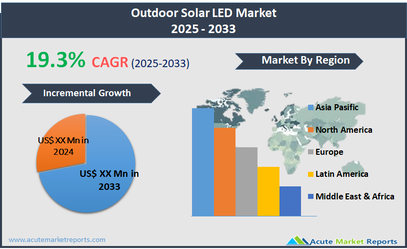

The global outdoor solar LED market is projected to expand at a robust CAGR of 19.3% from 2025 to 2033, fueled by rising energy efficiency mandates, falling solar panel costs, and government-led smart city initiatives. These lighting systems integrate photovoltaic cells, LED luminaires, and rechargeable batteries to offer off-grid, sustainable illumination in outdoor environments. Their adoption is accelerating across streets, gardens, parks, and pathways, especially in areas with unreliable grid access or high electricity tariffs.

Market Drivers

Supportive Government Policies and Sustainable Infrastructure Push

Many governments are prioritizing clean energy investments to meet carbon neutrality targets, with solar lighting playing a key role in public infrastructure. Programs like India’s “Street Lighting National Programme (SLNP)” and solar-powered urban renewal projects in Africa and Southeast Asia are catalyzing large-scale deployment of outdoor solar LEDs. Municipalities are leveraging these systems to reduce grid dependency, lower maintenance costs, and enhance safety in poorly lit areas.

Declining Technology Costs and Advancements in Efficiency

Rapid improvements in LED efficiency, lithium-ion battery storage, and solar PV cell output have made outdoor solar lighting more economically viable. This, combined with longer lifespans, zero operating costs, and ease of installation, is leading to their widespread adoption. Integrated systems with motion sensors, dimming controls, and remote monitoring further enhance their attractiveness in both public and private sectors.

Market Restraint

Weather Dependency and Limited Performance in Low-Sunlight Regions

The performance of solar-powered LEDs can be significantly impacted by weather conditions and geographic location. In areas with limited sunlight or frequent overcast conditions, light output and battery life may suffer, leading to inconsistent performance. Additionally, higher initial costs compared to conventional grid-based lighting remain a barrier in cost-sensitive markets without subsidy or financing support.

Market Segmentation by Wattage

By wattage, the market is segmented into Less than 40W, 40W to 150W, and More than 150W. In 2024, the 40W to 150W segment dominated the market, driven by its suitability for most public lighting applications such as streets, walkways, and community spaces. Less than 40W solutions are primarily used in residential and decorative garden settings. The More than 150W segment is expected to grow fastest through 2033, aligned with the rollout of high-capacity solar streetlights in highways, industrial estates, and large-scale urban projects.

Market Segmentation by Application

By application, the market includes Street, Garden, Pathway, and Others (such as parking lots, commercial campuses, and resorts). In 2024, street lighting accounted for the largest market share due to government mandates and public safety concerns. Garden and pathway lighting segments are seeing steady growth driven by residential landscaping, tourism zones, and gated community projects. The others category is expected to witness notable traction as private sector entities invest in sustainable outdoor illumination for aesthetic, branding, and cost-saving purposes.

Geographic Trends

In 2024, the Asia Pacific region led the outdoor solar LED market, with strong demand from India, China, and Southeast Asian countries. Government electrification initiatives, rising environmental awareness, and high solar irradiance levels contribute to regional dominance. North America and Europe follow, supported by smart city programs, stringent energy efficiency standards, and public-private partnerships. Middle East & Africa is a high-potential region, where solar lighting is essential in rural electrification, refugee camps, and urban expansion projects. Latin America is witnessing moderate adoption, especially in off-grid regions of Brazil, Mexico, and Chile.

Competitive Trends

In 2024, the outdoor solar LED market was led by global lighting and energy solution providers with strong portfolios in solar integration. Signify Holding (formerly Philips Lighting) dominated the premium segment with smart solar solutions for urban applications. Wipro Lighting leveraged its presence in the Indian market to deliver municipal solar lighting projects. Panasonic Holdings Corporation focused on modular solar lighting systems with smart energy storage. Sunna Design, a French-based innovator, stood out in the African and Middle Eastern markets for rugged, autonomous solar lamps. BISOL Group, with expertise in PV module manufacturing, offers integrated solar lighting products across commercial and utility-scale deployments. Key strategies include partnerships with city councils, integration of IoT-based monitoring, and development of high-durability, low-maintenance products tailored for varying environmental conditions.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Outdoor Solar LED market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Wattage

| |

Application

| |

End Use

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report