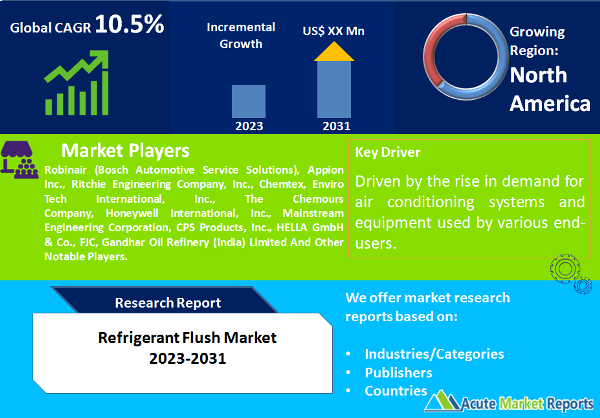

The refrigerant flush market is a critical component of the HVAC (Heating, Ventilation, and Air Conditioning) and refrigeration industry, playing a vital role in maintaining the efficiency and longevity of refrigerant systems. The refrigerant flush market is expected to grow at a CAGR of 10.5% during the forecast period of 2026 to 2034. The global refrigerant flush market is driven by the rise in demand for air conditioning systems and equipment used by various end-users. Refrigerant flush is a liquefied gas, hydrofluorocarbon (HFC) solution that is designed to remove impurities, contaminants, and detritus that build up in a system over time. An excellent flush system that helps maintain system pressure and ensures proper operation is a key factor driving the expansion of the global market for refrigerant flush. In addition, rising demand for AC cleansing chemicals is anticipated to boost global demand for refrigerant flush. Increased use of refrigerant flush in industrial, commercial, and residential sectors presents market participants with lucrative opportunities. Governments and corporations are taking steps to increase the use of cleaning compounds in HVAC system maintenance.

Regulatory Compliance and Environmental Concerns

A significant driver for the Refrigerant Flush market is the increased emphasis on regulatory compliance and environmental concerns. With the global commitment to environmental protection and sustainability, regulations related to refrigerants have become increasingly stringent. The phase-out of harmful chlorofluorocarbons (CFCs) and the transition to more eco-friendly refrigerants like Freon and Puron have driven the need for effective refrigerant flush solutions. These solutions ensure that residual refrigerants are properly removed and the system is clean, reducing the risk of cross-contamination and preventing the release of harmful substances into the atmosphere. International agreements such as the Montreal Protocol and the Kigali Amendment highlight the global commitment to phasing out harmful refrigerants and promoting the use of environmentally friendly alternatives.

Expanding HVAC and Refrigeration Installations

The expanding installations of HVAC and refrigeration systems, especially in residential, commercial, and industrial sectors, are another crucial driver for the refrigerant flush market. As urbanization and industrialization continue to rise, the demand for efficient and reliable HVAC and refrigeration systems is increasing. The installation of new systems, as well as the replacement and retrofitting of older systems, necessitates the use of refrigerant flush solutions to ensure optimal performance. Regular maintenance and system cleaning contribute to energy efficiency, which is a key consideration for consumers and businesses.

Technological Advancements in Refrigerant Flush Equipment

Technological advancements in refrigerant flush equipment have been a driving force in the Refrigerant Flush market. The development of more efficient, automated, and user-friendly flush equipment has improved the ease and effectiveness of the flushing process. These advancements result in reduced downtime, increased efficiency, and cost savings for end-users. Additionally, innovations in refrigerant flush equipment have led to the incorporation of diagnostics and monitoring capabilities, allowing for real-time assessment of system cleanliness. Trade publications and industry sources provide information on the latest advancements in refrigerant flush equipment, emphasizing their benefits for HVAC and refrigeration professionals.

