grip, and reduces internal moisture. Long-term use of powdered nitrile gloves may result in skin sensitivities or allergies.

Using Single-Use Gloves to Prevent the Spread of Infections in Healthcare Settings

In 2025, disposable gloves held a market share of approximately 85.0%. In healthcare or care settings, disposable gloves are used to prevent the spread of infection among patients and healthcare workers. When providing adequate care and assistance to a patient, especially if the carer will come into contact with bodily fluids, disposable gloves are worn. After each procedure or contact with a patient, the gloves will be removed and discarded, and the individual will be required to wash or sanitise their hands. This will increase future demand for disposable gloves.

Over the forecast period, the demand for durable products is anticipated to increase at a CAGR of 5.5%. Durable nitrile gloves offer benefits such as durability, strength, low waste production, and other environmental advantages. Durable gloves are intended for extended use, particularly in the oil & gas, chemical & petrochemical, automotive, and metal & machinery industries, where heavy-duty work environments prevail.Durable nitrile gloves are thicker than disposable ones, allowing them to provide superior durability. However, they lack the sensitivity of disposable alternatives and can be uncomfortable for intricate tasks. In addition, they require more frequent cleaning after use, which makes them less convenient than disposable gloves.

An Increase In Surgical Procedures And HAIs Will Increase The Demand For Nitrile Gloves

In 2025, sterile gloves held a market share of approximately 72.5%. An increase in surgical procedures necessitates FDA-approved sterile gloves. These gloves are subjected to multiple disinfection and sterilisation processes that eliminate the vast majority of germs and microorganisms, thereby increasing the demand for sterile gloves in the future.

Increasing Demand for Nitrile Gloves to Decrease Hospital-Acquired Infections

In 2025, hospitals hold a larger market share of approximately 62%. Gloves create a barrier between germs and the hands. This reduces the likelihood that health care professionals or patients will contract additional diseases. It is essential that hospitals keep their medical supply gloves in good condition. Hand hygiene is an effective method for preventing infections. According to CDC 2021, healthcare professionals disinfect their hands for less time than they should, affecting one in every 31 hospital patients per day. While receiving treatment for another condition, both patients and medical personnel are susceptible to contracting an infection.

In hospitals and other medical settings, such as dialysis clinics and nursing homes, the prevention of germs is of utmost importance, driving the market for nitrile gloves.The automotive industry's demand for nitrile gloves is anticipated to increase by 5.5% over the forecast period. The need for safety from sharp edges and tools to harmful chemicals and substances is anticipated to increase demand for this product in the automotive industry.Workers in the pharmaceutical industry are exposed to biological agents, chemical substances, and drugs, posing a variety of occupational risks. The demand for nitrile gloves is likely to increase as they protect both pharmaceutical products and workers from chemical hazards, thereby increasing their utility.

Market Competition to Intensify during the Forecast Period

Principally, manufacturers in the market for nitrile gloves invest in R&D in order to introduce new product lines. The market for Nitrile Medical Gloves is fragmented and composed of a number of major players. In terms of market share, a small number of major players currently dominate the industry. Dynarex Corporation, Ansell LTD, Halyard, Superior Gloves, Shield Scientific, Renco Corporation, TG Medical Inc, Reflexx S.p.A., HighTech Conversions Inc, and The Glove Company are among the current market leaders.

For example:

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Nitrile Gloves market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Type

|

|

Usage

|

|

Sterility

|

|

End User

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report