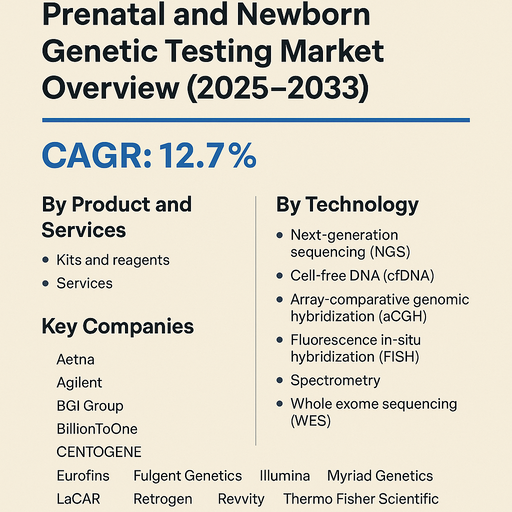

The global prenatal and newborn genetic testing market is projected to expand at a CAGR of 12.7% from 2025 to 2033, fueled by rising demand for early disease detection, advances in sequencing technologies, and growing awareness of genetic disorders. Prenatal and newborn testing enables early identification of chromosomal abnormalities, inherited conditions, and metabolic disorders, facilitating timely interventions and improving long-term health outcomes. Increasing adoption of non-invasive testing methods and integration of genetic testing into routine prenatal care are further supporting market expansion.

Rising Awareness and Technological Innovation Driving Growth

The adoption of next-generation sequencing (NGS), cell-free DNA (cfDNA) testing, and advanced spectrometry techniques is improving diagnostic accuracy and reducing risks associated with traditional invasive methods. Growing emphasis on personalized medicine, coupled with parental awareness about genetic diseases, is pushing demand for both prenatal screening and newborn testing programs. Supportive government initiatives, expansion of insurance coverage for genetic tests, and strategic partnerships between diagnostic firms and healthcare providers are accelerating market penetration.

High Costs and Ethical Concerns Present Challenges

Despite strong growth drivers, barriers such as the high cost of advanced genetic tests, limited access in low-income regions, and ethical debates surrounding prenatal testing continue to hinder adoption. Infrastructural gaps and shortages of trained professionals further limit market reach in developing economies. However, the increasing affordability of sequencing technologies, growing investments in laboratory infrastructure, and expansion of tele-genetics services are expected to reduce these challenges over time.

Market Segmentation by Product and Services

The market is segmented into kits and reagents and services. In 2024, services dominated, supported by growing demand for laboratory-based testing and diagnostic expertise. Kits and reagents are expanding rapidly, driven by the rising trend of decentralized and hospital-based genetic testing solutions.

Market Segmentation by Technology

By technology, the market includes next-generation sequencing (NGS), cell-free DNA (cfDNA), array-comparative genomic hybridization (aCGH), fluorescence in-situ hybridization (FISH), spectrometry, whole exome sequencing (WES), and other technologies. In 2024, cfDNA testing held the largest share due to its non-invasive nature and reliability in detecting chromosomal abnormalities such as Down syndrome. NGS is witnessing strong growth, enabling high-throughput and comprehensive genetic analysis. aCGH and FISH remain important tools for chromosomal and structural analysis, while WES is increasingly adopted for rare genetic disorders. Spectrometry and other technologies continue to support niche diagnostic needs.

Regional Insights

In 2024, North America led the market, driven by strong adoption of advanced genetic tests, favorable reimbursement policies, and leading presence of biotechnology companies. Europe followed, with countries such as Germany, France, and the UK implementing national prenatal and newborn screening programs. Asia Pacific is the fastest-growing region, with China and India showing rising demand due to expanding healthcare infrastructure and government-backed newborn screening initiatives. Latin America and Middle East & Africa are emerging regions, where affordability and access remain challenges but increasing healthcare investments are opening opportunities.

Competitive Landscape

The 2024 market was characterized by a mix of global diagnostics leaders and specialized genetic testing companies. Illumina, Thermo Fisher Scientific, and Agilent led with comprehensive sequencing and molecular diagnostics platforms. Natera, Myriad Genetics, and Revvity specialized in prenatal screening and hereditary condition testing. LabCorp and Eurofins provided broad laboratory-based genetic services across global markets. BGI Group, Fulgent Genetics, Trivitron Healthcare, and Genes2me strengthened regional presence with accessible genetic testing solutions. Companies such as BillionToOne, Yourgene Health, Retrogen, LaCAR, and Genelab (Clevergene) contributed to niche markets with innovative test offerings. Aetna played a supporting role in insurance coverage, increasing test accessibility. Competitive differentiation is driven by accuracy, non-invasive technologies, turnaround time, affordability, and global distribution networks.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Prenatal and Newborn Genetic Testing market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Product and Services

| |

Test Type

| |

Technology

| |

Application

| |

End Use

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report