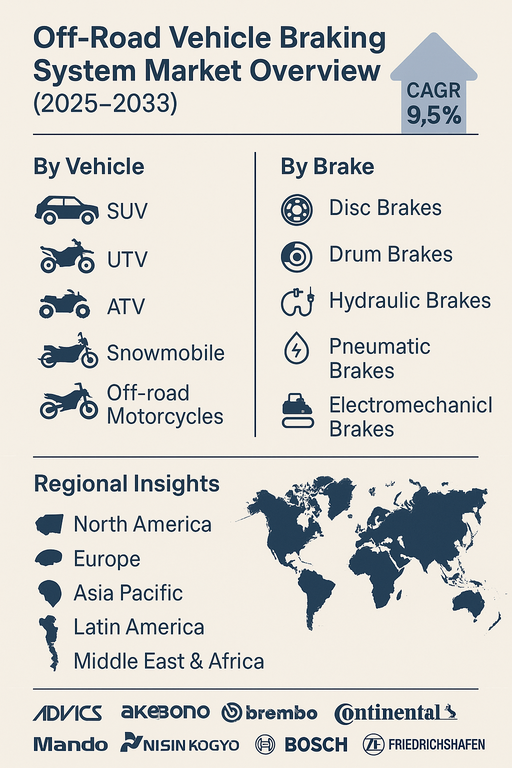

The global off-road vehicle braking system market is projected to expand at a CAGR of 9.5% from 2025 to 2033. Growth is fueled by the rising popularity of recreational off-road activities, expansion of UTV and ATV markets, and the need for reliable braking performance in challenging terrains. Advanced braking technologies are increasingly integrated into off-road vehicles to enhance safety, stability, and driver control across diverse environments.

Growing Recreational Activities and Safety Regulations

Demand for off-road vehicles such as SUVs, UTVs, ATVs, and snowmobiles is expanding globally, driven by outdoor recreation, motorsports, and tourism. With the growing vehicle base, the need for efficient braking systems is rising. Manufacturers are focusing on high-performance disc and hydraulic brakes to meet stringent safety regulations and customer demand for enhanced ride control. Increasing adoption of electromechanical systems in high-end SUVs and premium off-road motorcycles is further boosting the market.

Market Challenges: High Costs and Harsh Operating Environments

The market faces challenges such as high maintenance costs of advanced braking systems and wear-and-tear in rugged terrains. Pneumatic systems require regular servicing, while disc brakes in muddy or snowy conditions can degrade faster. However, innovations in materials, improved corrosion resistance, and sensor-based electronic braking are expected to overcome these limitations.

Market Segmentation by Vehicle

By vehicle, the market is segmented into SUV, UTV, ATV, snowmobile, and off-road motorcycle. In 2024, SUVs dominated due to their wide adoption globally and integration of advanced braking technologies. UTVs and ATVs are growing rapidly in recreational and utility applications. Snowmobiles are niche but important in North America and Northern Europe. Off-road motorcycles represent a dynamic segment with rising popularity in motorsports and adventure activities.

Market Segmentation by Brake

By brake type, the market includes disc brakes, drum brakes, hydraulic brakes, pneumatic brakes, and electromechanical brakes. Disc brakes hold the largest share due to durability and superior performance in rugged terrains. Hydraulic brakes are widely used in ATVs, UTVs, and motorcycles for precise control. Drum brakes remain relevant in cost-sensitive models, while pneumatic systems serve heavy-duty off-road SUVs. Electromechanical brakes are emerging in premium off-road vehicles, integrating sensors for advanced safety features.

Regional Insights

In 2024, North America led the market, supported by strong ATV and UTV adoption, motorsports culture, and winter demand for snowmobiles. Europe followed, with high SUV penetration and strong adoption of premium braking systems in Germany and Nordic countries. Asia Pacific is the fastest-growing region, with rising SUV demand in China and India, alongside increasing adoption of off-road motorcycles. Latin America shows steady growth, driven by UTV and SUV demand in Brazil and Mexico. Middle East & Africa markets are expanding due to off-road SUVs used in desert and rugged terrains.

Competitive Landscape

The 2024 market was competitive with leading global braking system manufacturers. Continental, Robert Bosch, and ZF Friedrichshafen dominated with comprehensive portfolios across SUVs and off-road vehicles. Brembo and Advics specialized in high-performance disc brakes for premium applications. Akebono Brake Industry and Nissin Kogyo maintained strong positions in Asia with OEM partnerships. Knorr-Bremse and Mando contributed to advanced hydraulic and pneumatic braking systems. Competitive differentiation is driven by durability, braking efficiency, integration of electronic controls, and partnerships with off-road vehicle OEMs.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Off-road Vehicle Braking System market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Vehicle

| |

Brake

| |

Brake System Operations

| |

Application

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report