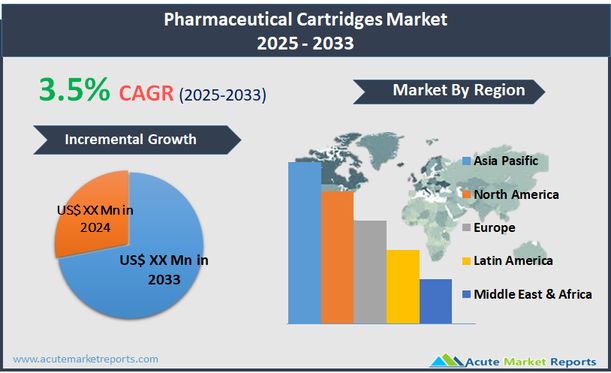

The pharmaceutical cartridges market involves the production and distribution of specially designed cartridges used in the packaging and delivery of pharmaceutical products. These cartridges are primarily used in pen injectors and other drug delivery systems for the administration of precise doses of medication, particularly for chronic conditions such as diabetes, rheumatoid arthritis, and growth hormone deficiencies. The cartridges are made from materials like glass or plastic that meet stringent medical-grade standards to ensure safety, stability, and compatibility with various drugs. The pharmaceutical cartridges market is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.5% over the forecast period.

Increasing Prevalence of Chronic Diseases

A primary driver for the pharmaceutical cartridges market is the increasing prevalence of chronic diseases globally, which necessitates ongoing medication management. Diseases such as diabetes, autoimmune disorders, and neurological conditions require frequent dosing that can be efficiently managed through the use of cartridges in pen injectors and similar delivery systems. These conditions often demand strict adherence to medication schedules, which can be facilitated by the convenience and precision of pharmaceutical cartridges. For instance, the global rise in diabetes incidence has led to heightened demand for insulin therapies that are typically administered through cartridge-based systems. The reliability and ease of use of these systems enhance patient compliance, making them invaluable in chronic disease management. As healthcare systems continue to focus on patient-centric solutions that encourage self-administration of medications, the demand for advanced drug delivery formats, such as pharmaceutical cartridges, is expected to rise significantly.

Expansion into Biologics

An emerging opportunity within the pharmaceutical cartridges market is the expansion of biologic drugs, which are increasingly preferred due to their efficacy in treating various medical conditions, including those not adequately addressed by traditional pharmaceuticals. Biologics often require precise dosages and specialized storage conditions, which pharmaceutical cartridges can provide. The integration of advanced material science and filling technology ensures that these sensitive biological products are kept stable and delivered accurately, enhancing therapeutic outcomes. As the biologics sector continues to grow, the need for compatible and efficient drug delivery systems like pharmaceutical cartridges also increases, presenting a significant growth avenue for manufacturers in this market.

High Cost of Development and Manufacturing

A significant restraint facing the pharmaceutical cartridges market is the high cost associated with the development and manufacturing of these specialized containers. Producing cartridges that meet the stringent regulatory standards for drug compatibility, sterility, and durability requires advanced manufacturing techniques and high-quality materials, which can be expensive. These costs are often passed on to the healthcare provider and, ultimately, the patient, making these systems less accessible in cost-sensitive markets. The investment in research and development to create cartridges that maintain drug efficacy without compromising safety further adds to the financial burden, posing a challenge for new entrants and smaller manufacturers in the market.

Regulatory Compliance and Material Compatibility

A major challenge in the pharmaceutical cartridges market is ensuring compliance with diverse regulatory standards and maintaining material compatibility with a wide range of pharmaceuticals. Different drugs can interact with the materials used in cartridges, such as glass or plastic, in ways that could compromise drug efficacy or patient safety. Adhering to international standards and obtaining approvals from regulatory bodies like the FDA and EMA is both time-consuming and costly. Each new drug formulation might require different storage and delivery conditions, necessitating continuous innovation in cartridge design and material science. Overcoming these hurdles requires a deep understanding of both pharmaceutical and material properties, as well as ongoing investment in technology and compliance efforts. This complexity not only impacts the speed to market but also the scalability of new cartridge solutions, making it a persistent challenge for companies operating in this space.