Restraint for the Refrigerant Flush Market

A significant restraint for the Refrigerant Flush market is the lack of awareness and education among end-users and technicians. Many individuals and professionals in the HVAC and refrigeration industry may not fully understand the importance of proper refrigerant system cleaning and the use of refrigerant flush solutions. This lack of awareness can lead to underutilization of flush equipment, improper cleaning practices, and missed opportunities for system optimization. Effective education and training programs are essential to address this restraint. Surveys and studies in the HVAC and refrigeration industry have highlighted the knowledge gap and the need for enhanced education regarding the benefits of refrigerant flush procedures.

Market Segmentation by Refrigerant System (Evaporative Cooling, Mechanical Compression, Absorption, Thermoelectric): Mechanical Compression Dominates the Market

The Refrigerant Flush market can be segmented by the refrigerant system into four categories: evaporative cooling, mechanical compression, absorption, and thermoelectric. In 2025, the "mechanical compression" system generated the highest revenue due to its widespread use in various HVAC and refrigeration applications. For the period from 2026 to 2034, the "absorption" system is expected to exhibit the highest compound annual growth rate (CAGR). Absorption systems are valued for their energy efficiency and suitability for certain applications, including industrial refrigeration and cooling.

Market Segmentation by Refrigerant Type (Chlorofluorocarbons (CFCs), Freon, Puron): Freon Dominates the Market

The refrigerant flush market can be segmented by refrigerant type into three categories: chlorofluorocarbons (CFCs), Freon, and Puron. In 2025, the "Freon" segment witnessed the highest revenue, as it represents a popular and environmentally friendly choice in HVAC and refrigeration systems. For the period from 2026 to 2034, the "Puron" segment is expected to experience the highest CAGR. Puron, also known as R-410A, is a non-ozone-depleting refrigerant commonly used as a replacement for CFCs and HCFCs.

North America Remains as the Global Leader

The refrigerant flush market exhibits geographic variations in demand and growth. Geographic trends indicate that regions with robust construction activities, expanding commercial and industrial sectors, and a focus on environmental regulations tend to lead in Refrigerant Flush adoption. North America, with its significant HVAC and refrigeration market and stringent environmental regulations, has been a prominent market for Refrigerant Flush solutions. When considering the region with the highest CAGR during the forecast period from 2026 to 2034, the Asia-Pacific region is expected to exhibit substantial growth. Rapid urbanization, industrialization, and the adoption of advanced HVAC and refrigeration systems in emerging economies are driving the demand for Refrigerant Flush solutions. In terms of revenue percentage, North America is expected to maintain its position as the region with the highest revenue percentage throughout the forecast period. The region's commitment to environmental sustainability and the replacement of older systems with eco-friendly alternatives contribute to its prominence in the Refrigerant Flush market.

Market Competition to Intensify during the Forecast Period

The refrigerant flush market features several key players, including Robinair (Bosch Automotive Service Solutions), Appion Inc., Ritchie Engineering Company, Inc., Chemtex, Enviro Tech International, Inc., The Chemours Company, Honeywell International, Inc., Mainstream Engineering Corporation, CPS Products, Inc., HELLA GmbH & Co., FJC, and Gandhar Oil Refinery (India) Limited. These companies employ specific strategies to maintain and expand their market presence. In 2025, Robinair (Bosch Automotive Service Solutions) held a significant market share, offering a range of HVAC and refrigeration service equipment, including Refrigerant Flush solutions. The company's strategy focused on product innovation, user-friendly design, and enhancing the performance of its equipment. Appion Inc., known for its refrigeration and HVAC tools, excelled in providing high-quality Refrigerant Flush equipment. Their strategy emphasized product reliability, durability, and providing solutions for professional technicians. Ritchie Engineering Company, Inc., a leader in HVAC/R service tools, positioned itself as a key player in the market. Their strategy centered on customer support, offering technical training, and providing a comprehensive range of HVAC/R service solutions. For the forecast period from 2026 to 2034, these companies are expected to continue their strategies, focusing on innovation, sustainability, and expanding their global footprint. They will explore new technologies and products to maintain their competitive edge in the evolving refrigerant flush market.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Refrigerant Flush market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Refrigerant System

|

|

Refrigerant Type

|

|

Application

|

|

End-Use

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report