"Growing usage of virtual money and rapid changes occurring in the financial sector is contributing to the growth of peer-to-peer lending apps market"

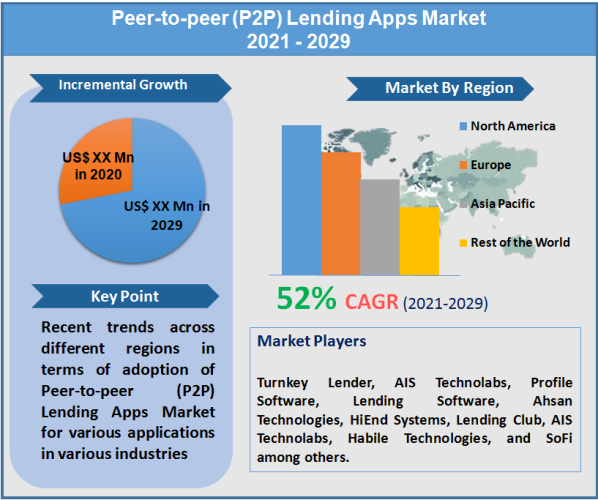

Globally, the peer-to-peer lending apps market is expected to grow with a CAGR of more than 52% during the forecast period from 2019 to 2028. Globally, the financial industry has reshaped due to the growing finance model of crowd funding and marketplace lending. Various new and innovative platforms/firms are introducing new financing services. These new platforms become the disruptors that provide the financial institutes with alternative financing models, ranging from marketplace lending, P2P lending to equity crowd funding. For this changing financial sector, various companies are designing new solutions to address the needs of the FinTech sector along with the regulatory requirements as they developed. This paradigm shift in the financial sector is the major factor driving the demand for peer-to-peer lending apps and software. Furthermore, the demand for virtual money and virtual financial transactions is gradually increasing. This demand also fuels the growth of peer-to-peer lending apps and software market across the globe. Moreover, increasing number of P2P lenders also facilitates the growth this market. However, risk of losing all money, lack of awareness of p2p lending benefits among general population and higher government limitations are the factors restraining the growth of this market during the forecast period.

"Cloud based peer-to-peer lending apps and software are expected to grow at a higher CAGR during the forecast period"

In 2018, the cloud based peer-to-peer lending apps and software are expected to reach the top of the chart during the forecast period. As the market for cloud lending is vastly growing and the number of cloud lenders is extending more than $1 trillion in digital loans each year, it opens new avenues for the software developers. Cloud based models are highly being adopted in every industry, financial sector is not exception to this adoption. These cloud-based models provide access to credit at an extraordinary level. These models reduce approval time from hours to minutes to in-an-instant and also provides outstanding loan management features for tracking borrower payments and monitoring changes to their credit rating. Advanced technology like cloud-based software are projected to be the key differentiator in the online money-lending arena.

"Asia Pacific to Register the Fastest Growth"

North America dominates the Peer to peer lending apps market by holding the largest market share on global level. Large number of new product developments and increasing investments in technological advancements are the primary factors contributing to this huge market share. Additionally, growing adoption of virtual money transaction methods in the US and Canada is leading to the growth of this market in North American region. Peer-to-peer lending apps and software market is experiencing a significant growth in the developed regions, however emerging market offer substantial growth opportunities to the players operating locally or internationally. Countries such as India and China are offering significant growth opportunities to the players, based on the growing demand for advanced technologies, government support to adopt digital tools for financial transactions and expansion of international players in this region. Moreover, local companies in this region are attracting much investment to develop and deploy peer-to-peer lending apps and software to local and international customers.

Some of the prominent players operating in the peer-to-peer lending apps market include Turnkey Lender, AIS Technolabs, Profile Software, Lending Software, Ahsan Technologies, HiEnd Systems, Lending Club, AIS Technolabs, Habile Technologies, and SoFi among others.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Peer-to-peer (P2P) Lending Apps market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Component

|

|

Deployment Model

|

|

Business Model

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report