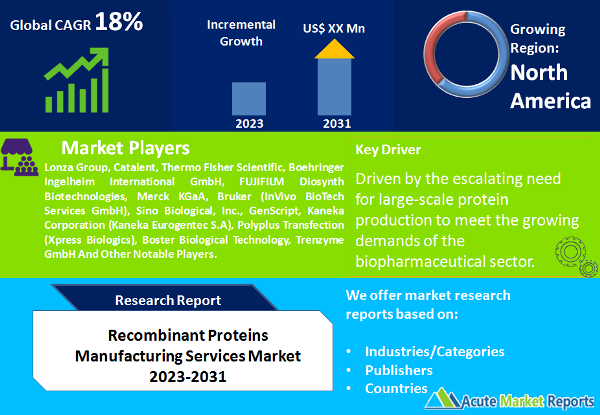

The recombinant proteins manufacturing services market is expected to grow at a CAGR of 18% during the forecast period of 2026 to 2034, recombinant proteins manufacturing services market plays a pivotal role in the biotechnology sector, providing essential support for research, diagnostics, and therapeutic developments. The recombinant proteins manufacturing services market occupies a central position within the biotechnology domain, supporting the development of groundbreaking therapies and facilitating academic research globally. Key drivers, including biopharmaceutical advancements, the proliferation of academic research, and substantial global biotech investments, continue to propel the market forward. However, the challenge of navigating complex regulatory compliance standards remains a potential impediment, warranting ongoing vigilance and investment in quality assurance. As the market advances from 2026 to 2034, the demand for commercial production services is projected to surge, driven by the escalating need for large-scale protein production to meet the growing demands of the biopharmaceutical sector. The pharmaceutical and biotechnology sector is expected to dominate in terms of revenue, underscoring the critical role of recombinant proteins manufacturing services in advancing therapeutic innovations. While North America is poised to remain a key player, the Asia-Pacific region is set to experience the highest growth rate, reflecting the global reach and potential of this dynamic market. In this fiercely competitive landscape, industry leaders are well-positioned to adapt and innovate, meeting the evolving needs of the biotechnology sector, and nurturing continued growth in the recombinant proteins manufacturing services market.

Perpetual Biopharmaceutical Advancements

The recombinant proteins manufacturing services market remains buoyant thanks to the ceaseless progress in the field of biopharmaceuticals. Biopharmaceutical companies continuously expand their pipelines, emphasizing protein-based therapies, which inevitably fuels the demand for specialized manufacturing services. Throughout 2026, the biopharmaceutical sector witnessed a remarkable surge in research and development endeavors, greatly stimulating the demand for recombinant proteins. Noteworthy breakthroughs encompassed innovative therapies like monoclonal antibodies and gene therapies.

Flourishing Academic Research Applications

The integration of recombinant proteins into academic research continues to flourish. Research institutions across diverse disciplines, from molecular biology to neuroscience, increasingly adopt these proteins, amplifying the market's growth. It is anticipated that from 2026 to 2034, academic and research institutes will further intensify their utilization of recombinant proteins. Collaborative research initiatives and augmented grant funding are set to catalyze the market's expansion.

Global Biotech Investment Surge

The biotechnology sector consistently attracts substantial investments on a global scale. Established biotech giants and agile startups secure funding to propel their research and development initiatives, driving the demand for recombinant protein manufacturing services. Projections indicate that investments in the biotech industry will soar to unprecedented heights from 2026 to 2034. A significant share of these investments will be funneled into the development of novel therapies and vaccines, invigorating the demand for recombinant protein production services.

Navigating Regulatory Compliance

Navigating the intricate labyrinth of regulatory compliance stands as a formidable challenge for companies operating in the recombinant proteins manufacturing services market. Adhering to evolving regulatory standards and guidelines necessitates substantial investments in quality control and assurance. From 2026 to 2034, it is projected that companies offering recombinant proteins manufacturing services will grapple with intricate regulatory compliance requirements. Meeting these stringent standards will demand investments in rigorous quality control measures, potentially impacting profit margins.

Market Segmentation by Service: Commercial Production Services Dominate the Market

The recombinant proteins manufacturing services market offers a spectrum of services, including pre-clinical and clinical services, as well as commercial production services. In 2025, commercial production services are poised to dominate both in terms of revenue and demand, driven by the escalating need for large-scale protein production. From 2026 to 2034, the demand for commercial production services is anticipated to experience a significant surge. This upswing will be attributed to the development and manufacturing of biopharmaceuticals, particularly monoclonal antibodies and viral vectors.

Market Segmentation by End-use: Pharmaceutical and Biotechnology Companies Dominate the Market

Market segmentation by end-use stratifies users into pharmaceutical and biotechnology companies, alongside academic and research institutes. In 2025, pharmaceutical and biotechnology companies are poised to reign supreme in terms of revenue, owing to their extensive pipelines of protein-based therapies. The forecast from 2026 to 2034 predicts substantial investments in research and development within the pharmaceutical and biotechnology sector. This surge in funding is expected to drive significant demand for recombinant protein manufacturing services, as these companies rely on service providers to meet their production requirements.

North America Remains as the Global Leader

Geographic trends within the recombinant proteins manufacturing services market are shaped by regional biotech clusters, prominent academic research hubs, and the state of healthcare infrastructure. In 2025, North America is forecasted to maintain its role as the market leader, fortified by its thriving biotech ecosystem. In 2025, North America, especially the United States, is predicted to uphold its position as a dominant player in the global biotech landscape. The region's well-established biopharmaceutical companies and renowned academic institutions are likely to contribute significantly to its market dominance. In the forecast period spanning from 2026 to 2034, the Asia-Pacific region is expected to exhibit the highest Compound Annual Growth Rate (CAGR). Increased investments in biotechnology and a growing emphasis on academic research are projected to drive the market's growth in this region.

Market Competition to Intensify during the Forecast Period

The recombinant proteins manufacturing services market presents a competitive landscape featuring several prominent players, including Lonza Group, Catalent, Thermo Fisher Scientific, Boehringer Ingelheim International GmbH, FUJIFILM Diosynth Biotechnologies, Merck KGaA, Bruker (InVivo BioTech Services GmbH), Sino Biological, Inc., GenScript, Kaneka Corporation (Kaneka Eurogentec S.A), Polyplus Transfection (Xpress Biologics), Boster Biological Technology And Trenzyme GmbH. In 2025 and as expected from 2026 to 2034, these industry leaders are anticipated to maintain their market positions by diversifying service portfolios, expanding production capacities, and forging strategic collaborations. Key players in the market are projected to strategically position themselves to cater to the surging demand for recombinant protein manufacturing services. Diversification of service offerings, encompassing everything from process development to large-scale production, is anticipated to help meet the diverse needs of clients. In the forecast period spanning from 2026 to 2034, these industry stalwarts are poised to sustain their competitive edge by innovating in areas such as cell culture systems, bioreactors, and purification technologies. Additionally, the market may witness the emergence of niche service providers specializing in specific therapeutic areas or unique manufacturing processes.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Recombinant Proteins Manufacturing Services market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Service

|

|

Host Cell

|

|

End-User

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report