Industry Outlook

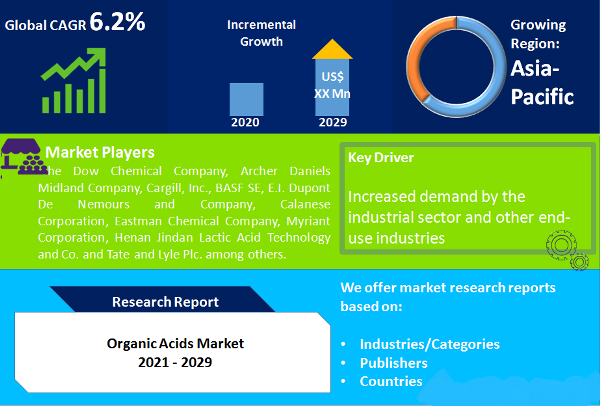

Organic acids market is projected to grow at 6.2% CAGR during the forecast period from 2022 to 2030. In 2021, Asia Pacific held the largest value and volume share in the global organic acids market and is projected to be the fastest-growing region between 2019 and 2030.

Organic acid is basically defined as a type of organic compound that has various acidic properties. These are part of weak acid group that do not dissolve in water. Organic acids are miscible and have low molecular mass. However, benzoic acids that have high molecular mass are basically not soluble in neutral form. Simplest form of organic acids includes formic and acetic acid are used in the stimulation treatment of oil and gas. These acids are also used for corrosion treatment. Organic acids find application in feed, food and beverages, pharmaceuticals, agricultural and personal care industry among others. These are also used in the manufacture of herbal insecticides, various lubricants, perfumes, colors and dyes, and household cleaners among others.

Production of organic acids involves various agro industrial residues that includes wheat bran, coffee husk, cassava bagasse, citric pulps, apple pomace, sugarcane, soybean, corn-cobs, press-mud, and kiwi fruit peel among others. Organic acids are also synthetically produced on a wide scale for various commercial applications that includes surfactants, catalysts and dyes among others. Formaldehyde is basically used in production of organic acids as an antimicrobial agent. Glycerine is mainly used as an energy source in the production of organic acids. Other feedstock used in organic acids production includes oil, amino acids, sulfuric acid, proteins, enzymes and salts of acids among others.

Increasing focus on producing bio based organic acid is expected to drive the global organic acids market. Increase in stringent regulations on conventional organic acids is mainly boosting the growth of this market. Key players are focusing on merger and acquisition strategy to cater to the growing demand for bio based organic acids. For example, in August 2017, BioAmber went into a partnership agreement with Mitsui and acquired a bio based acid plant located in Sarnia, Canada. Growing use of dietary microencapsulated organic acids followed by increasing applications in food and beverages industry is primarily driving the market. Increasing application of organic acids in pharmaceuticals is also expected to propel the demand for this market. Lactic acids play an important role in drug manufacture. The primary functions of lactic acid in pharmaceuticals applications includes chiral intermediate, pH-regulation, metal sequestration as various natural constituents in various pharmaceuticals products. Growing use of organic acids in cosmetic and personal care industry is another factor bolstering the market growth. The applications of lactic acid in cosmetic industry includes moisturizers, skin rejuvenating and lightening agents, PH regulators, humectants and anti-acne agents among others.

Organic acids are also utilized in petrochemical industry in the production of various end-use and intermediates petrochemical products. However, stringent regulations by the government on synthetic production of organic acids is restraining the market growth. In addition, increasing focus on various research and development activities by key manufacturers to produce organic acids from various bio based sources is acting as an opportunity factor in the growth of this market during the forecast period from 2018 to 2027.Growing application of organic acids in feed industry is also expected to augment the demand for this market. Organic acids are the most cost effective feed additive and aims at preservation of silages and feed. Organic acids are also effective in maintaining the nutritional value of feed that basically aims to improve nutrient digestibility and animal performance. All these factors are expected to boost the demand for organic acids during the forecast period from 2018 to 2027.

