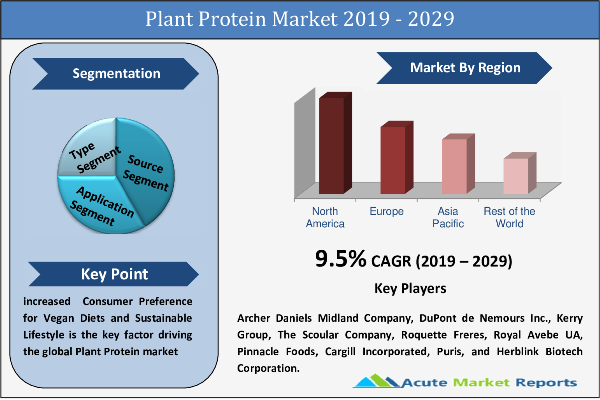

The plant protein market is expected to grow at a compound annual growth rate of 9.5% during the forecast period. Plant protein market growth is being fueled by rising consumer preference for vegan diets and a healthy, sustainable lifestyle. Plant protein is simply a useful source of protein derived from plants. Pulses, tofu, soy, tempeh, seitan, nuts, seeds, some cereals, and even peas fall into this category. Pulses are a broad category of plants that includes chickpeas, lentils, beans (including black, kidney, and adzuki beans), and split peas. Plant proteins are extremely healthy, not only because they are high in protein, but also because they include fiber, vitamins, and minerals. Plant protein is also useful for weight loss in addition to providing the building blocks for healthy muscles and tissues. Plant-based proteins are lower in calories and fat than animal proteins. This report covers all the quantitative and qualitative aspects of the plant protein market and also focuses on key drivers, restraints, challenges, and growth opportunities in the present market, and future prospects.

Vegan Diet and Sustainable Lifestyle Preferences Drive the Market

According to the National Institute of Allergy and Infectious Diseases, eggs, milk, fish, and red meat account for the vast majority of food allergies. Because of animal protein sensitivities, most meat consumers prefer meat alternatives comprised of vegan protein, which boosts the plant protein market. With more attention being paid to the precise forms of protein consumed, consumer interest in plant protein intake is increasing. Protein as a food-nutritional component is in high demand due to increased population and welfare. The high-protein diet trend is gaining popularity and will continue to do so in the future years. Protein's benefits in maintaining a healthy lifestyle have become increasingly well recognized. Plant proteins are gaining popularity as a result of consumer demand for a clean diet, ease of digestion, the requirement or desire to avoid allergens, compatibility with vegetarian and vegan diets, and general concerns about sustainability. As a result, the global plant-based protein market is growing due to increased interest in plant protein ingredients among food manufacturers and foodservice operators.

Soy and Wheat Allergies a Major Concern

In several nations, the Covid-19 epidemic has affected economies and sectors owing to lockouts, travel bans, and industry shutdowns. Food and beverage are one of the largest disruption industries in the course of this emergency, including breakages of the supply chain and shutdowns in the office. Moreover, Soy, along with cow's milk, eggs, peanuts, tree nuts, wheat, fish, and shellfish, is one of the "Big Eight" allergens responsible for 90% of all food allergies, according to the Cleveland Clinic. A soy allergy develops when the human immune system misidentifies the innocuous proteins found in soy as dangerous and generates antibodies to oppose them. Furthermore, soy protein has a high concentration of phytic acid, which can inhibit the absorption of vital minerals like calcium, magnesium, copper, iron, and zinc. Humans may experience itching and hives as a result of soy allergy. Gluten allergy, which is frequent in wheat proteins with similar features, has had an impact on the growth prospects of both protein sources.

Food and Beverage Industry Dominates the Market

The market has been segmented based on the type, source, application, and region. Based on the source segment, the plant protein market is divided into soy, wheat, pea, potato, oat, chickpea, hemp, and algae. The soy source segment held the highest proportion of the plant protein market in 2019. Soy proteins help lower cholesterol levels, enhance metabolism and bone mineral density, and reduce the risk of cancer. Furthermore, they supply vital amino acids for human nutrition. Soy proteins are utilized in a variety of culinary products, including meat substitutes, frozen desserts, soups, salads, non-dairy creamers, breakfast cereals, newborn formula, cheese, whipped cream, pasta, bread, and pet meals. Based on application, the market is divided into food and beverage, animal feed, and supplements. The food and beverage industry dominated the plant protein market. The large share of this segment is mainly attributable to the high demand for sustainable products from consumers, growing awareness of the health benefits of plant protein, increased public health concerns over animal products and ingredients, increased vegan population, and a clean diet.

North America to Lead Global Market

The plant protein market is divided into North America, Latin America, Europe, Asia Pacific, the Middle East and Africa, and the rest of the world based on the regional segmentation. For the year 2019, North America dominated the plant protein market, accounting for more than 37% of the total market share. The region's two largest economies are the United States and Canada, which together account for a significant portion of the market. The demand for alternative protein types that are sustainable and clean, with less environmental impact during production, is driving sales of these proteins in North America. Furthermore, growing awareness of vegan proteins, particularly among adults, is boosting the market growth in the region. To improve the taste, flavor, appearance, and nutritional value of bakery products, meat alternatives, dairy alternatives, processed foodstuffs, confectioneries, drinks, juices, and other products, food and beverage manufacturers in the region are experimenting with using healthy ingredients in the bakery products, meat alternatives, dairy alternatives, processed foodstuffs, confectioneries, drinks, juices, and other products.

Key Players

Major players in the plant protein market are Archer Daniels Midland Company, DuPont de Nemours Inc., Kerry Group, The Scoular Company, Roquette Freres, Royal Avebe UA, Pinnacle Foods, Cargill Incorporated, Puris, and Herblink Biotech Corporation. To stay competitive in the global plant protein market, players have used a variety of marketing methods such as new product launches, growth, joint ventures, and acquisitions. The research includes a complete study of top organizations as well as a discussion of market competition. The major players in the plant protein market use product launch as a major strategy.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Plant Protein market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Type

| |

Source

| |

Application

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report