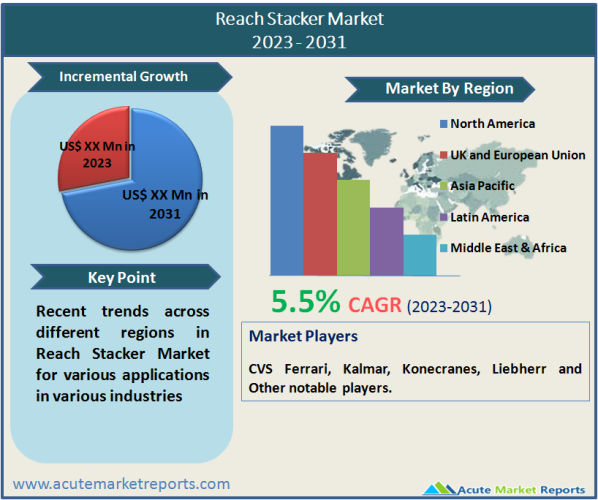

The global reach stacker market is expected to grow at a CAGR of 5.5% during the forecast period of 2026 to 2034. Hence, as a result of the increased global mobility of products and commodities. This will undoubtedly raise the demand for reach stackers in a variety of sectors and ports. Major producers of material handling equipment are spending to expand the load capacity of reach stackers. Nonetheless, the development of electric and hybrid reach stackers is projected to stimulate the global reach stacker market. The constant flow of commodities and things supports the modern world. With the increasing efficacy of data-driven logistics, the importance of rapid, safe, and accurate container handling in ports and terminals has increased. This makes it even more difficult to envision a seaport without a reach stacker, which can lift and move tens of thousands of containers every day. Emerging technologies, such as GPS and automated material handling equipment, as well as biometrics, are shaping the future of logistics in the logistics business, which is through a continuous period of fast change. Increasing investments in the quality and size of ports by various nations are predicted to increase port storage capacity. The introduction of autonomous and semi-autonomous reach stackers is anticipated to propel the reach stacker market globally. The global reach stacker market is projected to be propelled by the expansion of ports and the expansion of trade between developing nations. During the projection period, the demand for reach stackers is anticipated to be driven by an increase in the number of containers at ports and the number of worldwide companies using container handling equipment. The increasing popularity of online shopping has raised warehouses' demand for sophisticated material-handling equipment. Increasingly, e-commerce and third-party logistics organizations on the market are deploying reach stackers in warehouses and distribution centers to organize product storage.

Demand for Material Handling Equipment is Rising to Improve Warehouse Productivity

As a result of a number of free trade accords, including NAFTA, AFTA, and TPSEP, the global trade volume has increased exponentially over the past few decades. One of the key reasons anticipated to drive the expansion of the worldwide reach stacker market in the coming years is the rise in seaborne trade. The demand for material handling equipment such as reach stackers continues to increase as a result of the booming e-Commerce sector, the significant growth in the activity across seaports worldwide, the booming industrial sector in developing regions, and the increasing emphasis on promoting economic growth.

The market for material handling equipment has expanded rapidly over the past decade as a result of technological developments and significant improvements in the application of various engineering principles. Current reach stacker market participants are progressively emphasizing the creation of customized reach stackers to meet the needs of customers in a variety of industries. In order to acquire a competitive advantage over the projected period, market participants operating in the current environment are also likely to focus on enhancing the efficiency and quality of their products.

The global market for reach stackers is predicted to cross $600 million by the end of 2034 as a result of several factors: increasing commerce, rising seaborne trade, and increasing demand from the industrial sector.

Demand for Warehouse Applications Drives Market Expansion

Despite the fact that the need for reach stackers for warehouse applications is anticipated to remain predominant, the demand from seaports and terminals has exhibited a constant increase over the past few years – a trend that is anticipated to gather speed over the assessment period. Due to the explosive growth of the global e-commerce industry in recent years, warehouse management has steadily garnered a great deal of attention. The deployment of reach stackers has increased significantly in warehouses to ensure optimal efficiency, workflow, and production. This aspect is anticipated to boost the global market for reach stackers throughout the forecast period. As their name implies, reach stackers are primarily intended for reach and stack applications where the usage of traditional forklifts is restricted due to their height and reach. Reach stackers continue to have a favorable impact on the warehouse storage fleet and provide a practical solution for warehouse applications requiring material reaching and stacking. In addition, as reach stackers offer the added benefit of operating in short aisles and reaching heights of up to 14 meters, their use continues to increase. Side loaders, pallet jacks, cranes, and turret trucks are among the most commonly employed reach stackers. The demand for hybrid and electric reach stackers is on the rise due to rising environmental concerns and a changing regulatory landscape.

