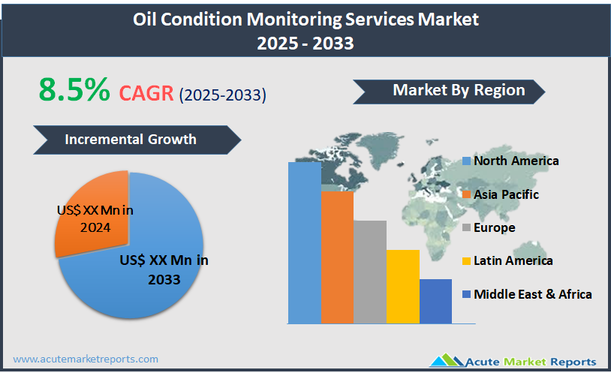

The oil condition monitoring services market encompasses the analysis and evaluation of lubricating oils and other fluids in machinery to assess their current condition and predict maintenance needs. This market involves services that detect potential problems in equipment before they become severe by analyzing oil for contaminants, wear debris, and chemical composition. Oil condition monitoring is critical for industries that rely heavily on machinery, such as manufacturing, automotive, energy, and transportation, as it helps extend the life of the equipment, minimize downtime, and reduce maintenance costs. The services provided in this market are integral to proactive maintenance strategies, allowing businesses to manage assets more effectively and efficiently. The oil condition monitoring services market is poised for substantial growth, with a projected compound annual growth rate (CAGR) of 8.5% from 2026 to 2034. This growth is driven by the increasing demand for cost-efficient operations across various industries where machinery and equipment play critical roles. As industries strive for maximum operational efficiency and prolonged equipment lifespan, the reliance on oil condition monitoring services intensifies. The ability of these services to prevent equipment failure and optimize maintenance schedules contributes significantly to reducing overall operational costs.

Increased Demand for Cost Efficiency in Maintenance Operations

The drive towards cost efficiency in maintenance operations significantly fuels the growth of the oil condition monitoring services market. Industries such as manufacturing, automotive, and transportation face continuous pressure to optimize operational costs and extend the lifespan of critical machinery. Oil condition monitoring plays a pivotal role by enabling early detection of potential failures and assessing the wear and tear on machinery. This preemptive approach to maintenance not only saves substantial costs associated with unexpected machinery breakdowns but also improves the overall equipment efficiency and safety. The integration of IoT and smart sensor technologies has further empowered companies to monitor oil conditions in real-time, providing timely data that facilitates immediate maintenance actions and reduces downtime, thereby enhancing productivity and profitability.

Integration of Advanced Analytics and IoT Technologies

The integration of advanced analytics and IoT technologies presents a significant opportunity for the oil condition monitoring services market. These technologies enhance the predictive capabilities of monitoring systems, allowing for more accurate assessments of oil quality and machinery health. The use of IoT devices enables continuous monitoring without human intervention, increasing the efficiency of data collection and analysis. Moreover, advanced analytics can predict potential failures before they occur, enabling proactive maintenance strategies. This technological advancement not only attracts industries seeking more sophisticated monitoring solutions but also opens up new markets in sectors increasingly reliant on predictive maintenance to ensure operational continuity.

High Initial Setup and Operation Costs

Despite the benefits, the high initial setup and operational costs of advanced oil condition monitoring systems pose a significant restraint. The installation of high-end sensors and the integration of IoT infrastructure require substantial upfront investment, which can be prohibitive for small and medium-sized enterprises (SMEs). Additionally, the need for skilled personnel to operate and interpret complex monitoring data adds to the ongoing costs, making it challenging for some companies to justify the investment, particularly in regions with limited industrial growth or under financial constraints.

Technological Complexity and Skilled Personnel Shortage

A major challenge in the oil condition monitoring services market is the technological complexity of advanced monitoring systems and the shortage of skilled personnel capable of managing and interpreting the data these systems generate. As oil condition monitoring technologies become more sophisticated, the need for highly trained professionals to operate these systems and make informed maintenance decisions increases. This skills gap can limit the adoption of advanced monitoring solutions, particularly in emerging markets or sectors with less focus on technological training. Moreover, the rapid pace of technological change requires continuous learning and adaptation, adding another layer of complexity to implementing and maintaining state-of-the-art monitoring systems effectively.

