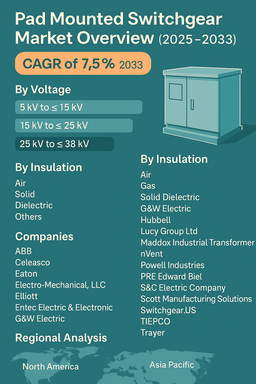

The global pad mounted switchgear market is projected to grow at a CAGR of 7.5% from 2025 to 2033, driven by rising demand for reliable and safe medium-voltage power distribution systems in utility, commercial, and industrial applications. Pad mounted switchgear, enclosed in tamper-resistant cabinets and installed at ground level, provides key functions such as circuit protection, sectionalizing, and fault isolation. Its compact and weather-resistant design makes it ideal for underground distribution networks and renewable energy integration in urban and rural grids.

Rising Demand for Grid Modernization and Underground Distribution

The growth of the market is strongly supported by ongoing modernization of aging electrical infrastructure, increasing adoption of underground cabling, and expansion of renewable energy projects. Utilities are increasingly investing in pad mounted switchgear to enhance operational safety, minimize outage time, and improve system reliability. Moreover, the shift toward smart grid deployment, distributed generation, and rural electrification is further propelling product demand. The integration of intelligent monitoring systems and SCADA-compatible switchgear is transforming the market toward automation and digitalization.

Challenges: High Installation Costs and Maintenance

Despite strong growth prospects, the market faces challenges such as high initial installation and maintenance costs associated with underground cabling and pad mounting systems. Environmental concerns related to SF₆ gas insulation are also prompting manufacturers to develop eco-friendly alternatives such as solid dielectric and vacuum-insulated switchgear. However, long-term operational reliability, reduced power losses, and lower failure rates continue to justify adoption across utilities and industrial users.

Market Segmentation by Voltage

By voltage, the pad mounted switchgear market is segmented into 5 kV to ≤15 kV, 15 kV to ≤25 kV, and 25 kV to ≤38 kV. In 2024, the 15 kV to ≤25 kV segment held the largest market share, as it represents the most commonly used voltage range for medium-voltage distribution in utilities and industrial networks. This segment supports urban electrical distribution, renewable integration, and commercial facility power management. The 25 kV to ≤38 kV segment is projected to register the highest CAGR during the forecast period, driven by increasing adoption in large-scale infrastructure projects, mining, and heavy industrial applications requiring higher load-handling capabilities.

Market Segmentation by Insulation

In 2024, gas-insulated pad mounted switchgear dominated the market, attributed to its compactness, arc fault protection, and superior reliability in harsh environmental conditions. However, the solid dielectric segment is expected to witness the fastest growth, supported by growing environmental regulations against SF₆-based systems and rising adoption of eco-friendly and maintenance-free designs. Air-insulated switchgear continues to be used for cost-sensitive and low-density grid installations, particularly in developing economies.

Regional Insights

In 2024, North America led the pad mounted switchgear market, driven by strong investments in grid automation, underground power distribution, and renewable energy integration. The U.S. remains a major market owing to modernization of aging utility networks and the adoption of SCADA-integrated smart switchgear. Europe followed, with countries such as Germany, France, and the UK implementing eco-friendly insulation technologies and renewable-driven grid upgrades. The Asia Pacific region is forecasted to exhibit the highest CAGR, propelled by large-scale infrastructure expansion, urban electrification programs, and government-led smart grid initiatives in China, India, and South Korea. Latin America and Middle East & Africa (MEA) are emerging markets where investments in power reliability and rural electrification are gradually strengthening product demand.

Competitive Landscape

The global pad mounted switchgear market is moderately consolidated, with leading manufacturers emphasizing safety, smart grid compatibility, and environmental sustainability. ABB, Eaton, and S&C Electric Company dominate the market with broad product portfolios and global service networks. G&W Electric, Lucy Group Ltd, and Powell Industries focus on solid dielectric and environmentally friendly switchgear systems. Hubbell, Entec Electric & Electronic, and Trayer are recognized for their innovative compact switchgear solutions tailored for urban power distribution and renewable projects. Electro-Mechanical, LLC, Maddox Industrial Transformer, Scott Manufacturing Solutions, and Switchgear.US serve niche markets emphasizing reliability and modularity. PRE Edward Biel, Celeasco, and TIEPCO strengthen regional supply networks across North America, Europe, and the Middle East. Competitive differentiation in this market is driven by voltage scalability, automation capability, environmental compliance, and maintenance-free insulation technologies, as manufacturers focus on delivering sustainable and intelligent power distribution solutions for the next-generation grid.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Pad Mounted Switchgear market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Voltage

| |

Insulation

| |

Application

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report