Seaborne Commerce Escalates

Shipping continues to be the lifeblood of the global economy, with the international shipping industry responsible for 90% of worldwide trade. According to UNCTAD statistics, worldwide maritime trade is rising at a faster rate of 4%. In recent years, handling equipment utilized in harbors and seaports has garnered considerable attention. This is due to the fact that shipping is the basis for intercontinental trade, large-scale transportation of raw materials, and import/export of reasonable food and manufactured goods. Seaborne trade continues to flourish, offering benefits to global consumers through competitive freight prices. This escalating volume of maritime commerce has boosted the demand for container handling technology that can function precisely and quickly even in the most congested seaports.

Innovation at Full Power

Manufacturers of reach stackers have turned their focus to producing highly-featured variations, as businesses increasingly gravitate toward innovative and technologically-driven solutions for varied applications. Numerous market participants, for instance, provide reach stacker tool changer attachments that let operators effortlessly switch between a steel slab handler, a c-hook coil handler, and a container spreader, therefore enhancing the equipment's multitasking capabilities.

Automation - A Promising Path to Market Expansion

As sea-borne trade continues to gain speed and create a demand for highly efficient operations at seaports, automation is making further inroads into port equipment. Moreover, a number of manufacturers of reach stacks are investing in modern technology, such as automation, to profit from the rising need for the rapid and effective handling of containers of varied sizes. The increasing emphasis of manufacturers on adopting automation to create highly efficient and real-time reach stackers is projected to positively influence the market's growth.

Dual Integrated Solutions Ahead

In response to the increasing demands of end customers for container handling equipment, numerous market participants are emphasizing the integration of dual solutions into their offers. They are emphasizing the production of hybrid variations that can transport and unload containerized bulk cargo with a single piece of equipment. Special connection features that enable the driver to move the machine, lift containers, and rotate them are likely to become a game-changing manufacturing feature that will attract a large number of port machinery handlers in the coming years.

KEY MARKET RESTRAINTS

Although the market for reach stackers continues to increase at a steady rate, a number of factors continue to impede the expansion of market participants. High initial investment and operational expenses of reach stackers continue to push end customers to rent rather than buy this container handling equipment. As an increasing number of end users see the economic benefits of renting expensive equipment rather than purchasing it, sales of reach stackers are extremely likely to decline. Several manufacturers in the reach stacker industry are utilizing cutting-edge technology to develop eco-friendly models that can effortlessly lift and transport even the heaviest containers without sacrificing maneuverability.

Hyster Europe, for instance, has stated that it is developing a zero-emission reach stacker with a hydrogen fuel cell for the Port of Valencia as part of the H2Ports project and the European Horizon 2021 initiative. In addition, several market participants are experimenting with permutations and combinations to minimize the equipment's overall price.

Electric Reach to Dominate the Market by Propulsion During the Forecast Period

Carbon emissions and climate change have emerged as a possible concern for the governing bodies of the world's leading industrialized and developing nations. The transportation industry is a significant contributor to greenhouse effects, accounting for around 24% of worldwide carbon dioxide emissions. In order to reduce carbon emissions from the transportation industry, large-scale deployment of technology with low or zero carbon emissions is necessary. Alternative fuel vehicles (AFV) offer significant energy-sustainable transportation and emerged as a viable innovation to address the issue in relation to zero carbon emission technologies. In the logistics and products services industry, which accounts for a significant portion of the U.S. gross domestic product, zero-emission vehicles are actively pursuing chances to electrify the entire ecosystem. In July 2026, for instance, the Swedish port of Helsingborg will order its first electric Kalmar reach stacker. The electric reach stacker has a wheelbase of 6.5 meters and is powered by a 587 KWh battery pack. Additionally, the equipment is available with lifting capacities of 45, 32, and 16 tons. With the expansion in international trade, the capacity of the current ports and the demand for the creation of additional ports continue to be the government's primary concern. In order to meet the demand, governments are planning properly and allocating funding for the expansion of current ports as well as the creation of new ports as part of numerous programs. Considering these developments and considerations, it is anticipated that demand for electric reach stackers would remain on an ascending trend.

