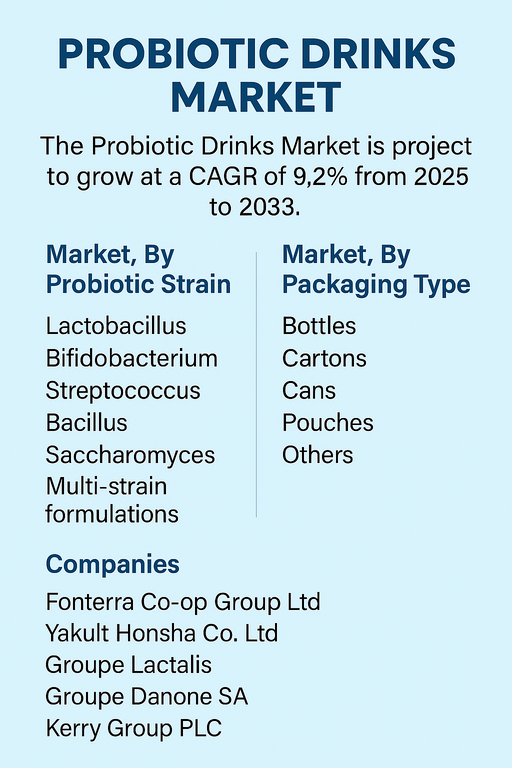

The probiotic drinks market is projected to grow at a compound annual growth rate of 9.2% during the forecast period of 2025 to 2033. This robust growth is driven by surging consumer interest in functional beverages that not only quench thirst but also deliver proven health benefits. Probiotic drinks have evolved from a niche health supplement into mainstream packaged beverages consumed by a broad demographic. Increased awareness of gut health, immunity support, and nutritional wellness among consumers is creating strong demand across both developed and developing markets. The popularity of probiotic drinks is being further amplified by expanding retail channels, sustained new product innovation, and heightened marketing focus on digestive wellness and holistic health. The continuing rise in preventive healthcare spending and a shift toward self-care among consumers contribute significantly to the expansion of the market. Younger consumers, especially millennials and Gen Z, who value convenience and wellness, have embraced probiotic drinks as part of their daily routine. Retailers and beverage companies are responding to this trend by making these drinks readily available in a range of sizes, flavors, and formulations, including low-sugar and organic variants. Furthermore, beverage companies are investing in research and technology to improve the probiotic profile, optimize flavor, and enhance shelf-stability without losing the health benefits, which further enhances the category’s commercial viability.

Market Drivers

A key growth driver for the market is the growing recognition of gut health as central to overall well-being. Continued research linking gut microbiome balance to immunity, mental health, and chronic disease prevention is spurring consumption of probiotics. Consumers have become increasingly aware that a healthy gut supports not only digestion but also energy levels, immunity, and even skin health. This greater knowledge of probiotics, fueled by both healthcare professionals and wellness influencers, is encouraging consumers to incorporate these drinks into their daily diet. The willingness of consumers to spend on premium health-focused beverages is also underlining the market’s upward trajectory. Companies have responded by launching products tailored to specific health needs, such as immunity-boosting, digestive-soothing, or protein-enriched variants.

Additionally, rapid urbanization and rising disposable incomes in Asia, Latin America, and the Middle East have enabled consumers to experiment with novel beverage formats and embrace packaged drinks that offer functional benefits. This is complemented by the ongoing growth of e-commerce and subscription models, which are making these beverages more accessible. The combination of convenient online availability, effective influencer marketing, and aggressive promotional campaigns is enhancing visibility for probiotic drinks across multiple consumer segments.

