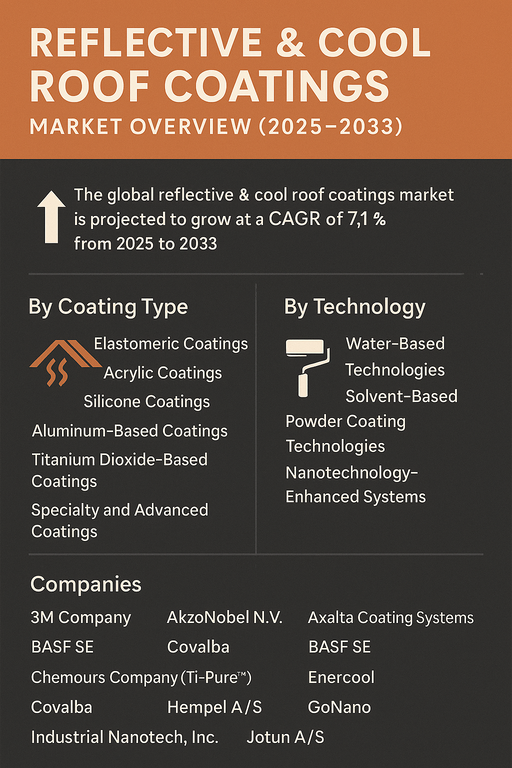

The global reflective and cool roof coatings market is projected to grow at a CAGR of 7.1% from 2025 to 2033, driven by rising demand for energy-efficient building materials, growing urban heat island mitigation efforts, and supportive government regulations promoting sustainable construction. These coatings significantly reduce rooftop temperatures, lower HVAC energy usage, and improve building longevity by minimizing thermal expansion stress. Adoption is accelerating across residential, commercial, and industrial roofing segments, with growing traction in both new construction and refurbishment projects.

Market Drivers

Increasing Demand for Energy Efficiency and Climate Resilience

With escalating energy costs and global warming concerns, reflective and cool roof coatings have gained prominence for their ability to reflect solar radiation and enhance thermal emittance. These coatings reduce indoor cooling loads, contributing to lower energy bills and peak demand reduction in power grids. Urban municipalities are incorporating cool roofing in building codes to address the urban heat island effect. Additionally, building owners are adopting cool roof coatings to comply with green certification programs such as LEED and ENERGY STAR®, further driving product demand.

Technological Advancements and Nanomaterial Integration

Manufacturers are developing next-generation cool roof coatings incorporating nanotechnology, titanium dioxide, and specialty polymers to enhance reflectivity, UV resistance, and hydrophobic properties. Nanotechnology-enhanced coatings deliver longer performance cycles, reduced reapplication frequency, and higher solar reflectance index (SRI). Powder coating and water-based technologies are gaining popularity for their environmental friendliness and low VOC emissions. These innovations are expanding use-cases beyond traditional elastomeric and acrylic systems into harsh climate zones and industrial facilities.

Market Restraint

Performance Limitations and Climatic Dependency

Despite their benefits, reflective and cool roof coatings may not perform optimally in cooler climates where heat retention is preferred. In such regions, the energy savings from reduced cooling needs may be offset by increased heating requirements. Furthermore, the long-term durability of coatings can vary based on substrate type, weather exposure, and maintenance frequency. High initial costs for premium coatings and limited awareness in price-sensitive markets may also restrict widespread adoption. Additionally, retrofit installation can be limited by compatibility with aged roofing materials.

Market Segmentation by Coating Type

By coating type, the market is segmented into Elastomeric, Acrylic, Silicone, Aluminum-Based, Titanium Dioxide-Based, and Specialty & Advanced Coatings. In 2024, Acrylic Coatings held the largest market share due to their cost-effectiveness, strong reflectivity, and ease of application. Silicone coatings are expected to register the highest CAGR from 2025 to 2033, owing to their superior UV stability, moisture resistance, and long-term durability, particularly for flat roofs and extreme climates. Titanium Dioxide-Based and Specialty Coatings, including nanomaterial formulations, are gaining traction for their self-cleaning, thermal insulating, and high-SRI performance attributes. Elastomeric and aluminum-based coatings maintain steady demand in commercial and metal roof applications.

Market Segmentation by Technology

Based on technology, the market is divided into Water-Based, Solvent-Based, Powder Coating, and Nanotechnology-Enhanced Systems. In 2024, Water-Based Technologies dominated the market due to their low VOC emissions, compliance with environmental regulations, and broad applicability across roof types. However, Nanotechnology-Enhanced Systems are forecast to grow at the fastest CAGR during 2025–2033. These coatings offer higher surface durability, thermal insulation, and resistance to microbial growth, positioning them as premium options in both commercial and defense sectors. Powder coatings are gaining relevance for pre-coated roofing systems, while solvent-based coatings retain niche applications in harsh or moisture-prone environments.

Geographic Trends

North America led the reflective & cool roof coatings market in 2024, with the U.S. and Canada benefiting from stringent energy efficiency codes, incentives, and widespread commercial adoption. Europe followed, supported by progressive climate policies and green building initiatives in countries like Germany, France, and the Netherlands. Asia Pacific is expected to witness the highest CAGR from 2025 to 2033, fueled by rapid urbanization, heat stress concerns, and rising investments in green infrastructure across India, China, and Southeast Asia. Latin America and the Middle East & Africa are emerging markets where government programs and rising heatwave incidence are expected to spur demand for cool roofing technologies.

Competitive Trends

The 2024 competitive landscape featured a mix of multinational coatings corporations, material science innovators, and nanotech startups. Sherwin-Williams, PPG Industries, and AkzoNobel N.V. led the market with broad product portfolios, strong distribution networks, and R&D in high-performance polymer technologies. BASF SE and The Dow Chemical Company focused on polymer additives and specialty resins. Chemours (Ti-Pure™) and NanoTech Materials Inc. specialized in titanium dioxide and nanotechnology applications. National Coatings Corporation and Roofclix offered market-specific reflective solutions tailored to regional climates. Emerging players like Enercool, NEOtech Coatings, and Industrial Nanotech, Inc. focused on advanced formulations for extreme durability, IR reflection, and military-grade thermal shielding. Strategic priorities include expanding product certifications, aligning with environmental standards, forming partnerships with roofing contractors, and leveraging AI for predictive coating performance monitoring.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Reflective and Cool Roof Coatings market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Coating Type

| |

Technology

| |

Application

| |

Function

| |

Roof Type

| |

End Use

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report