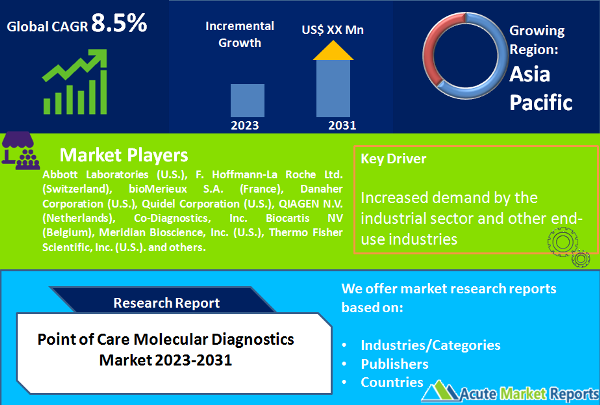

The global market for point-of-care molecular diagnostics is anticipated to expand at a CAGR of 8.5% during the forecast period of 2026 and 2034. The rise of the point-of-care molecular diagnostics market is primarily driven by the increasing prevalence of infectious diseases and cancer, as well as the growing desire of end users for point-of-care molecular testing due to its attractive features. Medical personnel has long utilized molecular diagnostics in laboratories and other healthcare settings. However, the expensive cost of testing, the time-consuming nature, and the delayed findings of molecular diagnostics has encouraged them to seek out alternative diagnostic methods. This has brought the market for molecular diagnostics at the point of care into the limelight. Point-of-care molecular diagnostics has acquired significant traction across end-use verticals, including hospitals and research institutes, due to its ability to cut turnaround time and deliver reliable results quickly. Molecular testing at the point of care enables the rapid and early diagnosis of illnesses in non-laboratory settings. Typically, these tests are administered at the locations of close patients.

A key factor driving the growth of the point-of-care molecular diagnostics market is the increasing adoption of point-of-care molecular diagnostic solutions for the early detection of a wide range of diseases, from respiratory diseases and cancer to sexually transmitted diseases and gastrointestinal disorders. In the future years, the rapid expansion of the molecular diagnostics and molecular imaging markets, fueled by rising health consciousness in emerging nations, will generate possibilities for point-of-care molecular diagnostics producers. In addition, recent advances in microfluidics and genetic sequencing, along with the development of low-cost and speedy point-of-care molecular diagnostic platforms, will increase sales of POC molecular diagnostics devices, thereby growing market for molecular POC tests.

Rising Frequency of Infectious and Malignant Diseases

The rising incidence of infectious diseases and cancer in both developed and emerging regions will favorably impact the growth of the market for point-of-care molecular diagnostics. The increasing frequency of prescriptions for molecular diagnostic tests is attributable to the diagnosis and treatment of such disorders. Demand for point-of-care molecular diagnostics is anticipated to be driven over the projected period by the aforementioned causes and the growing trend toward preventive medicine.

Opportunities For Expansion in Emerging Nations

Emerging economies such as India, South Korea, Brazil, and Mexico present substantial growth potential to market participants in the point-of-care molecular diagnostics sector. This is due to low regulatory hurdles, advancements in healthcare infrastructure, a growing patient population, an increase in the prevalence of infectious diseases, and rising healthcare expenditures. In addition, the regulatory policies of several of these nations are more adaptable and business-friendly than those of developed nations.

Unfavorable Reimbursement Scenario to Limit the Market Growth

Inadequate reimbursements are a major factor inhibiting the growth of the market for molecular diagnostics at the point of care. Getting Medicare and private health insurers to pay for diagnostic testing is a significant obstacle to the commercialization of most diagnostic tests. In 2018, Medicare in the United States updated its funding process for several IVD tests, including point-of-care molecular diagnostics. Several of these tests are billed using unlisted Healthcare Common Procedure Coding System (HCPCS) codes. In such instances, Medicare Administrative Contractors (MACs) establish a payment amount for their respective local governments. CMS cut the Medicare payment rate for COVID-19 tests based on high throughput technology to USD 75 unless laboratories can process findings in less than two days. Medicare does not currently fund genetic testing for those without a cancer family history (Source: American Society of Clinical Oncology).

