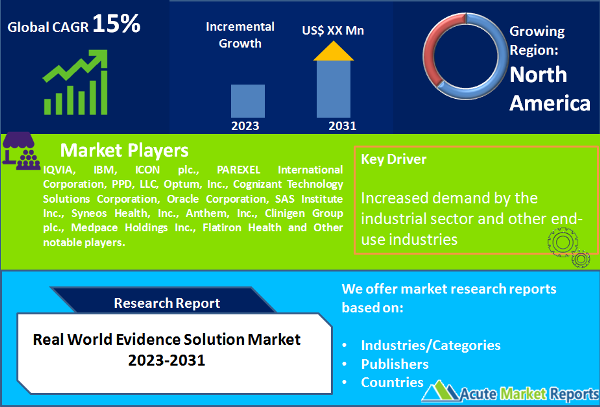

The global market for real-world evidence solutions is expected to grow at a CAGR of 15% during the forecast period of 2025 to 2033. This market's expansion is primarily driven by the primary factors driving the growth of this market are the expansion of clinical trials and the change from volume-based to value-based treatment. Utilizing RWE and RWD can improve protocol design, hence reducing the number of costly protocol changes, and enabling the creation of synthetic control arms to speed up trial execution and save expenses. Similarly, RWE can expedite label expansion and reduce the overall cost of filing-required documentation. Due to these benefits, the adoption of RWE systems in drug and medical device research and development is increasing. Support from regulatory bodies for the use of Real-World Evidence (RWE) solutions and a rise in R&D expenditures are expected to stimulate market growth. In addition, the shift from volume-based to value-based care is anticipated to contribute to the rise. As a result of the COVID-19 pandemic, numerous market participants began to experience widespread business disruptions, which hindered routine corporate operations.

Increased Investment in Research and Development

The majority of pharmaceutical, biopharmaceutical, and medical device businesses continue to make substantial investments in the development of novel medications and technologies. Particularly, the pharmaceutical business is heavily invested in R&D. To meet the demands of both drug discovery and development, pharmaceutical and biopharmaceutical businesses are opting for fully integrated or functional outsourcing services, from the early development phase to the late-stage development phase, due to increased R&D expenditures. The pharmaceutical industry spends the highest proportion of its income on research and development compared to all other industries. This increase in R&D spending, spurred by the requirement for multiple preclinical and clinical services during the drug development process, is anticipated to fuel the expansion of the RWE market.

Medical Practitioners and Academics' Reluctance to Rely on Real-World Evidence Solutions

Despite the widespread use of RWE across applications, certain stakeholders continue to be hesitant to rely on real-world evidence. For instance, although payers have begun using RWE, they prefer to base drug coverage decisions on randomized clinical trials (RCTs) rather than external observational data. The primary reason for this preference is the provision of numerous standards and methodologies for examining clinical experience evidence derived from actual patient care. In addition, payers utilize a wide range of procedures and evidence when determining pharmaceutical coverage. During the pharmaceutical technology assessment (PTA) procedure, these differences can impact reimbursement, patient access, and potential healthcare outcomes. Therefore, stakeholders are hesitant to use evidence without a standardized data-gathering strategy.

Increased Emphasis on RWE's End-To-End Services

As players in the healthcare business seek innovative solutions to address the unsustainable cost burden and relatively low return on investment, the healthcare ecosystem is transforming, and there is a growing focus on healthcare costs. To demonstrate value, businesses require robust capabilities in evidence lifecycle management. Consequently, an opportunity for an end-to-end approach to leverage the data, evidence, and knowledge assets of a life sciences organization has been created, which is aiding in the dismantling of conventional silos and enabling insight-driven decision-making from the product R&D phase to its commercialization. This entails creating an effective governance plan and using technologies like cloud and self-service analytics, as well as acquiring the capacity to integrate data sets and comprehend the relevant resources for the required analytics (and tactical issues around data access and quality).

