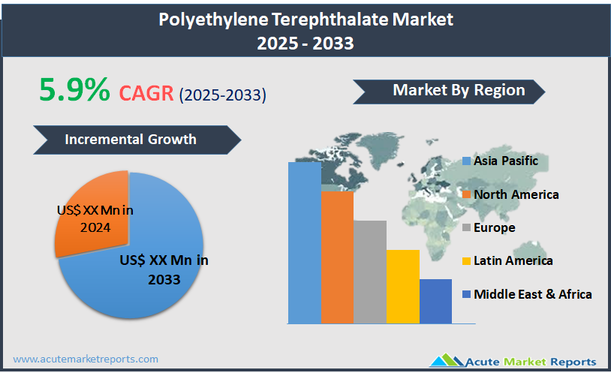

The polyethylene terephthalate (PET) market comprises the production and distribution of PET, a thermoplastic polymer resin of the polyester family. PET is widely recognized for its robustness, clarity, chemical resistance, and suitability for various types of manufacturing processes like extrusion, thermoforming, and injection molding. This resin is extensively used in packaging applications, particularly in the food and beverage industry for bottling soft drinks, water, and other liquids. It is also employed in the production of fibers for clothing, containers for food and cosmetics, and in engineering resins often blended with glass fiber for automotive parts. The global polyethylene terephthalate (PET) market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.9%. This growth is largely driven by the high demand from the packaging industry, which utilizes PET extensively due to its superior properties such as strength, transparency, and recyclability. The market is also benefiting from the increasing consumption of packaged foods and beverages in emerging economies, where urbanization, rising incomes, and changing lifestyles are leading to greater consumption of convenient and processed food products.

Driver: Surge in Demand for Sustainable Packaging Solutions

The primary driver of the polyethylene terephthalate (PET) market is the surging demand for sustainable packaging solutions. PET's high recyclability plays a crucial role in its adoption, as industries and consumers increasingly prefer materials that contribute to environmental sustainability. The food and beverage industry, a major consumer of PET, continuously seeks packaging that combines functionality with minimal environmental impact. PET bottles and containers offer a durable, lightweight, and recyclable packaging option, aligning with global initiatives to reduce the use of single-use plastics. These factors, coupled with the material's ability to be recycled multiple times without significant degradation in quality, enhance PET's attractiveness as a packaging material in efforts to meet both consumer preferences and regulatory requirements for sustainability.

Opportunity: Expansion into Biodegradable PET Alternatives

An emerging opportunity within the PET market is the development and expansion of biodegradable PET alternatives. As the push for eco-friendly materials intensifies, the industry is exploring innovations that include modifying PET to enhance its biodegradability. This advancement could open new markets for PET in sectors that are highly sensitive to environmental impact, such as food services and healthcare, which require both high-performance and sustainable packaging solutions. The integration of biodegradable components into PET formulations is anticipated to cater to the next generation of consumer demands, focusing on sustainability without compromising the material’s inherent attributes like clarity, strength, and barrier properties.

Restraint: Volatility of Raw Material Prices

A significant restraint in the PET market is the volatility of raw material prices, particularly those derived from petroleum, as PET synthesis largely depends on petrochemical derivatives. Fluctuations in oil prices directly impact the cost of producing PET, which in turn affects the profitability of PET manufacturers and the pricing strategies within the supply chain. This volatility can lead to uncertainty in procurement and budgeting for manufacturers who rely on PET for packaging and textile applications. Additionally, geopolitical issues and changes in trade policies can exacerbate price instability, making it challenging for businesses to maintain stable production costs and competitive pricing in the market.

Challenge: Managing PET Waste and Recycling Efficiency

The challenge of managing PET waste and enhancing recycling efficiency remains a significant hurdle for the industry. Despite PET's recyclability, the actual rates of recycling and the efficiency of recycling processes vary widely globally. In many regions, inadequate waste management infrastructure and recycling technologies lead to substantial amounts of PET being disposed of in landfills or incinerated, contributing to environmental pollution and resource wastage. The industry faces the task of improving collection systems, recycling facilities, and technological innovations to increase the yield and quality of recycled PET. This includes addressing the contamination of PET waste streams and developing more effective methods for sorting and processing recycled PET, which are crucial for maximizing the material's lifecycle and supporting the sustainability goals of the industry.

Market Segmentation by Application

The polyethylene terephthalate (PET) market is segmented by application into beverages, films, food packaging, cosmetic bottles, and household products. The beverage segment commands the highest revenue within the PET market, driven predominantly by the extensive use of PET bottles for water, carbonated soft drinks, and other liquid beverages. This segment benefits from PET's excellent barrier properties, which prevent the ingress of gases such as oxygen and carbon dioxide, thus preserving the product's quality and extending its shelf life. PET's lightweight nature also reduces transportation costs and its clear, aesthetic appeal makes it highly desirable for branding purposes. Conversely, the films segment is projected to experience the highest Compound Annual Growth Rate (CAGR) from 2025 to 2033. PET films are increasingly utilized in flexible packaging, electronics, and photovoltaic applications due to their superior mechanical strength, thermal stability, and clarity. The demand for PET films is growing particularly in the packaging of perishable goods and in consumer electronics, where high-performance materials are critical. Innovations in film technology that improve the barrier and mechanical properties of PET films are expected to drive this growth further, catering to evolving industry needs and consumer preferences.

Geographic Segment

The polyethylene terephthalate (PET) market exhibits distinct regional trends, with Asia Pacific dominating in terms of revenue in 2024. This dominance is largely due to high consumption rates in China and India, driven by rapid urbanization, growth in disposable incomes, and increased demand from the food and beverage packaging industries. The region's expansive manufacturing base and favorable government policies supporting industrial growth also contribute significantly to its market leadership. Meanwhile, the Middle East and Africa (MEA) region is expected to display the highest Compound Annual Growth Rate (CAGR) from 2025 to 2033. The growth in MEA is anticipated to be fueled by increasing investments in manufacturing facilities, rising urban populations, and expanding retail sectors which demand high-quality packaging solutions.

Competitive Trends

In 2024, the competitive landscape of the PET market was shaped by key players such as Far Eastern New Century, SK Chemicals, and Indorama Ventures Public Co. These companies focused on expanding their production capacities and innovating in product offerings to meet the growing demand for high-quality PET. Far Eastern New Century led with significant investments in recycling technologies, aligning with global trends towards sustainability. SK Chemicals concentrated on developing specialized PET grades that cater to niche markets, such as high-clarity PET for packaging applications. Neo Group and Octal capitalized on their strategic locations to serve both European and Middle Eastern markets, enhancing their logistical advantages and market reach. From 2025 to 2033, companies like M&G Chemicals and DAK Americas are expected to focus on increasing their operational efficiencies and enhancing their product sustainability to compete in a market that increasingly values environmental responsibility. Key strategies are anticipated to include mergers and acquisitions, as seen with Egyptian Indian Polyester Co. and Jiangsu Sanfanxiang Group Co., aiming to consolidate market positions and expand global footprints. Reliance Industries Ltd. and Dhunseri Petrochem Ltd., known for their scale and integration, are likely to invest in advanced technologies to produce recycled PET, meeting the rising consumer and regulatory demands for sustainable products. Indorama Ventures Public Co. is expected to continue leading in innovation, focusing on creating value-added products that offer better performance and environmental profiles, ensuring their leadership in the global PET market well into the future.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Polyethylene Terephthalate market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Application

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report