"Acetic acid is the Largest Segment by Product Type in The Global Organic Acids Market"

Increasing demand of acetic acid in the manufacture of vinyl acetate monomer (VAM) and purified terephthalic acid (PTA) is mainly driving the global organic acids market. Growing demand for VAM in food and beverages industry mainly preservatives and food packaging is expected to drive the acetic acid segment in the global organic acids market. It is also majorly consumed in producing diketene, mono chloroacetic acid, chemicals and camphor among others. Acetic acid is also used as a raw material in various chemicals that includes vinegar. Vinegar finds application in cooking and its demand as a food ingredient is showing upward trend. Consumer awareness related to health benefits of vinegar in recommended quantity is expected to spur its demand in food items. With the rapidly growing food industry, the vinegar application is expected to rise which in turn is expected to fuel the demand for acetic acid during the forecast period from 2022 to 2030.

Acetic anhydride which is a type of acetic acid finds application in the production of various medicines that includes aspirin and acetaminophen. In addition, it is also used to preserve frozen food mainly meat with an objective to enhance the shelf life thereby keeping it fresh. Acetic acid also acts as an intermediary for formulating greases, coatings, sealants and polyester that mainly finds application in various end-user industries that includes automotive, electronics, packaging, and textiles. Growing trend among youngsters for superior quality fabrics and fashionable apparels produced by mills is expected to drive the demand for textile industry.

In January 2017, Avantium, a leading chemical technology company, based in Netherlands, acquired Liquid Light. The company’s patent portfolio includes acetic acid for the production of coatings, polymers and cosmetics. This acquisition was aimed at development of powerful technology platform based on CO2 feedstock, that basically turns waste into various valuable products that includes plastics and chemicals among others.

"Food and Beverages Segment Driving the Growth of Organic Acids Market"

Growing penetration of organic acids in food preservation is expected to drive the global market. Organic acids are basically used in various foods to preserve the shelf life owing to its antibacterial and antioxidant properties. Formic acid is also used in combination with hydrogen peroxide in the production of epoxidized soy bean oil, as oxidizing agent. Lactic acid, a type of organic acid, also finds application in food industry. The primary functions of lactic acid for food application includes acidulates, preservatives, flavoring agent, PH regulators and mineral fortification. Organic acids also contribute to the sensory properties of food by providing aroma and taste. Increasing application of citric acid in soft drinks that aims to provide sour taste of citrus fruits is also expected to drive the overall market. Fumaric acid is also used as a acidulant in baking powder and proprionic acid also finds application as a preservative in baked goods that basically kills bacteria and prevent growth of molds. Owing to such properties and application of different organic acids, the global market is expected to show steady growth during the forecast period from 2018 to 2027.However, organic acids application in food is regulated in various countries, and the amount and type is constantly monitored with an objective to ensure that the food is safe for consumption and also complies with regulation.

"Asia Pacific is the Largest Region in the Global Organic Acids Market"

Globally, Asia Pacific accounted for the largest share of organic acids market. India and China are the key countries in the Asia Pacific organic acids market. The growth is mainly attributed to the growing demand for organic acids in pharmaceuticals and food and beverages industry. Increasing awareness among consumers related to the health benefits of organic acids is also expected to propel the growth of this market during the forecast period from 2019 to 2030. Less stringent regulations over marketing and trading of food additives is also expected to bolster the demand for organic acids which in turn enables the manufacturers to reduce the operational costs and offer competitive pricing of organic acids in the global market. North America and Europe followed Asia Pacific in the global organic acids market. Strict regulations implemented to control the application of synthetic organic acids is restraining the growth of these markets. Hence growing demand for bio based organic acids is expected to create new opportunities in the North America and Europe organic acids market.

"New Product development followed by Capacity Expansion are the Key Strategies Adopted by the Manufacturers"

Key players operating in the global organic acids market includes The Dow Chemical Company, Archer Daniels Midland Company, Cargill, Inc., BASF SE, E.I. Dupont De Nemours and Company, Calanese Corporation, Eastman Chemical Company, Myriant Corporation, Henan Jindan Lactic Acid Technology, and Co. and Tate and Lyle Plc. among others. For example, in March 2017, BASF SE launched an organic acid Lupro-Mix® NA. This new product aims to make animal drinking water safer by suppressing the growth of microorganisms thereby improving acidification. In April 2018, Celanese Corporation, based in the U.S, announced to increase the production capacity of acetic acid and vinyl acetate monomer (VAM) at its global manufacturing facilities. The company also projects that it will add 150 KT per annum of VAM and 140 KT per annum of acetic acid by 2021 to meet the growing demand for organic acids.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Organic Acids market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Product

|

|

Industry Vertical

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report