Industry Outlook

The Contract Development and Manufacturing Organization (CDMO) industry had begun decades ago as a niche business by offering specialty services and manufacturing capacities to pharmaceutical companies. The advent of CDMOs was mainly attributed to the failures of pharmaceutical companies due to challenged competencies and financial constraints. Therefore, to reduce the risk of overcapacity and financial burden, the demand for outsourcing of development and manufacturing picked pace. In the current situation where pharma companies are facing increase in pricing pressure form payers; therefore, in order to reduce operational expensed, such companies are increasingly outsourcing their pharmaceutical manufacturing processes to CDMOs. Furthermore, growing number of companies are refocusing their core competencies, therefore initiating divestments of in-house capacities in critical areas and increasing dependence on CDMOs in other processes.

CDMOs also play a critical role in offering additional capacities and mitigate the risk of supply shortages by providing additional manufacturing and development sites and backup facilities. Such moving of manufacturing facilities is highly desirable as it reduces time to market. Issues regarding documentation and quality of drug manufacturing process during regulatory reviews can lead to delay in marketing authorization. Therefore for pharmaceutical companies, prompt quality standards with proven reliability is a definitive key for outsourcing to CDMOs.

Growing consumption of medicines, evolution of robust drug pipeline, and increasing rate of NDA and BLA approvals, increasing number of underdevelopment biologic drugs, entry of small startups with no manufacturing capacities, growing patent expiries and other several factors are driving the global pharmaceutical CDMO services market. Other attributes to the growth of this market are increasing complexity of small and large molecule drugs, greater need for cost efficiencies, and convenient access to proprietary technologies.

CDMOs are characterized with offering a wide range of services while having global footprint and help in simplification of supply chain while fulfilling expectations of regional markets. Furthermore, in order to save costs, drug companies are aiming to reduce the extent of their supplier network to select companies that provide a wide range of services for several products. Likewise, virtual companies, specialty and generic pharma firms also demand a range of services for development and production through supply chain support. Hence, pharmaceutical companies will continue to outsource more and more of this development and manufacturing processes.

"Drug Substance Development and Manufacturing Leading the Global Market"

With extensive in-house investments being made by drug sponsors, biopharmaceutical contract manufacturers are expanding their capacities. Most of such investments are made by big contract development and manufacturing organizations, to offer full support to drug manufacturer from drug discovery to commercial manufacturing. Many of such firms are industry leaders and are increasingly investing to meet the possible increased demand for their service offering. Other CDMO companies are focusing on offering contract development and manufacturing services for next generation technologies requiring highly specialized capabilities, and in certain cases, development of novel technologies and processes for prompt commercialization.

"Innovator Drugs to Acquire Renewed Interest during the Forecast Period"

CDMOs play an important role in providing successful development of innovator small molecule drug candidates, as these important activities are many a times achieved through outsourcing to CDMOs. CDMO activities can significantly vary subject to the services offered by them, ranging from one-stop-shots to specific expertise focusing on development and manufacture of innovator APIs. Irrespective of the range of CDMO service offerings, these organizations today are witnessing a growing demand for GMP manufacturing and drug substance development for innovator small molecule drugs. Of all the indications are being investigated for API manufacturing, small molecules are in the highest demand and it is likely to remain strong for the coming years.

"North America to Dominate the Global Market, Attributed to Proliferation of Service Providers and Improved Funding"

CDMO services for generic drugs have a huge growth opportunity in North America. The traditional CMO services in this region are not willing to take risk of manufacturing generics at low profit margins. However, as the increasing drug prices are pushing companies to enter in generic products, CDMOs with exclusive expertise will benefit from strong generics demand. Furthermore, development of super generics is also leveraging the status of CDMOs with niche dosage forms such as inhalation and transdermal technologies. High production cost is the key factor for driving the growth of CDMOs market in North America. There is also a growing number of CDMOs in emerging markets of Asia Pacific building specialized and general development and manufacturing facilities.

Currently, the global pharmaceutical CDMOs market is highly fragmented with the largest companies together holding below % of the global market share. There are significant consolidation opportunities available in the market and buying capacities are concentrated in select CDMOs with sufficient financial resources. The merger and acquisition strategies of CDMOs is focused on augmenting technical capabilities and expanding geographic footprint. Medium sized CDMOs are active in the market to compete in terms of offering niche services.

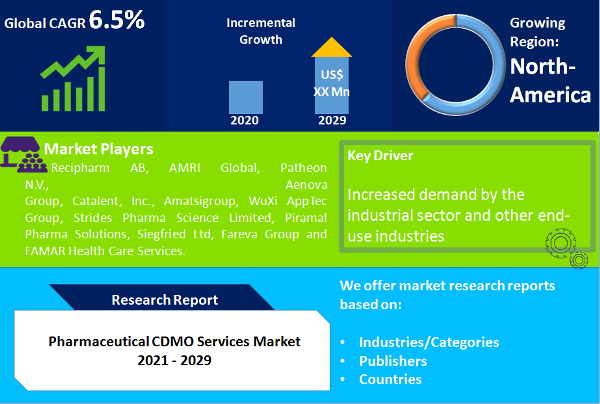

This report incorporates sets of qualitative and quantitative information respective to the global pharmaceutical CDMO services market. Drivers and challenges pertaining to this market are incorporated in this study to analyze the currently prevalent market dynamics, whereas market opportunities are also enumerated to give insights pertaining to the pharmaceutical CDMO services market. Market size and forecast of each segment in terms of services, products and geographical demarcation is provided in this report for the period from 2018 to 2027. This report concludes with company profiles section giving brief of key market players based on their business description, financial overview, product portfolio and key developments. The major market players profiled in this study are Recipharm AB, AMRI Global, Patheon N.V., Aenova Group, Catalent, Inc., Amatsigroup, WuXi AppTec Group, Strides Pharma Science Limited, Piramal Pharma Solutions, Siegfried Ltd, Fareva Group and FAMAR Health Care Services.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Pharmaceutical CDMO Services market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Service

|

|

Product

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report