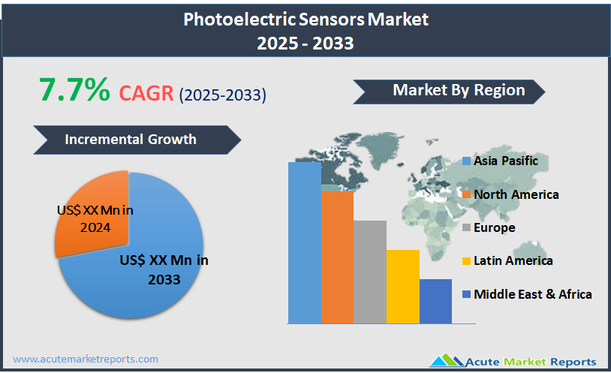

The photoelectric sensors market refers to the sector involved in the production and distribution of photoelectric sensors, devices that use a light transmitter, often infrared, and a photoelectric receiver to detect the presence, color, distance, and size of objects. These sensors are essential components in various automation and industrial applications because they provide non-contact detection of objects, making them highly effective for positioning and differentiating products. Photoelectric sensors are widely used in manufacturing, packaging, material handling, and automotive industries, among others. The photoelectric sensors market is projected to grow at a compound annual growth rate (CAGR) of 7.7%. This growth is driven by the increasing adoption of automation across various industries to enhance efficiency and reduce operational costs. As industries continue to integrate more automated and intelligent systems into their operations, the demand for reliable and efficient sensing solutions like photoelectric sensors intensifies. These sensors are particularly valued for their versatility and precision in monitoring and controlling processes, contributing to improved productivity and safety in manufacturing environments.

Increasing Automation in Manufacturing

A significant driver for the photoelectric sensors market is the increasing automation in manufacturing industries globally. As manufacturers seek to improve efficiency, reduce costs, and increase production output, there is a growing reliance on automation technologies that can accurately and efficiently manage production processes. Photoelectric sensors play a critical role in these systems, providing essential data that help automate complex manufacturing tasks such as material handling, packaging, and quality control. These sensors are favored for their precision and reliability in detecting and measuring various object characteristics without contact, which minimizes wear and tear and prolongs their operational life. The trend towards smarter, more connected manufacturing facilities, often referred to as Industry 4.0, further amplifies the demand for advanced sensing solutions like photoelectric sensors that can seamlessly integrate into networked environments and communicate with other devices to optimize manufacturing operations.

Expansion in Consumer Electronics

An emerging opportunity within the photoelectric sensors market is the expansion of their use in consumer electronics. The increasing sophistication of electronic devices requires more advanced components that can handle complex functions in compact spaces. Photoelectric sensors are used in various consumer electronics to enhance user interfaces and increase functionality through touchless gesture control, precise object detection, and automated adjustments of settings based on ambient conditions. As consumer expectations for smarter, more interactive gadgets grow, manufacturers are incorporating photoelectric sensors to drive innovation in product design, such as smartphones, tablets, and wearable devices.

High Costs of Advanced Sensor Technology

A significant restraint in the photoelectric sensors market is the high costs associated with advanced sensor technology. While the benefits of using photoelectric sensors in terms of accuracy and efficiency are clear, the initial investment required to integrate these advanced sensors into systems can be prohibitive for small and medium-sized enterprises (SMEs). Additionally, the ongoing maintenance and potential need for regular calibration or replacement add to the total cost of ownership, which can deter businesses from adopting these high-tech solutions, particularly in cost-sensitive markets.

Integration and Compatibility Issues

A major challenge facing the photoelectric sensors market is integration and compatibility issues with existing systems. As industries upgrade to more advanced automation technologies, integrating new sensor technologies with older systems can pose significant technical challenges. Photoelectric sensors must be compatible with a variety of communication protocols and operational platforms. Ensuring seamless integration often requires additional resources for system upgrades or modifications, which can complicate deployment and increase costs. Additionally, as these sensors become more sophisticated, the requirement for technical expertise to manage and maintain these systems increases, potentially limiting their adoption in regions where such expertise is not readily available.

