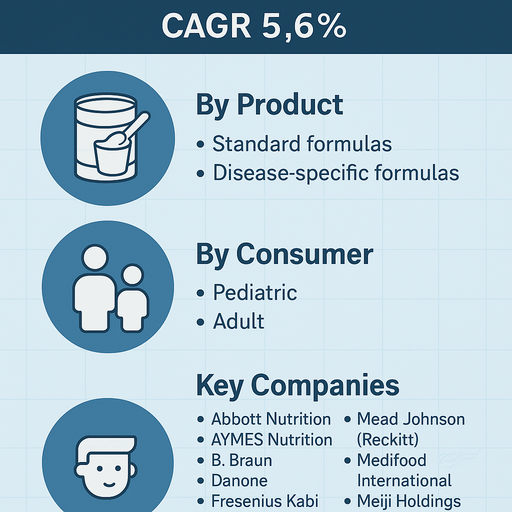

The global oral clinical nutrition market is projected to expand at a CAGR of 5.6% from 2025 to 2033, supported by rising prevalence of chronic diseases, aging populations, and increasing awareness of nutrition as a critical element in disease management. Oral clinical nutrition products provide targeted nutritional support for patients who are unable to meet their dietary requirements through regular food intake due to medical conditions such as cancer, gastrointestinal disorders, or neurological diseases. Demand is further driven by healthcare providers integrating nutrition therapy into routine patient care to improve recovery outcomes and reduce hospitalization costs.

Growing Role of Medical Nutrition in Disease Management

Clinical nutrition is increasingly recognized as an essential component of therapeutic regimens across hospitals, long-term care facilities, and home healthcare settings. Disease-specific formulas designed for oncology, renal disorders, diabetes, and immune-compromised patients are witnessing strong adoption. Additionally, the rising incidence of malnutrition, both in pediatric and geriatric populations, is accelerating the use of oral nutrition products as preventive and supportive care solutions. Healthcare reimbursement frameworks in developed markets are further enhancing access to these products.

High Costs and Limited Awareness Restrict Adoption

Despite positive market trends, barriers such as the high cost of specialized formulas, limited awareness in developing economies, and cultural hesitancy in using medical nutrition products hinder broader adoption. In low- and middle-income regions, lack of standardized nutritional care protocols and limited distribution networks are significant challenges. However, ongoing innovations in palatability, product formats (powders, ready-to-drink, and modular supplements), and government-led malnutrition reduction programs are expected to boost accessibility and acceptance.

Market Segmentation by Product

The market is segmented into standard formulas and disease-specific formulas. In 2024, standard formulas dominated due to their wide use in general hospital care, post-surgical recovery, and elderly nutrition. Disease-specific formulas are the fastest-growing segment, driven by increasing demand for tailored solutions in oncology, metabolic diseases, and critical care nutrition.

Market Segmentation by Consumer

By consumer, the market is divided into pediatric and adult populations. In 2024, the adult segment held the largest share, supported by aging demographics, higher incidence of chronic diseases, and the growing use of oral nutrition in rehabilitation programs. The pediatric segment remains critical, driven by rising concerns over childhood malnutrition and demand for specialized pediatric formulations to support growth and development.

Regional Insights

In 2024, Europe led the oral clinical nutrition market, supported by robust healthcare infrastructure, favorable reimbursement systems, and high awareness among healthcare providers. North America followed closely, with strong adoption in hospitals and home healthcare settings, particularly in the U.S. Asia Pacific is the fastest-growing region, with rising malnutrition rates, expanding middle-class populations, and investments in pediatric and geriatric nutrition. Latin America and Middle East & Africa represent emerging opportunities, with government and NGO-led initiatives to reduce malnutrition boosting demand.

Competitive Landscape

The 2024 market featured both multinational nutrition companies and specialized clinical nutrition providers. Nestlé Health Science, Abbott Nutrition, and Danone led the global market with comprehensive portfolios across standard and disease-specific formulas. Fresenius Kabi and B. Braun remained prominent players in Europe with strong hospital-focused products. Mead Johnson (Reckitt) and AYMES Nutrition supported pediatric and specialized care solutions. Kate Farms and Medifood International expanded plant-based and modular clinical nutrition offerings. GlaxoSmithKline, Pfizer, Otsuka Pharmaceutical, Meiji Holdings, and Nutriset contributed to regional and therapeutic-specific solutions. Competitive differentiation is shaped by product innovation, clinical validation, taste and palatability improvements, and distribution reach across hospital, retail, and e-commerce channels.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Oral Clinical Nutrition market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Product

| |

Consumer

| |

Application

| |

Dosage Form

| |

Distribution Channel

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report