Market Segmentation by Material Type

In the pharmaceutical cartridges market, segmentation by material type includes Glass and Plastics. Glass holds the highest revenue within this segment due to its extensive use, driven by its superior barrier properties, chemical stability, and inertness, which make it the preferred choice for many pharmaceutical formulations. Glass cartridges are particularly favored for sensitive biologic drugs where interaction with the container can compromise drug efficacy. However, Plastic cartridges are expected to exhibit the highest Compound Annual Growth Rate (CAGR). This growth is fueled by advances in polymer science that have improved the chemical resistance, clarity, and break resistance of plastic cartridges. Additionally, plastic offers versatility in design and is often more cost-effective to produce and transport than glass, making it increasingly popular as manufacturers seek more durable and lightweight alternatives.

Market Segmentation by Capacity Type

The pharmaceutical cartridges market is also segmented by capacity into Below 5 ml, 5-50 ml, 51-250 ml, and Above 250 ml categories. The Below 5 ml segment generates the highest revenue, reflecting its widespread use in applications requiring precise, small-volume dosages such as insulin and dental anesthesia. These cartridges need to ensure exact dosing, which is critical in clinical settings. Meanwhile, the 5-50 ml segment is projected to have the highest CAGR. This growth is attributed to the increasing use of this cartridge size in the administration of a broader range of pharmaceuticals, including those for autoimmune diseases and biologics, where slightly larger volumes are required. The versatility and efficiency of 5-50 ml cartridges in meeting the dosing requirements for a variety of treatments support their rapid adoption and market growth.

Geographic Segment

In 2024, North America generated the highest revenue in the pharmaceutical cartridges market, primarily driven by the region's advanced healthcare infrastructure, robust pharmaceutical industry, and stringent regulatory standards requiring high-quality drug delivery systems. The presence of major pharmaceutical companies and a strong focus on innovative drug delivery solutions further cemented its leading position. From 2025 to 2033, the Asia Pacific region is expected to exhibit the highest Compound Annual Growth Rate (CAGR). This anticipated growth will likely be fueled by the expanding pharmaceutical sector in countries like China and India, increased investments in healthcare infrastructure, and rising demand for chronic disease management solutions. Additionally, government initiatives to enhance local pharmaceutical manufacturing capabilities and the growing middle-class population with access to healthcare services will drive the demand for pharmaceutical cartridges in this region.

Competitive Trends and Key Strategies

Key players in the pharmaceutical cartridges market include Schott AG, Gerresheimer AG, Nipro Corporation, West Pharmaceutical Services, Inc., Stevanato Group, SGD Pharma, Baxter Healthcare Corporation, Sigma-Aldrich Corporation, Pierrel group, and Transcoject GmbH. In 2024, these companies focused on advancing manufacturing technologies, expanding production capacities, and enhancing product portfolios to include a wider range of cartridge specifications tailored to various pharmaceutical needs. Strategic collaborations and acquisitions were also prominent, aimed at strengthening market presence and enhancing R&D capabilities. For example, partnerships with biotech firms were common, helping to integrate the latest scientific advancements into cartridge designs. From 2025 to 2033, these companies are expected to increasingly invest in eco-friendly production processes and materials, responding to global demands for sustainability. Furthermore, the development of cartridges with improved compatibility and stability for new biologic drugs will be crucial as the market for biopharmaceuticals continues to grow. Expanding into emerging markets will also be a key strategy, leveraging rising healthcare expenditures and regulatory reforms favoring quality drug delivery systems in these regions. These efforts will likely focus on aligning products with local regulatory requirements and patient needs to capture growth opportunities in these dynamic markets.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Pharmaceutical Cartridges market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Material Type

| |

Capacity Type

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report