"Ever-Rising Telecommunication Traffic Worldwide to Bolster the Demand for Optical Satellite Communication"

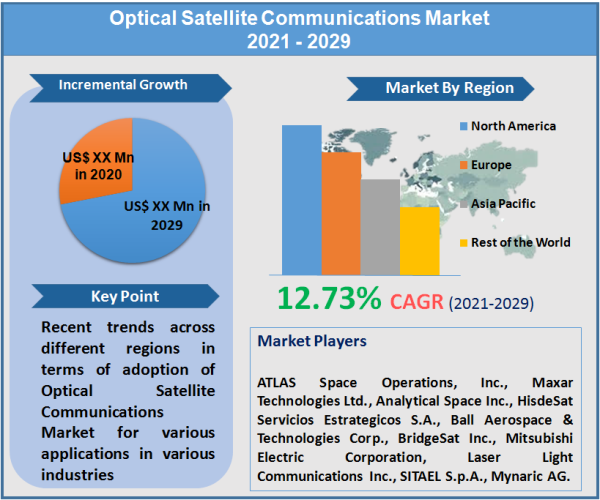

Optical satellite communication market projected to grow with a promising CAGR of 12.73% throughout the forecast period from 2026 to 2034. Chiefly commanded by North America, optical satellite communication market primarily driven by rapid growth in telecommunication sector. Proliferation of Internet as well as telecommunication traffic worldwide is driving the market growth worldwide. The global Internet traffic witnessed a CAGR of over 25% during the period from 2013 to 2016. With rising Internet users along with telecommunication traffic across the world, several private players have started investing in optical satellite communication market in search of feasible ways to cater the rising demand for real-time communication.

"Transmitter Segment Anticipated Continuing Leading the Market"

In 2022, Transmitter segment dominated the overall optical satellite communication market accounting for more than 1/4th of the global market value. Presently majority modules in IoT driven world equipped with location services. Further, proliferation of connected vehicles demonstrating promising growth of navigation services. Rapid penetration of navigation function in smart digital equipment and connected vehicles among other location based functioning systems, subsequently driving the growth of transmitter segment. Credence Research, Inc. accounted that by 2034, over 250 Mn units of vehicles in China will be Internet-connected vehicles. Similarly, use of satellite transmitters for surveillance & security application by defense authorities worldwide is further stimulating the demand for the segment. Transmitter plays inevitable part in satellite telemetry application credited to improved accuracy in location tracking. This advancement has revolutionized the study of raptor migration & life histories, and even expected to follow the trend across the forecast period.

"North America Leads the Market; Asia Pacific to Emerge as the Fastest Growing Regional Market"

Currently, North America dominates the optical satellite communication market with over 1/3rd of the total market value worldwide. The U.S. with strong awareness for benefits of using optical satellite communication across the nation chiefly supports the market growth here. Military satellite constellation assists the U.S. defense sector from orbit to track the defense activities globally. Similarly, with major focus on development of security system, the U.S. military are equipping commercial satellite receivers with trucks, aircraft and other defense systems in case of their own protected communication capabilities are malfunctioned. Further, Asia Pacific estimated to be the fastest growing market for optical satellite communication across the following years. India, China and Japan are among the lucrative markets having promising penetration of optical satellite communication. These countries hold huge potential for market majorly credited to increasing digital satellite broadcasting, Internet service, satellite R&D studies and satellite launching among several others.

"Leading Players Focusing on Alliances & Acquisitions for Market Expansion"

The overall optical satellite communications market was highly consolidated until late 2012. However, post 2012 nature of market became fragmented credited to growing access to optical satellite technology by private players. One of the key strategies adopted by the global players is alliance with small-scale network service providers. This helps the companies to swell their communication network reach, subsequently catering to more number of subscribers. Key instances include In January 2018, ATLAS Space Operations, Inc. and Xenesis, Inc. announced the alliance to develop advanced optical satellite communication network designed for high data flow from the space. Similarly, In July 2018, Maxer Technologies Ltd. announced the acquisition of Neptec Design Group. This acquisition expected to help the Maxer Technologies Ltd. to deliver robotic systems and expanded set of solutions, strengthening the brand to capture growth in North America as well as global space exploration markets and accelerate advancement into expanding space segments. Further, Ball Aerospace & Technologies Corporation announced the alliance with Honeywell Corporation to design & produce high reliability and high performance optical communication data links. This alliance expected to enable Ball Aerospace & Technologies Corporation to deliver high capacity, affordable and high bandwidth connectivity to consumers across the globe. Some of the key players profiled in the report include ATLAS Space Operations, Inc., Maxar Technologies Ltd., Analytical Space Inc., HisdeSat Servicios Estrategicos S.A., Ball Aerospace & Technologies Corporation, BridgeSat Inc., Mitsubishi Electric Corporation, Laser Light Communications Inc., SITAEL S.p.A. and Mynaric AG among others.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Optical Satellite Communications market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Component

|

|

Application

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report