Market Restraint

Despite these strong drivers, the probiotic drinks market faces some notable barriers that could impact future adoption rates. One significant challenge is the comparatively higher cost of probiotic drinks due to the specialized strains, fermentation processes, and refrigerated logistics that must be maintained to preserve the drinks’ efficacy. Furthermore, the need for temperature-controlled supply chains can restrict distribution, especially in rural and price-sensitive markets. Shelf-life limitations and the perception that probiotics may lose potency over time also present hurdles that can discourage new consumers from trying these products. Addressing these challenges requires ongoing research into more stable probiotic strains and affordable cold-chain solutions that can support wider adoption without compromising product effectiveness.

Market Segmentation by Probiotic Strain

Among different types of probiotic strains, Lactobacillus-based drinks continue to hold a substantial share due to their recognized digestive benefits and long-standing use in traditional fermented beverages. Meanwhile, Bifidobacterium-based drinks have witnessed rapid demand, driven by their proven effectiveness in supporting gastrointestinal health and immunity across all age groups. Streptococcus-based formulations cater to consumers looking for improved gut immunity and resistance to common infections. Bacillus strains are appreciated for their high survivability through manufacturing and gastrointestinal transit, allowing stable probiotic drinks with an extended shelf-life. Saccharomyces-based drinks are also witnessing interest owing to their unique ability to help restore gut flora following antibiotic therapy. Multi-strain formulations have emerged as a promising growth area, as consumers are increasingly attracted to drinks with diverse, complementary probiotics that deliver broad-spectrum health benefits across the gut ecosystem.

Market Segmentation by Packaging Type

When analyzing packaging types, bottles continue to generate the highest demand owing to their visual appeal, portability, and consumer convenience, especially for on-the-go consumption. Cartons also maintain a substantial share because of their cost-effectiveness and suitability for family-sized servings that encourage habitual consumption at home. Cans have begun to grow steadily, especially in premium and craft probiotic beverages marketed to a younger demographic that appreciates modern, visually engaging packaging. Pouches also present a promising opportunity as they offer lightweight, travel-friendly options and reduce packaging waste. Other innovative options like tetra packs and specialty glass containers cater to more premium or sustainable-focused consumers and help brands diversify their product portfolio.

Geographic Trends

Asia Pacific holds the largest share of the probiotic drinks market and is expected to register the highest CAGR between 2025 and 2033. This region benefits from long-established consumption of fermented drinks, high awareness of gut health, rapid urbanization, and increasing disposable incomes across China, India, Japan, and Southeast Asian countries. North America follows closely owing to the well-developed health and wellness industry, rising per capita spending on functional beverages, and strong retail penetration across supermarket chains, health stores, and online channels. Europe’s stable growth is driven by strong product innovation, stringent quality standards, and robust demand in countries such as Germany, France, and the United Kingdom. Latin America and the Middle East & Africa present emerging opportunities as health trends gradually penetrate these markets, with improving cold-storage infrastructure and expanding retail channels encouraging increased consumption.

Competitive Trends

The competitive landscape is marked by the strong presence of established global companies with robust research and marketing capabilities. Major players like Fonterra Co-op Group Ltd, Yakult Honsha Co. Ltd, Groupe Lactalis, Groupe Danone SA, and Kerry Group PLC lead the market by continuously launching new products formulated with clinically proven probiotic strains. These companies leverage deep expertise in fermentation and dairy technology to innovate across different formats and flavors that cater to diverse regional preferences. Competitors also focus on product claims related to gut health, immunity, and even mental well-being to capture a larger health-conscious customer base. Going forward, strategic partnerships with nutrition scientists, collaborations with retail giants, aggressive promotional campaigns, and the integration of personalized digital health tools will be key to market leadership. Smaller brands and niche players contribute by targeting specialty segments like vegan probiotics, dairy-free drinks, or organic, clean-label beverages, further enriching the competitive landscape. The rapid pace of innovation, sustained R&D investments, and a shared commitment to functional health will continue to shape the dynamics of this market through 2033.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Probiotic Drinks market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Product Type

| |

Probiotic Strain

| |

Packaging Type

| |

Target Consumer Group

| |

Consumption Occasion

| |

Price Segment

| |

Distribution Channel

| |

Sales Channel

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report