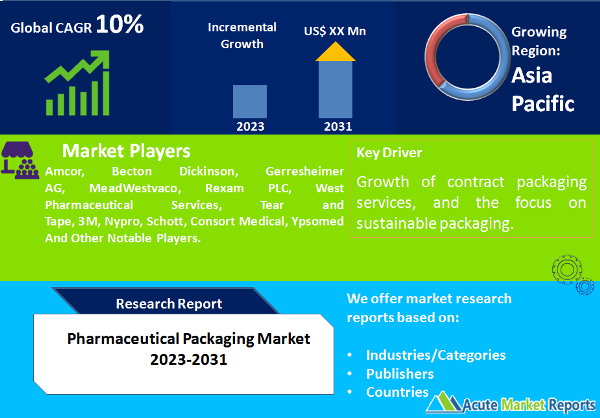

The pharmaceutical packaging market is expected to witness a CAGR of 10% during the forecast period of 2026 to 2034, driven by various compelling factors, while still facing notable challenges. The pharmaceutical packaging market is thriving due to increased pharmaceutical manufacturing, the growth of contract packaging services, and the focus on sustainable packaging. However, regulatory challenges present hurdles that need to be navigated. The shift toward glass as a preferred packaging material and the growing reliance on contract packaging services are key trends to watch. North America is set to lead in CAGR, while Asia-Pacific will continue to dominate in revenue. The future of this market is bright, with a focus on enhancing pharmaceutical packaging to meet evolving regulatory requirements and sustainability goals, ensuring the safety and efficacy of medications for patients worldwide.

Expanding Pharmaceutical Manufacturing

The Pharmaceutical Packaging market is experiencing substantial growth due to the expanding pharmaceutical manufacturing sector. The pharmaceutical industry has witnessed a surge in demand for various drugs and medications, further fueled by the ongoing global health challenges. This demand necessitates robust and diverse packaging solutions to ensure the safety and integrity of pharmaceutical products. The evidence for this growth driver lies in the increasing number of pharmaceutical manufacturing facilities worldwide, with a subsequent rise in the requirement for advanced packaging materials and technologies.

Rising Contract Packaging Services

Another crucial driver is the increasing reliance on contract packaging services. Many pharmaceutical companies are outsourcing their packaging needs to specialized service providers to focus on core competencies and reduce operational costs. Contract packaging offers flexibility, scalability, and expertise in handling various packaging formats. The market evidence includes the growing number of contract packaging companies, showcasing the demand for these services to meet the dynamic needs of pharmaceutical manufacturers.

Advancements in Sustainable Packaging

Advancements in sustainable packaging are significantly driving the Pharmaceutical Packaging market. Sustainability has become a central focus for pharmaceutical companies, as they aim to reduce their carbon footprint and environmental impact. This shift is evident in the adoption of eco-friendly materials, recyclable packaging, and reduced waste. Several pharmaceutical packaging companies are innovating by introducing sustainable solutions, indicating a positive trend toward more environmentally responsible packaging.

Regulatory Challenges

A substantial restraint in the Pharmaceutical Packaging market is the complex and ever-evolving regulatory landscape. The pharmaceutical industry is subject to stringent regulations that govern packaging, labeling, and quality control. Adherence to these regulations is crucial to ensure the safety and efficacy of pharmaceutical products. The evidence lies in instances where pharmaceutical companies have faced regulatory hurdles and compliance issues, leading to delays and additional costs in packaging processes.

Material: Plastics And Polymers Dominate the Pharmaceutical Packaging market

In 2025, plastics and polymers dominated the Pharmaceutical Packaging market due to their versatility and cost-effectiveness. However, during the forecast period from 2026 to 2034, the highest Compound Annual Growth Rate (CAGR) is expected in the glass segment. Glass offers excellent barrier properties and preserves the integrity of pharmaceutical products, making it a favored choice for packaging. This trend is supported by an increasing focus on product quality and patient safety.

End-use: Pharma Manufacturing and Retail Pharmacy Dominate the Pharmaceutical Packaging market

In 2025, pharma manufacturing and retail pharmacy constituted the highest revenue segments. However, during the forecast period from 2026 to 2034, the highest CAGR is anticipated in the contract packaging segment. The growth in contract packaging services reflects the pharmaceutical industry's demand for outsourced packaging solutions to enhance efficiency and reduce operational costs. This trend is evident in the increasing utilization of contract packaging services by pharmaceutical manufacturers.

APAC Remains as the Global Leader

During the forecast period from 2026 to 2034, North America is projected to exhibit the highest CAGR in the Pharmaceutical Packaging market. This growth is attributed to the strong presence of pharmaceutical manufacturers and the adoption of advanced packaging technologies. Asia-Pacific is expected to maintain the highest revenue percentage, primarily due to the growing pharmaceutical manufacturing sector and increasing access to healthcare in the region.

Innovation Remains as the Key to Enhancing Market Share among Key Competitors

In 2025, the Pharmaceutical Packaging market featured several key players, including packaging companies specializing in pharmaceuticals. Amcor, Becton Dickinson, Gerresheimer AG, MeadWestvaco, Rexam PLC, West Pharmaceutical Services, Tear and Tape, 3M, Nypro, Schott, Consort Medical, and Ypsomed These companies are expected to maintain their dominant positions during the forecast period from 2026 to 2034. Key strategies for industry leaders will focus on innovation, developing sustainable packaging solutions, and expanding service offerings to cater to the evolving needs of pharmaceutical companies. The market is anticipated to witness intensifying competition and further innovations in pharmaceutical packaging.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Pharmaceutical Packaging market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Material

|

|

Product

|

|

End-Use

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report