Absence Of Globally Acknowledged Methodology Standards and Data Processing Infrastructure

In this sector, the lack of globally agreed standards or principles that may be used in the design, analysis, and reporting of RWE has become a serious obstacle. This lack of unanimity has resulted in RWE not being of sufficient quality to be included in the body of evidence used to compare the efficacy of various treatment approaches. This has decreased the potential value of the produced information, hence decreasing the incentive to produce it. This further diminishes the likelihood that significant stakeholders will use RWE solutions.

In 2024, The Services Category Dominated the RWE Solutions Market

The rising requirement to translate data into actionable evidence and the availability of a vast quantity of healthcare data are the primary reasons driving the expansion of this market sector. Clients can save time and money by relying on vendors to tailor their services to their specific needs, as opposed to acquiring data sets and analyzing them to generate valuable information. Consequently, the demand for RWE services is greater than that for RWE data sets. Experts in RWE communicate and work with the subject matter expert of pharmaceutical and medical device firms to provide services to establish intelligent RWE plans (consulting services) and employ analytical capabilities to provide significant statistical insights.

In 2024, The Drug Development and Approvals Segment Led the RWE Solutions Market

Due to the increasing number of clinical studies in oncology and cardiovascular medicines, the drug development and approvals market segment is the most significant. In addition, post-pandemic treatment advancements for the COVID-19 infection had a substantial increase. This division is further subdivided into oncology, cardiovascular disease, neurology, immunology, and other therapeutic fields. Due to the rising incidence of cancer and the growing number of clinical trials and research focusing on cancer treatment and prevention, the oncology segment leads the market.

Pharmaceutical And Medical Device Firms Are Anticipated to be The Fastest Growing End Users Segment

The rapid rise of pharmaceutical and medical device firms is attributable to the growing significance of RWE studies in medication approvals, the prevention of costly drug recalls, and the evaluation of therapeutic performance in real-world contexts. In addition, the pharmaceutical industry's use of RWE continues to rise due to its application in addressing regulatory compliance requirements and payer obligations connected to HEOR. Pharmaceutical businesses demand information detailing both the approved and medically acknowledged alternative uses for previously approved medications. For novel medications to effectively progress through clinical phases, RWE data is required. Therefore, the successful phase transition is contingent upon robust real-world results.

North America remains the Global Leader, and APAC is the Growth Leader

North America held the greatest share of the RWE solutions market, while Asia-Pacific is anticipated to maintain the highest growth rate over the forecast period. Supporting the growth of the RWE solutions market in the Asia Pacific region are factors such as the rising number of clinical trials, increasing government initiatives for the adoption of RWE studies, the rising incidence of chronic diseases, the rising demand for better healthcare services, and the rising geriatric population. Moreover, nations such as Japan and China in the region have a well-established clinical trial infrastructure, a strong medical workforce, solid healthcare capabilities, and high-quality requirements, all of which contribute to the growth of the market in the Asia Pacific.

Market Competition to Intensify During the Forecast Period

The worldwide market is highly fragmented and competitive. Through subsidiaries and partnerships, market participants implement strategic initiatives such as product development and launch, distribution network expansion, and global footprint expansion. In addition to portfolio diversification and mergers & acquisitions, key players engage in portfolio diversification and mergers & acquisitions. For example, in August 2021, Syneos Health teamed with Aetion to develop a solution based on real-world evidence and to give analytically-driven data and regulatory-grade data. Similarly, Thermo Fisher Scientific announced in April 2021 that it will purchase PPD, Inc. for USD 47.50 per share. The key companies that are active in the market include IQVIA, IBM, ICON plc., PAREXEL International Corporation, PPD, LLC, Optum, Inc., Cognizant Technology Solutions Corporation, Oracle Corporation, SAS Institute Inc., Syneos Health, Inc., Anthem, Inc., Clinigen Group plc., Medpace Holdings Inc., Flatiron Health and Other notable players.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Real World Evidence Solution market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Component

| |

Application

| |

End User

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report