Market Segmentation by Service

The oil condition monitoring services market is segmented into Lubricant and Oil Testing, Grease Testing, Cylinder Liner Monitoring, Ferrography Testing, and Tribology Testing. Lubricant and Oil Testing currently generates the highest revenue within this segment, as it is a fundamental service demanded across various industries to ensure the optimal performance and longevity of machinery. This service helps detect contaminants and irregularities in oil that could indicate underlying machinery issues. However, Tribology Testing is expected to experience the highest CAGR from 2026 to 2034. This growth can be attributed to its comprehensive approach in analyzing the interactions between surfaces in motion, including wear and lubrication analysis, which are critical in predicting equipment failures. The rising demand for this sophisticated testing technique underscores the industry’s shift towards more detailed and predictive maintenance strategies that aim to preemptively address wear and tear before it leads to significant downtime or catastrophic failures.

Market Segmentation by Fluid

In terms of fluid types used in oil condition monitoring, the market is mainly divided into Lubrication Oil and Hydraulic Oil. Lubrication Oil dominates in terms of revenue due to its extensive use in a wide range of industrial applications, from automotive engines to large industrial machinery. The consistent need to maintain and monitor the condition of lubrication oil to ensure machinery operates efficiently drives significant demand for this segment. On the other hand, Hydraulic Oil is projected to register the highest CAGR during the forecast period. This anticipated growth is largely driven by the increasing complexity of hydraulic systems in construction, mining, and manufacturing industries, which require meticulous monitoring to prevent failures that could result in costly downtime and repairs. As industries continue to adopt more advanced hydraulic systems, the demand for specialized monitoring of these fluids is expected to grow, reflecting broader trends towards preventive maintenance and efficiency optimization.

Geographic Segment

The oil condition monitoring services market shows significant geographic differentiation, influenced by regional industrial activities and regulatory standards. In 2025, North America accounted for the highest revenue share, driven by stringent environmental regulations and the substantial presence of industries such as manufacturing, automotive, and energy, which require rigorous equipment maintenance protocols. The region’s focus on reducing operational downtime and enhancing machinery efficiency has made it a strong market for oil condition monitoring services. However, Asia-Pacific is expected to exhibit the highest CAGR from 2026 to 2034. This growth is anticipated due to rapid industrialization in countries like China and India, coupled with increasing awareness about the cost savings and efficiency gains from effective condition monitoring. The expansion of manufacturing capabilities and the rise in automotive production in these economies are likely to drive substantial demand for oil condition monitoring services.

Competitive Trends

In 2025, the competitive landscape of the oil condition monitoring services market was shaped by key players including Bureau Veritas, CONDITION MONITORING SERVICES, INC., Eastway, Element Materials Technology, Exxon Mobil Corporation, Intertek Group plc, SGS SA, Shell, Veritas Petroleum Services, and Vickers Oils. These companies leveraged advanced analytical techniques and broad service networks to meet the diverse needs of global clients, focusing on delivering customized solutions that enhance client operations. Bureau Veritas and SGS SA, for example, emphasized their comprehensive testing and monitoring capabilities, which are critical in industries requiring high reliability and safety standards. Exxon Mobil and Shell, with their expertise in lubricant technologies, provided targeted solutions for optimizing machinery performance and longevity. From 2026 to 2034, these companies are expected to focus on expanding their technological capabilities and geographic footprint, particularly in high-growth regions such as Asia-Pacific. Strategies will likely include the development of more sophisticated, IoT-enabled monitoring systems and partnerships with industrial firms to integrate real-time monitoring solutions directly into client operations. The emphasis will be on enhancing predictive maintenance capabilities and customizing solutions to specific industry needs, ensuring sustained growth and market penetration during the forecast period.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Oil Condition Monitoring Services market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Service

|

|

Fluid

|

|

Application

|

|

End-use Industry

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report