Infectious Diseases Led the Market by Application

PoC testing in molecular diagnostics has many uses, including testing near the patient in infectious disease management, oncology, hematology, prenatal screening, and endocrinology. In the disciplines of infectious illnesses and oncology, point-of-care (PoC) molecular testing has seen the greatest application-based advancements. In 2025, the infectious diseases segment had the biggest revenue share. Contributing to the revenue share of infectious diseases for rapid molecular diagnostic tests are the provision and facilitation of appropriate antibiotic therapy, faster disease management, enhanced distribution of healthcare laboratory assets, and reductions in mortality and healthcare expenditures.

PCR Based Testing Led the Market by Technology

On the basis of technology, the market for point-of-care molecular diagnostics has been divided into PCR-based, genetic sequencing-based, hybridization-based, and microarray-based tests and devices. In 2025, PCR-based testing generated the greatest revenue share. The market will be driven by the commercialization of point-of-care diagnostics that deliver accurate, rapid real-time PCR analysis for infectious illnesses such as H1N1 and influenza. Due to a number of industry advances, NGS-based molecular testing in close proximity to the patient is expected to have substantial growth during the projection period. Innovative platform modifications that enable genetic sequencing and DNA data processing at the point of care with high precision and give speedy diagnosis contribute to the predicted growth of this market sector. Rapid DNA analysis is anticipated to have substantial growth in the next years as a result of the continuing innovation and R&D efforts of market leaders.

OTC Tests to Dominate During the Forecast Period for Market by Test Site

The market is divided into Proof-of-Concept (PoC) and Over-the-Counter (OTC) tests, depending on the location of the tests. The versatility and portability of OTC tests are superior to POC tests for use in homes and assisted care facilities. The majority of OTC users are untrained professionals and, in the majority of cases, the patients themselves. In addition, a number of these testing instruments are exempt from CLIA, which encourages their use outside of laboratories. Over-the-counter (OTC) tests are anticipated to create more revenue during the projected period due to their usability, accessibility, and higher adoption rate.

Decentralized Laboratories Led the Market by End User

The market is segmented by end-use into decentralized laboratories, hospitals, home care, and assisted living healthcare facilities, among others. In 2025, decentralized laboratories generated the greatest revenue share. The ability of these tests to provide speedy and accurate molecular analysis with a substantially smaller physical footprint than their central laboratory-based equivalents is a crucial driver in the segment's greater revenue share.

APAC to Remain the Fastest-Growing Region

Continuous efforts by big market participants to bolster their market position are a significant contributor to the majority share. In addition, a number of clinical studies examining the efficacy and precision of novel molecular tests are anticipated to contribute to the expansion of the market throughout the forecast period. The growing need for speedy diagnosis and the introduction of innovative molecular diagnostic procedures for DNA analysis has positioned Europe as a significant market niche. Due to a lack of advanced central laboratory testing services, a bigger population base requiring clinical testing, and the potential cost-effective implementation of PoC molecular assays, Asia Pacific is predicted to experience the highest growth rate over the forecast period.

Innovations Remain as the Key to Enhance Market Shares

Abbott Laboratories, F. Hoffmann-La Roche Ltd., bioMerieux S.A., Danaher Corporation, Quidel Corporation, QIAGEN N.V., Co-Diagnostics, Inc. Biocartis NV, Meridian Bioscience, Inc., Thermo Fisher Scientific, Inc., and other notable players. These firms are continually concentrating on the development of innovative point-of-care molecular diagnostic platforms, such as the point-of-care molecular COVID test and paper-based nucleic acid amplification assays, which may diagnose diseases with relative simplicity. In addition, they have utilized techniques such as mergers, acquisitions, and alliances, among others, to increase its global presence.

Key developments:

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Point of Care Molecular Diagnostics market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Product & Service

|

|

Technology

|

|

Application

|

|

End User

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report