Maritime Ports and Terminals to Dominate the Market by Application

On the basis of application, maritime ports and terminals represented the largest proportion of the worldwide reach stacker market. Rapid port expansion and a big number of new installations are projected to boost the reach stacker industry.

APAC to Remain as the Global Leader

Despite the ongoing trade war between the world's two largest economies, the United States and China, trade exports to other regions of the globe were in high demand and kept the region's ports active. During the projected period, it is anticipated that trade tensions between these two nations would subside, and commerce will return to normal, hence accelerating export volumes from the region. The region accounts for around 40% of the world's overall trade volume. Governments in the region are investing actively with an eye toward the future in order to create high-capacity ports and preserve the environment.

There are 34 main ports and 2,000 minor ports in China that are extending the country's commerce route. The economic and historical contributions of several of these ports to global commerce volumes make them globally significant. In addition, 158 ports located on the eastern and southern shores of China play a pivotal role in import-export operations. The Chinese government is boosting the development of world-class ports. With the ambitious goal of achieving breakthroughs in the green, smart, and safe development of major ports by 2026, regional and other ports will be expanded. By 2035, major ports should reach world-class status, and by 2050, multiple clusters of world-class ports with leading development levels should be established.

In India, which is also a rapidly developing nation, more than 90% of trade by volume is conducted via the country's maritime route; therefore, there is an ongoing need to develop India's ports and trade-related infrastructure to support the 'Make in India' initiative and accelerate growth in the manufacturing sector. There are thirteen major ports in the country that collectively handle the majority of cargo and container traffic. In addition, the ports of Kandla, Mumbai, Mangalore, Mormugao, JNPT, and Cochin are located on the west coast. Comparatively, the ports of the east coast are located in Chennai, Visakhapatnam, Tuticorin, Kolkata, Paradip, and Ennore.

The region's rising need for material handling and transportation services is fueled by the increasing number of ports in the area. The leading operators in the region are producing new, clean, and efficient fuel equipment for the region's ports in order to reduce carbon footprints while simultaneously enhancing output efficiency. Kalmar has announced that three Eco reach stackers would be supplied to North China Yantai Port in June 2026 to improve the port's overall efficiency, financial stability, and sustainability. The Yantai Port is located in the northern portion of the Shandong Peninsula, a crucial node on the maritime silk route of the twenty-first century. Additionally, since the 1990s, Kalmar and Yantai Port have continuously maintained longer-term working connections. In light of this development, the Asia-Pacific region is anticipated to experience a rapid growth rate for reach stackers over the forecast period.

Market Consolidation to Restrict New Entrants

The Reach Stacker Market is monopolized by a small number of dominant market participants. CVS Ferrari, Kalmar, Konecranes, Liebherr, and others are some of the leading firms in the Reach Stacker Market. Key players on a worldwide scale are growing their footprint through mergers and acquisitions with many industry participants. Cargotec Corporation and Konecranes Plc inked a combination agreement and merger plan on October 1, 2021, to unite the two firms into the Future Company. The Future Company is anticipated to be a global leader in sustainable material flow with a customer-centric focus. To achieve significant market share, the biggest businesses in the country are forming a strategic collaboration with global giants. For example,

Due to the changing industrial and regulatory environment, industry participants in the present reach stacker market are pushed to diversify their product offerings and provide customized solutions to their end users in order to maintain a competitive advantage. As an example, Konecranes announced the release of the first-of-its-kind hybrid reach stacker, which is anticipated to comply with emission regulations, increase productivity, reduce fuel consumption, and enhance operator performance. Similarly, in September 2021, XCMG will debut an electric reach stacker equipped with a maintenance-free battery, a smart power management system, and energy recycling technology in response to the growing emphasis on reducing carbon emissions.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Reach Stacker market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Capacity

|

|

Propulsion

|

|

Application

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report