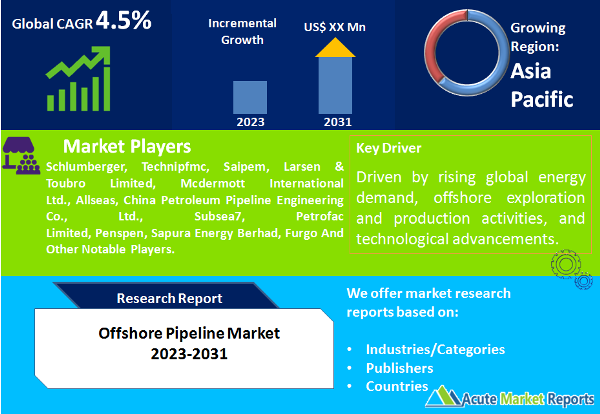

The offshore pipeline market plays a vital role in the global energy sector, facilitating the transportation of hydrocarbons from offshore production sites to onshore facilities. It encompasses a complex network of pipelines designed to withstand harsh marine conditions. The offshore pipeline market is expected to grow at a CAGR of 4.5% during the forecast period of 2026 to 2034, due to increasing demands for oil, gas, and refined products. However, the market is also expected to face challenges related to environmental concerns and cost-effectiveness. The offshore pipeline market is poised for continued growth, driven by rising global energy demand, offshore exploration and production activities, and technological advancements. Key players are expected to maintain their competitive edge through innovation and partnerships, with revenues projected to rise from 2026 to 2034.

Rising Global Energy Demand

The escalating global energy demand, driven by population growth and industrialization, serves as a significant driver for the offshore pipeline market. In 2025, the world's thirst for energy continued to grow, with the highest revenue attributed to this driver. As expected from 2026 to 2034, this trend is likely to persist, as developing nations increase their energy consumption, and the demand for offshore pipelines, especially for oil and gas, remains robust.

Offshore Exploration and Production Activities

The offshore pipeline market has been heavily influenced by offshore exploration and production activities, which witnessed a surge in 2025. New oil and gas reserves are continually being discovered in offshore areas, necessitating the construction of pipelines to transport these resources. These activities are anticipated to maintain a high CAGR during the forecast period, reflecting the industry's confidence in the viability of offshore resources.

Advancements in Pipeline Technology

Technological advancements have played a pivotal role in the growth of the offshore pipeline market. Innovations in materials, corrosion protection, and remote monitoring systems have increased the efficiency and safety of offshore pipelines. Such innovations were notable in 2025, and they are expected to continue driving the market with a high CAGR as companies invest in research and development to further enhance pipeline technology.

Restraints in the offshore pipeline market

Despite the promising outlook, the offshore pipeline market faces the restraint of environmental concerns. With increasing attention to climate change and the environmental impact of energy production, the market is under pressure to adopt more sustainable practices. In 2025, environmental concerns led to challenges in permitting and the development of offshore pipelines, and it is expected that these concerns will continue to pose a restraint from 2026 to 2034. Striking a balance between meeting energy demands and environmental sustainability will be crucial.

Market Segmentation by Diameter: The Smaller Diameter Pipelines Dominate the Market

The offshore pipeline market can be segmented by diameter into two main categories: pipelines with a diameter below 24 inches and those with a diameter greater than 24 inches. In 2025, both segments contributed significantly to the market's revenue. The smaller diameter pipelines were favored for their cost-effectiveness, while the larger diameter pipelines were essential for the transportation of larger volumes of resources. During the forecast period from 2026 to 2034, it is expected that the larger diameter pipelines will exhibit the highest CAGR, as offshore production sites require the capacity to handle increasing volumes of oil and gas.

Market Segmentation by Product: Gas Pipelines to Promise Significant Opportunities during the Forecast Period

Another crucial segmentation factor is the type of product transported through offshore pipelines. This market can be divided into three categories: oil, gas, and refined products. In 2025, each of these segments contributed significantly to market revenues. However, during the forecast period from 2026 to 2034, gas pipelines are expected to exhibit the highest CAGR. The global shift towards cleaner energy sources and the demand for natural gas as a transition fuel is expected to drive this segment's growth.

The Middle East Remains the Global Leader

The offshore pipeline market exhibits distinct geographic trends. In recent years, the Asia-Pacific region experienced the highest CAGR due to its rapid industrialization and energy demand. On the other hand, the Middle East, with its abundant oil and gas reserves, contributed the highest revenue percentage in 2025. As we look ahead to 2026-2034, it is expected that the Asia-Pacific region will continue to have the highest CAGR, while the Middle East will maintain its position as a significant revenue generator.

Focus on R&D to Enhance Market Share among the Key Companies

The offshore pipeline market is marked by intense competition among key players. Leading companies, such as Schlumberger, Technipfmc, Saipem, Larsen & Toubro Limited, Mcdermott International Ltd., Allseas, China Petroleum Pipeline Engineering Co., Ltd., Subsea7, Petrofac Limited, Penspen, Sapura Energy Berhad And Furgo, have consistently invested in research and development to enhance pipeline technology. These companies have established themselves as industry leaders through cutting-edge products and strategic partnerships. In 2025, they recorded substantial revenues, and it is expected that their strategic investments will continue to yield high returns from 2026 to 2034. Strategic collaborations with energy companies and governments to implement sustainable offshore pipelines are anticipated to be a key trend in the coming years.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Offshore Pipeline market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Diameter

|

|

Product

|

|

Line Type

|

|

Installation Type

|

|

Depth

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report