Market Segmentation by Type

In the photoelectric sensors market, segmentation by type includes Through-Beam Photoelectric Sensors, Retroreflective Photoelectric Sensors, and Diffused Photoelectric Sensors. Diffused Photoelectric Sensors dominate the market in terms of revenue and are projected to exhibit the highest CAGR. This prominence is due to their versatility and ease of installation in various industrial applications, where space and alignment might be challenging. Diffused sensors integrate both the emitter and receiver in a single housing, making them ideal for applications with limited space and where precise object detection and proximity sensing are required. These sensors are particularly effective in automated manufacturing lines, packaging, and material handling systems, offering reliable detection with minimal setup complexity. Through-Beam sensors, although highly accurate, are generally used in specific applications requiring long-range detection and high levels of reliability, such as in security systems and large-scale manufacturing processes. Retroreflective sensors, which utilize a reflector to return the light beam to the receiver and simplify alignment, also hold a significant market share, particularly in applications where high object reflectivity can be utilized effectively.

Market Segmentation by Range

Regarding range, the photoelectric sensors market is segmented into Upto 100 mm, 100 to 1,000 mm, and Above 1,000 mm. The 100 to 1,000 mm range segment holds the highest revenue and is anticipated to grow at the highest CAGR. Sensors in this range are extensively used across a broad spectrum of industrial applications, from intricate component positioning in assembly lines to object detection in automated warehouses. This range offers the versatility needed for precise operations in both compact and moderately expansive environments, making it suitable for a wide variety of automation tasks that require moderate to long-range detection capabilities without the need for the high precision of shorter-range sensors or the extensive reach of long-range models. This segment's versatility makes it a preferred choice for manufacturers looking to balance cost with performance across diverse applications, driving its rapid growth in the market.

Geographic Segment

The photoelectric sensors market has experienced pronounced geographic trends, with Asia Pacific leading in both the highest revenue and highest CAGR as of 2024. This dominance is driven by the region's robust manufacturing sectors, particularly in China, Japan, and South Korea, where there is a significant emphasis on automation and technological integration into industrial processes. Additionally, the rapid industrialization in Southeast Asian countries, coupled with investments in sectors such as electronics, automotive, and manufacturing, has further bolstered the demand for advanced sensing solutions like photoelectric sensors. North America and Europe also display strong market presence, supported by their mature industrial sectors and ongoing advancements in technologies such as IoT and smart manufacturing, which integrate extensive use of sensors for enhanced operational efficiency.

Competitive Trends

In 2024, the competitive landscape of the photoelectric sensors market was characterized by the activities of key players such as Autonics Corporation, Balluff (Thailand) Ltd, Baumer Group, Eaton Corporation PLC, ifm electronic gmbh, Keyence Corporation, Omron Corporation, Panasonic Industry Co., Ltd., Rockwell Automation Inc., Schneider Electric SE, and SICK AG. These companies focused on technological innovations, strategic expansions, and partnerships to enhance their market positions. They concentrated on developing more advanced, reliable, and accurate sensors that cater to the increasing demands of industries leaning towards automation. Innovations aimed at improving the efficiency, connectivity, and versatility of photoelectric sensors were particularly emphasized, with many firms investing in research and development to push the boundaries of what these sensors can achieve in terms of range and environment adaptability. From 2025 to 2033, these companies are expected to continue their pursuit of innovation, particularly focusing on integrating AI and machine learning technologies to enhance the capabilities of photoelectric sensors further. This integration is anticipated to lead to smarter, more adaptive sensor solutions capable of functioning in increasingly complex and data-driven environments.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Photoelectric Sensors market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Type

| |

Range

| |

Configuration

| |

Application

| |

End-use Industry

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report