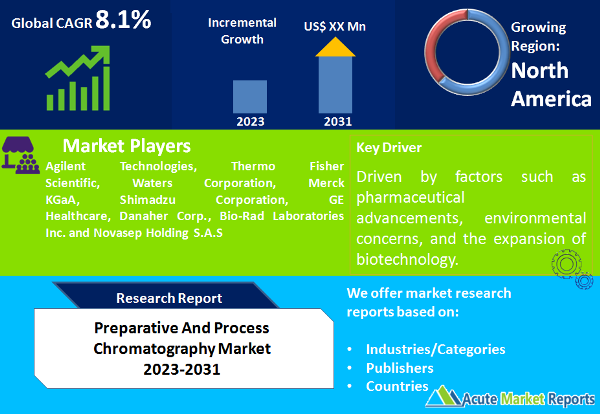

The preparative and process chromatography market is expected to grow at a CAGR of 8.1% during the forecast period of 2026 to 2034. The market has been undergoing significant transformation in recent years, driven by several key factors. The preparative and process chromatography market is poised for robust growth, driven by factors such as pharmaceutical advancements, environmental concerns, and the expansion of biotechnology. As the demand for biopharmaceuticals and high-value chemicals continues to surge, the chromatography market will play a pivotal role in ensuring product quality and purity. While cost and accessibility challenges remain a concern, ongoing technological innovations and strategic initiatives by key players are expected to mitigate these obstacles. Geographically, the Asia-Pacific region is set to experience the highest growth rate, underlining the global nature of the chromatography market. With leading companies consistently striving for product excellence and customization, chromatography solutions will continue to be essential tools for diverse industries, contributing to advancements in healthcare, environmental protection, and materials science.

Pharmaceutical Advancements and Drug Development

The pharmaceutical industry is a major driver of the preparative and process chromatography market. The continuous advancements in drug development, particularly in biopharmaceuticals and monoclonal antibodies, have led to an increasing demand for efficient chromatography techniques. Chromatography plays a crucial role in the purification and analysis of these complex molecules. For instance, as the biopharmaceutical sector expands, the need for large-scale protein purification has grown substantially, driving the demand for preparative chromatography systems. According to the Pharmaceutical Research and Manufacturers of America (PhRMA), in 2025, there were over 9,000 medicines in development worldwide, many of which rely on chromatography techniques for purification and analysis. This represents a significant driver for the chromatography market.

Environmental Concerns and Regulations

The increasing awareness of environmental issues and stringent regulations regarding pollutants and contaminants have fueled the growth of process chromatography in environmental analysis. Chromatography techniques are vital in detecting and quantifying pollutants in air, water, and soil. Additionally, the monitoring of chemical processes and emissions in industries requires accurate chromatographic methods. As governments worldwide impose stricter environmental regulations, the demand for process chromatography in environmental applications continues to rise. The Environmental Protection Agency (EPA) in the United States has been consistently tightening regulations on air and water quality. Compliance with these regulations necessitates advanced chromatography solutions for accurate analysis, creating a robust market for preparative and process chromatography systems.

Biotechnology and Bioprocessing

The biotechnology sector has witnessed remarkable growth, particularly in the production of biopharmaceuticals, vaccines, and biofuels. Preparative and process chromatography systems are indispensable for the purification and separation of biologically derived products. With the increasing adoption of bioprocessing techniques and the expansion of biopharmaceutical pipelines, the chromatography market is experiencing substantial growth. The Biotechnology Innovation Organization (BIO) reported that in 2025, there were over 1,100 biotechnology companies in the United States alone, highlighting the extensive use of chromatography in bioprocessing applications.

Cost and Accessibility Challenges

While the preparative and process chromatography market is poised for growth, challenges related to cost and accessibility can act as significant restraints. High initial costs associated with chromatography equipment, maintenance, and consumables may limit the adoption of these technologies, especially among small and medium-sized enterprises (SMEs) and research laboratories with budget constraints. Additionally, the expertise required to operate chromatography systems effectively can pose a barrier to entry for new users. A study by the American Chemical Society (ACS) revealed that the initial investment for preparative chromatography systems can be substantial, hindering their widespread adoption, particularly in resource-constrained settings. Addressing cost-related challenges is crucial for market expansion. The preparative and process chromatography market is expected to continue its growth trajectory, driven by pharmaceutical innovations, environmental concerns, and biotechnology advancements. However, addressing cost and accessibility issues will be essential to unlock the full potential of this market in diverse applications. In the coming years, advancements in technology and increasing awareness of the benefits of chromatography are likely to mitigate these restraints, fostering market growth.

Market Segmentation by Product (System, Consumables, Service): Systems Dominate the Market

In 2025, the preparative and process chromatography market exhibited diverse product offerings, including systems, consumables, and services. Systems accounted for the highest revenue, driven by the increasing demand for efficient chromatography equipment across industries. However, during the forecast period from 2026 to 2034, consumables are expected to demonstrate both the highest revenue and the highest compound annual growth rate (CAGR). This growth can be attributed to the recurrent need for chromatography consumables such as columns, resins, and filters, as chromatography processes require constant replenishment of these components. Additionally, the service segment is also expected to grow steadily due to the rising requirement for maintenance, technical support, and expertise in chromatography system operation.

Market Segmentation by Type (Liquid Chromatography, Gas Chromatography, Thin Layer Chromatography, Paper Chromatography, Gel-permeation Chromatography, Hydrophobic Interaction Chromatography): Liquid Chromatography Dominates the Market

The preparative and process chromatography market is segmented by type, with liquid chromatography being the dominant technique in 2025. This is attributed to the versatility and widespread applicability of liquid chromatography in various industries, particularly in pharmaceuticals and biotechnology. However, during the forecast period from 2026 to 2034, hydrophobic interaction chromatography is anticipated to exhibit both the highest revenue and the highest CAGR. This growth is driven by its effectiveness in separating hydrophobic molecules, making it essential in the purification of biopharmaceuticals and biomolecules.

North America Remains the Global Leader

Geographically, North America held the largest share of the Preparative And Process Chromatography Market in 2025. This dominance is primarily driven by the concentration of pharmaceutical and biotechnology industries in the region, as well as stringent regulatory standards necessitating advanced chromatography techniques. However, during the forecast period, the Asia-Pacific region is anticipated to witness the highest CAGR. The growth in Asia-Pacific is propelled by the expansion of biopharmaceutical manufacturing, increasing research and development activities, and a burgeoning pharmaceutical industry in countries like China and India.

Market Competition to Intensify during the Forecast Period

The preparative and process chromatography market features a competitive landscape with several key players dominating the industry. Prominent companies operating in this market include Agilent Technologies, Thermo Fisher Scientific, Waters Corporation, Merck KGaA, Shimadzu Corporation, GE Healthcare, Danaher Corp., Bio-Rad Laboratories Inc., Novasep Holding S.A.S and among others. These companies have been at the forefront of innovation, consistently introducing advanced chromatography systems and consumables to cater to the evolving needs of end-users. Leading companies focus on continuous research and development to introduce innovative chromatography systems and consumables. By staying at the forefront of technology, they address the evolving demands of the pharmaceutical, biotechnology, and environmental sectors. Many major players collaborate with research institutions and academic organizations to develop cutting-edge chromatography solutions. Collaborations enable knowledge sharing and access to novel technologies.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Preparative And Process Chromatography market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Product

|

|

Type

|

|

End-Use

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report