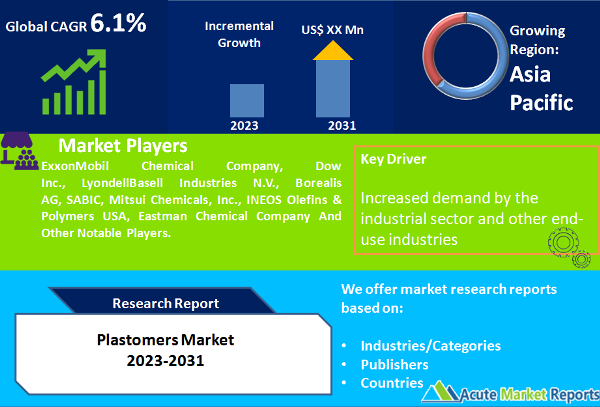

Plastomers are a class of materials that exhibit properties of both plastics and elastomers, which means they have the elasticity and flexibility of rubber but also the strength and durability of plastic. The global plastomers market is expected to grow at a CAGR of around 6.1% from 2026 to 2034. The increasing demand for plastomers in various end-use industries such as packaging, automotive, and healthcare is driving the growth of the market. Plastomers are used in the manufacturing of films, sheets, and injection-molded products, among others.

Increasing demand for sustainable packaging

Plastomers are increasingly being used as a sustainable alternative to traditional packaging materials such as glass, metal, and paper. They are lightweight, flexible, and have good barrier properties, which make them ideal for use in packaging applications. The growing concern over environmental issues and the need for eco-friendly packaging solutions are driving the demand for plastomers in the market. As a result, many companies are investing in research and development to improve the sustainability of plastomers.

Growing demand from the construction industry

Plastomers are also increasingly being used in the construction industry, particularly in the manufacturing of roofing materials and waterproofing membranes. They offer several advantages over traditional materials, such as improved durability, flexibility, and resistance to harsh weather conditions. The growing demand for durable and high-performance building materials is driving the demand for plastomers in the construction industry.

Increasing adoption in the electrical and electronics industry

Plastomers are also gaining popularity in the electrical and electronics industry, particularly in the manufacturing of electrical insulation materials and electronic components. They offer several advantages over traditional materials, such as improved heat resistance, flexibility, and ease of processing. The growing demand for lightweight and high-performance materials in the electrical and electronics industry is driving the demand for plastomers in the market. As a result, many companies are investing in research and development to improve the properties of plastomers for use in electrical and electronics applications.

Environmental concerns and regulations

Despite their advantages, plastomers are derived from petrochemicals, which are non-renewable resources and have a negative impact on the environment. The production and disposal of plastomers can also contribute to environmental pollution and waste. As a result, there is growing concern over the use of plastomers and their impact on the environment. Governments around the world are imposing regulations and restrictions on the use of plastic materials, which could adversely affect the demand for plastomers in the market. For instance, the European Union (EU) has implemented several regulations and policies to reduce plastic waste, such as the Single-Use Plastics (SUP) Directive and the Circular Economy Action Plan. These regulations aim to ban certain single-use plastic products and encourage the use of sustainable alternatives. Similarly, many countries around the world are implementing regulations and taxes on plastic materials to reduce their consumption and promote sustainable alternatives.

Ethylene Butene Dominated the Market by Grade

In 2025 Ethylene Butene held the highest revenue in the plastomers market, accounting for 25% of the total revenue. Ethylene Buteneplastomers offer excellent sealing and barrier properties, making them suitable for use in food packaging applications where oxygen and moisture resistance are important. Additionally, they have low density, which reduces the weight of the packaging material, resulting in lower shipping costs and reduced environmental impact. Ethylene Propylene segment is expected to have the highest CAGR in the plastomers market during the forecast period due to the growing demand for sustainable and high-performance materials across various industries.

The Transportation Segment is expected to Witness the Highest Growth

The transportation segment is expected to witness the highest CAGR in the plastomers market due to several factors. One of the key factors driving the demand for plastomers in the transportation sector is the increasing demand for lightweight materials in the automotive industry. Plastomers are being increasingly used in the manufacturing of various automotive components, such as dashboards, bumpers, and interior trims, due to their lightweight, durable, and cost-effective properties. Moreover, the growing demand for fuel-efficient vehicles and electric vehicles is also driving the demand for plastomers in the transportation sector. Plastomers are being increasingly used in the manufacturing of various components in electric vehicles, such as battery housings and charging ports, due to their electrical insulation properties.

Asia Pacific Remains as the Global Leader and the Growth Leader

In 2025, Asia-Pacific held the largest share of the global plastomers market, followed by North America and Europe. Asia Pacific held the largest market share in the plastomers market due to factors such as a growing population and urbanization, increasing industrialization, favorable government policies, low labor costs, and increasing demand for sustainable packaging solutions. The region's relatively low cost of labor is making it an attractive location for manufacturing activities in the plastomers market, which has resulted in the establishment of several manufacturing facilities in the region. Additionally, the rise of urbanization and infrastructure development is driving demand for plastomers in the building and construction industry. The region's increasing industrialization is driving the growth of the plastomers market in various industrial applications, and many countries in the region have implemented favorable government policies to encourage investment in the plastics and polymer industry. Furthermore, there is a growing trend towards sustainable packaging solutions in the Asia-Pacific region, which is driving demand for bio-based and recycled plastomers.

Market Competition to Intensify During the Forecast Period

The plastomers market has several major players and regional players, including ExxonMobil Chemical Company, Dow Inc., LyondellBasell Industries N.V., Borealis AG, SABIC, Mitsui Chemicals, Inc., INEOS Olefins & Polymers USA, and Eastman Chemical Company. These players are focused on various strategies such as mergers and acquisitions, product launches, and strategic collaborations to expand their market presence and increase their product offerings. For instance, in 2021, Dow Inc. launched its new AGILITY CE Thermoplastic Elastomers (TPEs) for packaging applications. Similarly, SABIC launched a new grade of plastomers and elastomers in 2021 for the healthcare industry. These initiatives demonstrate the intense competition in the plastomers market, and players are striving to innovate and offer cost-effective solutions to their customers while maintaining a competitive edge in the market.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Plastomers market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Grade

|

|

Application

|

|

Molded and extruded products

|

|

End-Use

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report